MicroStrategy Acquires 390 Bitcoin, Total Approaches 641,000 BTC

- MicroStrategy acquires 390 BTC, total reaches approximately 641,000.

- Purchase backed by preferred stock issuance, valued at $43.4 million.

- Continues as the largest corporate Bitcoin holder globally.

Michael Saylor’s MicroStrategy acquired 390 Bitcoin for $43.4 million in October 2025, maintaining its status as the largest corporate holder with approximately 640,808 BTC.

This acquisition underscores MicroStrategy’s continuous buy-and-hold strategy, influencing corporate Bitcoin trends and potentially affecting market sentiment through substantial institutional buying activity.

Lede

MicroStrategy, the leading corporate holder of Bitcoin, has increased its holdings with an additional 390 BTC. The acquisition was finalized at a cost of $43.4 million, bringing MicroStrategy’s total Bitcoin reserves to nearly 641,000 BTC.

“MicroStrategy has acquired an additional 390 BTC for $43.4 million. Our Bitcoin strategy remains unchanged: accumulate and hold for the long term.” — Michael Saylor, Executive Chairman, MicroStrategy

Market Influence

The acquisition highlights the sustained trend of corporate treasury investments in Bitcoin . By expanding its reserves, MicroStrategy continues to influence market sentiment and demonstrate Bitcoin’s viability as a corporate asset.

MicroStrategy’s approach mirrors a broader corporate shift towards Bitcoin for long-term holding. This strategic act may impact Bitcoin’s market dynamics and inspire other corporations to consider similar treasury allocations.

Regulatory Observations

MicroStrategy’s Bitcoin acquisition strategy has historically coincided with increased market awareness and price activity. The company’s actions often prompt discussions around Bitcoin’s role in corporate treasuries .

Expectations of regulatory and market responses are integral to institutional Bitcoin acquisition narratives. As MicroStrategy continues its Bitcoin purchases, potential future impacts on regulatory frameworks and market behaviors become focal points of observation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

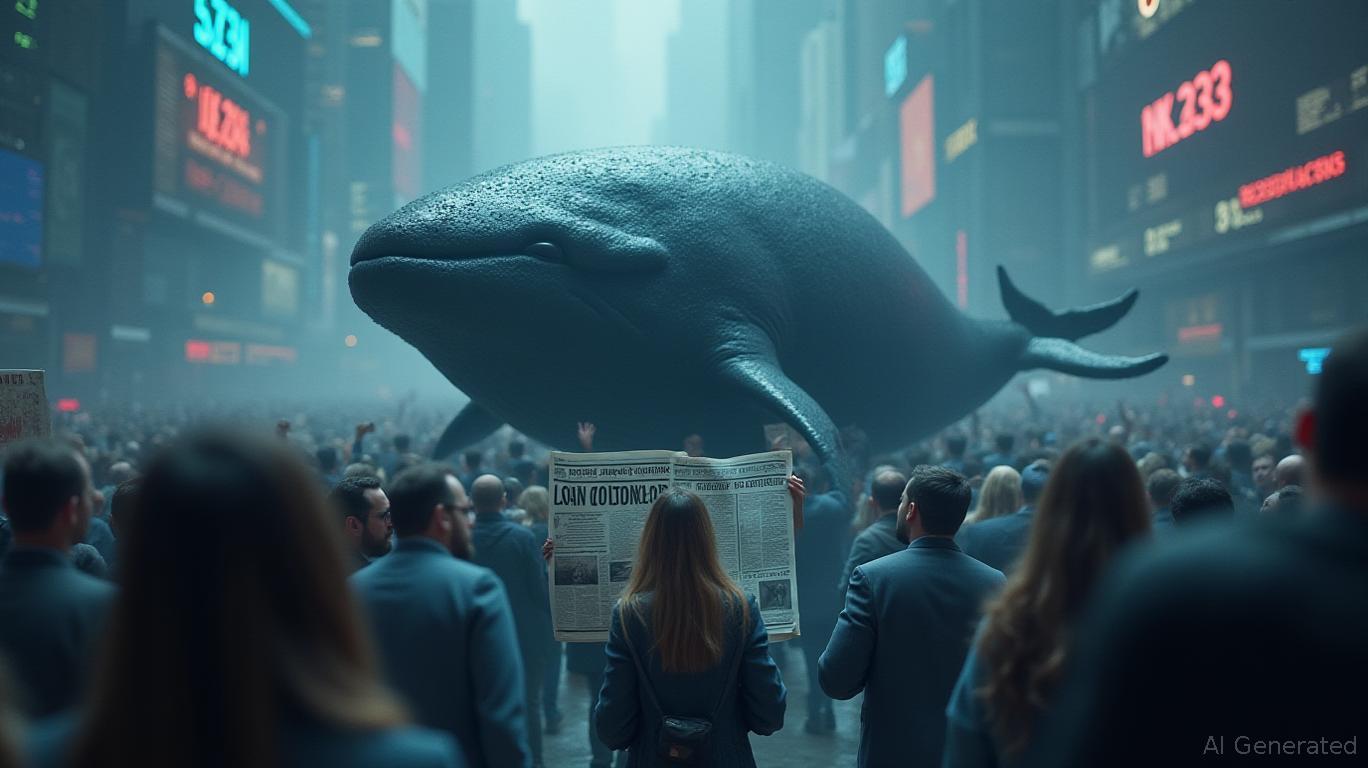

Crypto’s Ideal Whale: Absorb a $7M Deficit or Weather the Turbulence?

- A top crypto whale with 100% historical trade success now faces $7M in losses amid market shifts. - Analysts link the downturn to macroeconomic pressures, regulatory risks, and reduced speculative trading. - The whale's position volatility highlights risks even seasoned traders face in crypto's unpredictable market. - Market observers watch whether this whale will adjust strategies, potentially signaling broader sentiment changes.

Orbs Drives DeFi’s Expansion into Institutional Futures through a Modular Hub

- QuickSwap integrates Orbs' Perpetual Hub Ultra to enable institutional-grade perpetual futures trading on Ethereum's Base Layer-2. - The modular infrastructure combines on-chain transparency with CeFi-level performance, reducing technical barriers for DEXs to launch high-performance platforms. - Intent-based trading features and liquidity routing from centralized exchanges enhance DeFi's execution capabilities while maintaining decentralization. - Orbs' solution, already powering protocols like dLIMIT, a

Fidelity Updates Solana ETF Filing for Fast Approval

Fidelity updates its Solana ETF filing, removing delay clause to fast-track approval. More Solana ETFs may follow.What It Means for Solana and Crypto InvestorsA New Phase for Crypto ETFs?

Trump Token Issuer Eyes Republic.com’s US Arm

Fight Fight Fight LLC, issuer of the Trump token, is in talks to acquire Republic.com’s U.S. operations.Why This Move MattersWhat’s Next?