Key Market Insights for October 29th, how much did you miss?

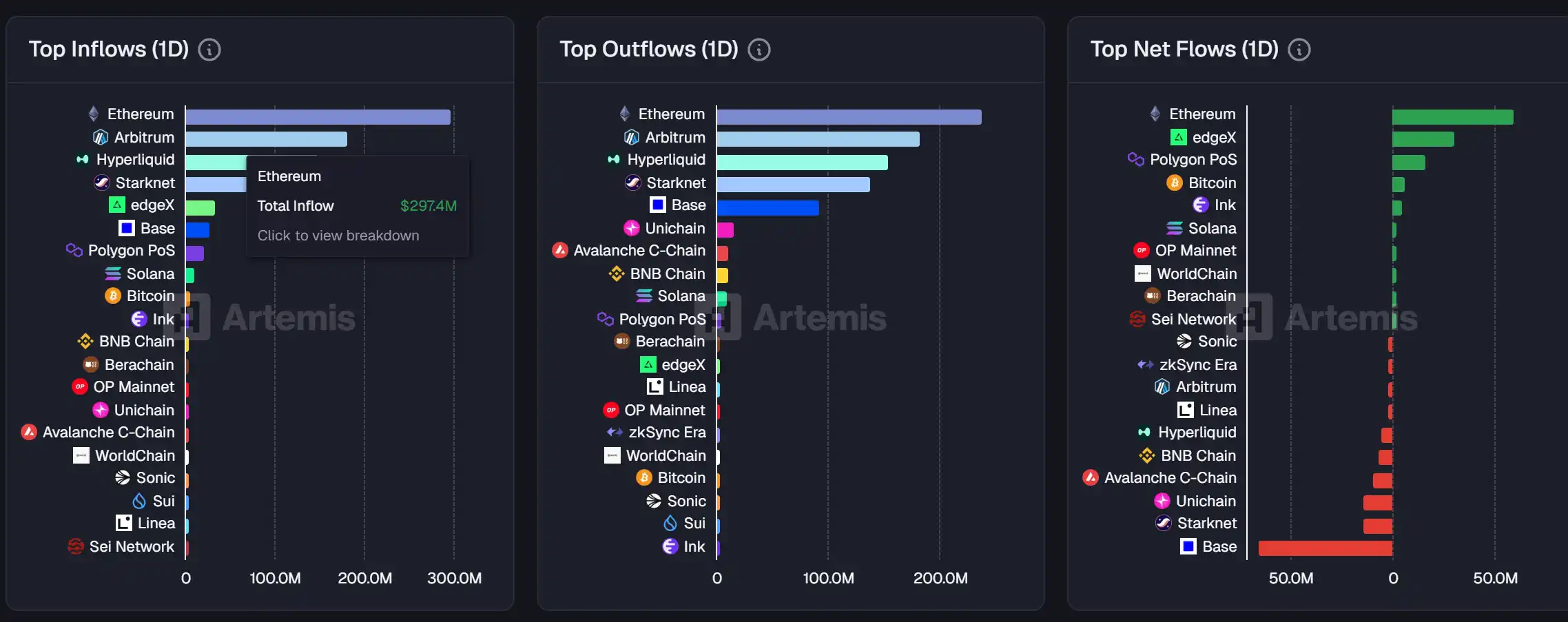

1. On-chain Fund Flow: $59.2M inflow to Ethereum today; $65.1M outflow from Base 2. Largest Price Swings: $FACY, $VULT 3. Top News: Zhihu x Ludong jointly hosted a roundtable on "Stablecoin Transparency" today, with a total view count of 25 million

Top News

1. Zhihu x Eudemonia Co-hosted Roundtable on "Penetrating Stablecoins" is now online today, with a total views of 25 million

2. MegaETH's public sale has raised over $700 million, with an oversubscription of 14.2 times

3. A total of $376 million has been liquidated across the network in the past 12 hours, with long positions being the main liquidations

4. FLM surged over 30% briefly and then retraced, with a market cap currently at $11 million

5. Users with at least 240 points in Binance Alpha can claim 2,688 BOS airdropped tokens

Featured Articles

1. "Chillhouse Leading Alone: The Past and Present of "Web3 Fun People""

The long-lost Solana meme hasn't been as lively for a long time, and it's happening in a way we can hardly imagine—a Solana meme coin "abstraction" involving Jesse Pollak, Base Protocol's lead, well-known crypto KOL Cobie, Solana's founder Toly, and pump.fun's founder alon. Especially with the addition of the Base camp, there is a sense of "breaking the taboo barrier." In the current environment where each chain is enthusiastically competing with each other, it is beyond players' expectations.

2. "The Best Market Performance in the Last Two Months of the Year? Is it Time to Surge or Retreat?"

As October draws to a close, the cryptocurrency market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the cryptocurrency market, especially after experiencing the 10/11 crash. The impact of this major drop is gradually fading, and market sentiment seems not to have further deteriorated but instead gained new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: positive net inflow data, approval of a batch of altcoin ETFs, and increasing rate cut expectations.

On-chain Data

Chain data for the week of October 28th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Outflows in Bitcoin and Ethereum—Strategic Investment or Indication of Waning Interest?

- Bitcoin and Ethereum face $2.6B in exchange outflows, signaling potential long-term holding shifts or market pessimism post-October downturn. - Whale activity, including $260M BTC transfers from Binance, suggests strategic moves toward off-exchange storage amid reduced trading volumes. - October's 4% Bitcoin and 7.15% Ethereum losses shattered the "Uptober" trend, fueling debates over investor confidence versus market weakness. - Analysts highlight lower blockchain activity and liquidity risks, with Nove

Ethereum Updates: DeFi Enigma: Did the 20,000 ETH Withdrawal Fund an Aave Loan or Serve as a Risk Management Move?

- A crypto address withdrew 20,000 ETH from a CEX, sparking speculation it could repay an Aave loan or adjust DeFi collateral ratios. - Aave's v3 platform streamlines borrowing, driving increased utilization as traders rebalance risk in volatile markets. - Blockchain analysts note the receiving address's prior Aave interactions, though the transaction's exact purpose remains unconfirmed. - Experts caution DeFi users about liquidation risks and slippage when managing leveraged positions amid price fluctuati

Trump’s Crackdown on Immigration Sparks Clash Over Civil Rights

- Trump administration expands 287(g) program, enlisting 16,000 officers across 40 states to assist ICE immigration raids, sparking legal and ethical debates. - President defends ICE's use of force in deportations, blaming judicial resistance from Biden/OBAMA-appointed judges for slowing enforcement efforts. - Florida's 10,500 deputized officers face implementation challenges, with Miami-Dade sheriff refusing immigration priorities amid threats of legal action. - New policies disrupt workplaces by ending E

Ethereum Updates Today: Concerns Over Liquidations Rise as Corporate Buybacks Trigger Ethereum Withdrawals

- An anonymous address withdrew 20,000 ETH from a CEX, potentially to repay an Aave loan, sparking speculation about a large loan liquidation. - AB InBev announced a $6B share buyback program and $2B bond redemption to optimize capital structure and reward shareholders. - Lithuanian bank AB Artea executed a share repurchase program to manage equity and enhance shareholder value through stock buybacks. - The crypto sector's volatility contrasts with traditional corporate strategies, highlighting divergent a