World Liberty Financial, a project connected to Donald Trump, has announced the distribution of 8.4 million WLFI coins to reward early participants in its USD1 loyalty program. Launched only two months ago, the USD1 Points Program quickly exceeded a transaction volume of $500 million, positioning USD1 as the sixth-largest stablecoin by market capitalization.

WLFI Coin Distribution on Six Exchanges

In a recent announcement on their X account, World Liberty Financial detailed that the first coin distribution will target early users trading in USD1 pairs or maintaining a specified balance. The distribution will occur across six cryptocurrency exchanges: Gate.io, KuCoin, LBank, HTX Global, Flipster, and MEXC. The specifics of which users will receive the AirDrop, and the timing of these distributions, will be individually determined by each exchange.

With this move, World Liberty Financial aims to broaden its loyalty ecosystem and expedite the adoption of the USD1 stablecoin. The company emphasized that the WLFI coin would serve not only as a reward token but also as a governance tool, enhancing community participation.

USD1 Quickly Ascends to Fifth Largest Stablecoin

The USD1 Points Program generated remarkable momentum in the crypto market , amassing a transaction volume of half a billion dollars in just two months. Participants accrued points by buying or trading USD1 coins across partner exchanges. These activities elevated the circulating supply of the stablecoin and laid the groundwork for the WLFI coin distribution.

World Liberty Financial plans to introduce more use cases for USD1 in the forthcoming phases of the loyalty campaign. The company announced intentions to strengthen the coin ecosystem through DeFi integrations, new trading pairs, and additional reward opportunities.

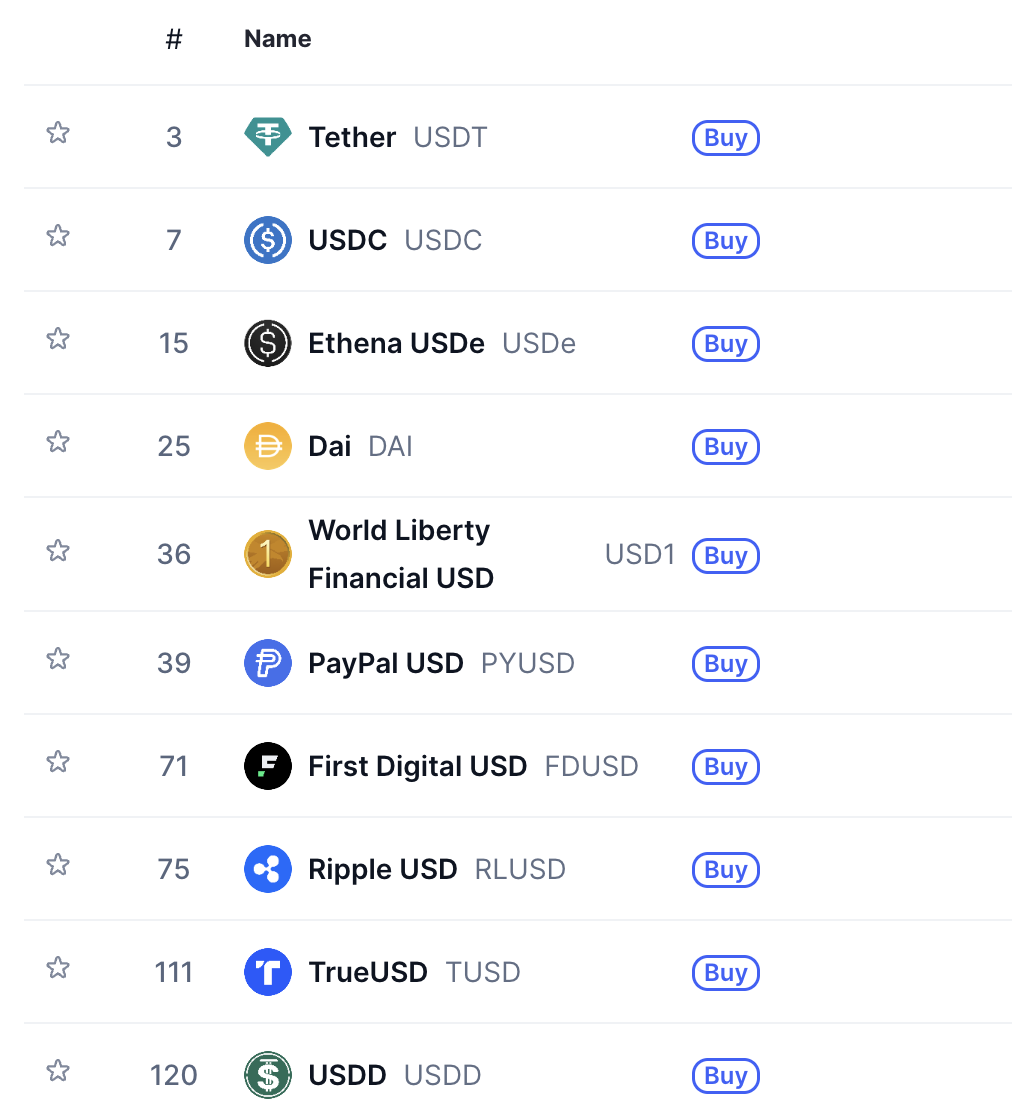

According to CoinMarketCap data, USD1 now ranks fifth in the stablecoin segment by market value. Tether’s USDT leads the list, followed by Circle’s USDC, Ethena’s USDe, and Dai.