Bitcoin News Update: RentStac Establishes a New Crypto Base Rooted in Real Estate Rather Than Speculation

- RentStac, a real estate tokenized platform, offers inflation-resistant crypto returns via property-backed income streams, contrasting Bitcoin's volatility. - Its presale model allows early investors to buy RNS tokens at $0.025, with potential 40x returns if the token reaches $1, driven by tiered pricing and deflationary mechanics. - The project aligns with crypto trends like DEX growth, anchoring digital assets to physical real estate to address liquidity and utility demands in volatile markets. - Risks

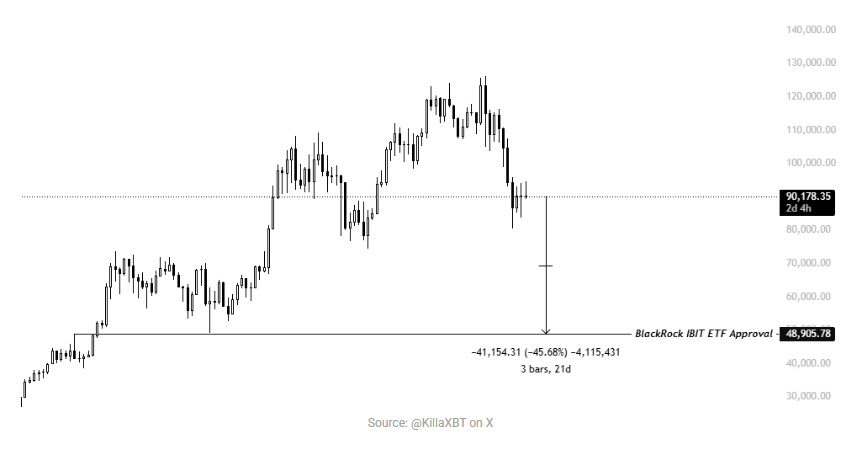

With Bitcoin’s unpredictable price swings leaving many investors uneasy, a fresh cryptocurrency initiative is capturing attention by introducing a new concept: generating yields backed by real-world assets. RentStac, a platform centered on tokenized real estate, is quickly becoming a leading candidate for the next major crypto breakthrough. Both market experts and early supporters highlight its ability to provide returns that can withstand inflation, thanks to income streams tied directly to property assets.

This initiative tackles a significant shortcoming in the current crypto landscape.

RentStac’s approach also reflects broader movements within the crypto sector. Decentralized exchanges (DEXs) have recently achieved a record, surpassing $1 trillion in monthly trading volume for perpetual derivatives, fueled by market fluctuations and incentive schemes. This growth highlights increasing interest in crypto solutions that combine liquidity with practical, real-world applications—a gap RentStac seeks to bridge by linking digital tokens to tangible assets.

The platform’s clear and open approach to fund management adds to its attractiveness. Fifty percent of the funds raised are allocated to acquiring properties, 20% are set aside for liquidity, and 15% go toward developing the platform. Any unsold tokens are destroyed, introducing a deflationary effect that increases scarcity. Moreover, investor assets are protected in multi-signature wallets, with funds only released as the project achieves specific milestones.

Nevertheless, RentStac does face certain risks. Its future depends on the performance of the real estate market, regulatory developments regarding tokenized assets, and ongoing investor trust. The prospectus emphasizes that returns are not guaranteed and that investing involves significant risk, including the possibility of losing the entire investment.

At present, RentStac stands out as an intriguing example of how crypto is evolving. By blending the reliability of real estate with the efficiency of blockchain, it challenges the idea that cryptocurrencies are purely speculative. As decentralized derivatives platforms demonstrate their robustness in turbulent times, RentStac’s asset-backed strategy could mark a move toward more concrete value creation within the crypto industry.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why

What’s the Latest on Chainlink (LINK)? Analysis Firm Assesses the Likelihood of a Recovery

Tether’s Offer to Buy Juventus Has Received a Response