Are Meme Coins Dead? Mindshare Drops Nearly 90% Since 2024

Investor interest in meme coins has plunged to new lows, with shrinking volumes and fewer launches. As traders pivot to AI and DeFi narratives, the crypto community remains divided on whether meme coins can recover or if their era is ending.

Market enthusiasm for meme coins has cooled dramatically. The sector’s mindshare has fallen to just 2.5%, an indicator of shifting investor sentiment in the cryptocurrency space.

The decline in new token launches, along with dwindling investor appetite, has sparked debate across crypto communities. While some traders view the drop as a potential “generational bottom,” others suggest that the meme coin era may finally be losing momentum.

Why Are Meme Coins Losing Market Interest?

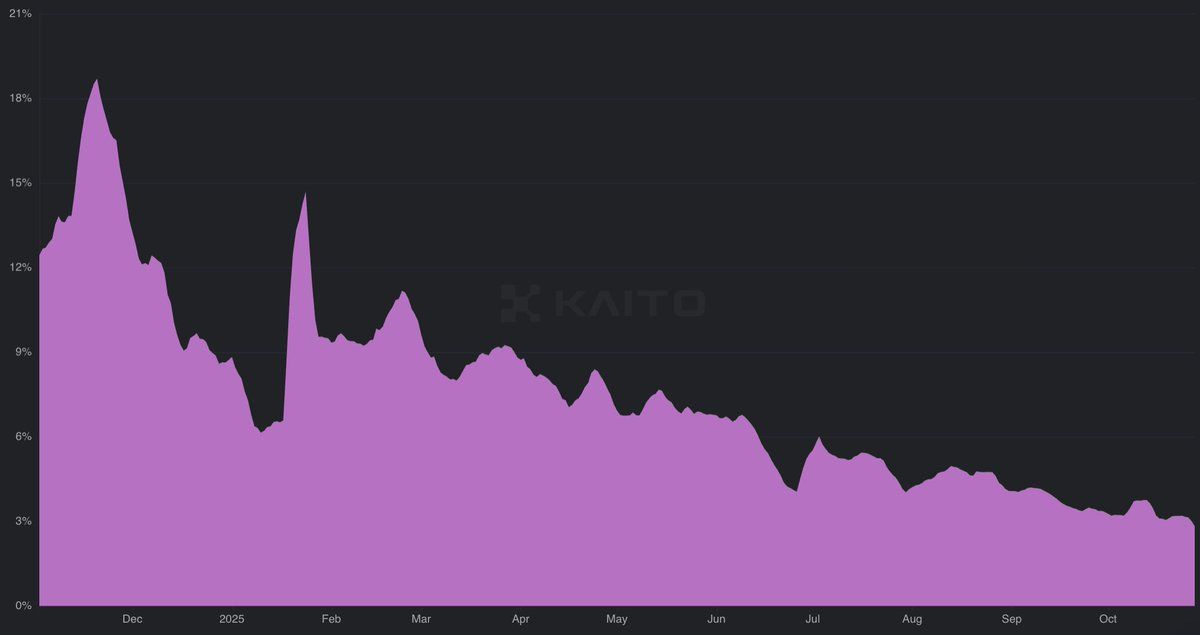

According to recent data compiled by KAITO and shared on social media, meme coin mindshare has plunged from around 20% in late 2024 to just 2.5% by October 2025. This represents a near 90% collapse.

Memecoin Mindshare Over The Past Year. Source:

Memecoin Mindshare Over The Past Year. Source:

Search trends reflect the same cooling sentiment. Google Trends showed that global search interest for “meme coins” dropped from a peak score of 100 at the beginning of 2025 to just 7 in October, suggesting a sharp decline in public attention.

This fading curiosity is also evident in trading behavior across major blockchains, where meme coins have lost a sizable share of activity. In early 2025, these coins accounted for roughly 60% of Solana’s decentralized exchange (DEX) trading volume. By October, that figure had dropped to about 30%.

Price performance has mirrored this trend. Data revealed that even during the recent bull run, when major assets like Bitcoin (BTC), Ethereum (ETH), and more surged to new all-time highs, leading meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) failed to revisit their own records. Subcategories of meme tokens have also recorded a consistent decline in performance over recent months.

In addition, market value within the meme sector has become increasingly concentrated. In early October, tokens launched via Pump.fun collectively held a fully diluted market capitalization of over $4.8 billion.

However, just 12 of these tokens accounted for more than 55% of that total. This suggested that most new projects failed to attract meaningful capital or community traction.

Lastly, token creation has also slowed. More than 13 million meme coins were launched in the past year. Yet, activity has dropped sharply in recent months, with 56% fewer launches in September compared to January. Collectively, these trends point to the fading of the meme coin frenzy.

But why is this happening? According to a16z’s latest report,

“Sound policy and bipartisan legislation clears the way for more productive blockchain use cases.”

Now, the spotlight has shifted toward narratives like AI agents, which have captured significant market attention. Tokens within the x402 ecosystem have recorded triple- and quadruple-digit gains. Meanwhile, perpetual DEXs have also seen explosive growth this year, attracting investors.

Community Divided on Meme Coin Sector’s Future

So, does this mean meme coins are dead? The meme coin community is split on whether the current downturn is a short-term correction or a fundamental shift.

“Memecoins will NEVER die,” an analyst claimed.

Ethan, another analyst, suggested that the drop in minshare could mark “generational bottom.” This indicated that interest in memecoins has fallen to such extreme lows that it might signal the end of their decline, potentially setting the stage for renewed investor attention.

“Don’t buy memecoins if you are here to complain it’s down. Memes are like this. The risks are high. The rewards are higher (at times),” another trader added.

Nonetheless, skeptics remain, with some market watchers arguing that the sharp decline in interest reflects the end of the memecoin era altogether.

Whether this downturn marks the end of an era or just another cycle, meme coins continue to reflect the speculative side of the crypto market. As investor focus shifts toward utility-driven narratives like AI and DeFi, only time will tell if meme coins can reclaim their former influence or fade into digital history.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nixon Cox's diverse industry experience drives Faraday Future's worldwide growth in Crypto-AI.

- Faraday Future appoints Nixon Cox, grandson of ex-U.S. President Nixon, as global strategic advisor to advance its "EAI + Crypto" dual-strategy, leveraging his capital markets and policy expertise. - The company reports 200+ FX Super One preorders in the Middle East and a 36% stake increase by Vanguard, signaling growing investor confidence and regional market traction. - FF integrates crypto payments for its $84k FX Super One, partnering with RAK Innovation City to build an electric mobility ecosystem a

South Korean Crypto Leaders Stop $8.9 Million Money Laundering Operation Linked to Blacklisted Cambodian Company

- South Korea's top crypto exchanges, including Upbit, suspended transactions with Cambodia's Huione Guarantee amid U.S./UK sanctions over alleged money laundering ties to fraud and cybercrime. - FSS data revealed a 1,400-fold surge in 2024 to $8.9 million in cross-border transfers, with Bithumb reporting 12.4 billion won in dealings with the sanctioned firm. - Regulators intensified AML oversight, requiring exchanges to enhance due diligence after Huione's virtual asset arm was linked to Southeast Asian c

Meta's pursuit of artificial intelligence ignites a debate over the balance between technological progress and the principles of democracy

- Meta's AI-driven social media era sparks debates on authenticity, free speech, and corporate accountability amid synthetic content proliferation. - Vibes app's 20B AI-generated images test blurred human-machine content boundaries, while legal cases highlight free speech vs. workplace accountability tensions. - Corporate greenwashing controversies (Coca-Cola) and political scandals (JD Vance) demonstrate AI's dual role in amplifying both innovation and ethical risks. - Legal challenges emerge from AI-gene

Faraday Future's EAI-Crypto Platform Sees Growing Momentum in the UAE as Crypto Preorders Reach New Milestone

- Faraday Future appoints Nixon Cox, grandson of ex-U.S. President Nixon, as global strategic advisor to advance its "EAI + Crypto" strategy merging electric vehicles with blockchain. - UAE launch of FX Super One secured 200+ preorders, including a crypto transaction using USDT, marking a milestone in crypto-integrated sales. - Partnership with RAK Motors and strong investor confidence, including 36% shareholding increase by Vanguard, highlight growing momentum for the company's dual-track expansion. - Nix