Data: Hyperliquid and BNB Chain's share of transaction fees among major Layer 1s rises to 40% and 20%

Jinse Finance reported that this year, the fee structure generated by mainstream Layer 1 blockchains has undergone significant changes. At the beginning of the year, Solana accounted for more than 50% of the fees generated by mainstream Layer 1 blockchains, but now its share has dropped to only 9%. This decline is partly attributed to the fierce competition from Hyperliquid and BNB Chain. At the beginning of the year, the combined fees generated by Hyperliquid and BNB Chain accounted for about 10% of the total fees among mainstream Layer 1 blockchains. As of last week, their respective shares have exceeded 40% and 20%. This shift may be caused by multiple factors such as market demand, user preferences, and structural changes, all of which have had a significant impact on capital flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale accurately bought the dip in ETH twice, with a total profit of $29 million.

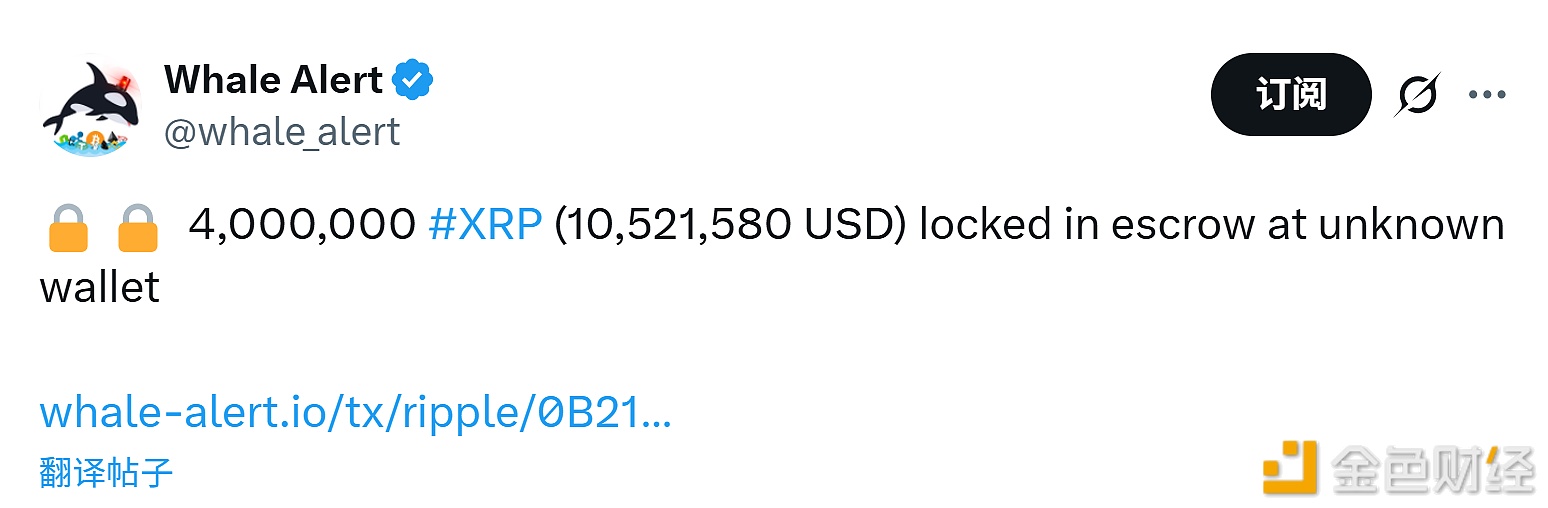

4 million XRP have been locked in an escrow account of an unknown wallet

Spot gold surged $20 in the short term, now quoted at $3992.21 per ounce.