ZEC ‘Bubble’ Bigger Than 2021, CryptoQuant Data Shows

Zcash (ZEC) is signaling a bubble phase, with current trade volume exceeding 2021 highs, CryptoQuant reports. The analyst warns new retail buyers may face a sharp correction.

Zcash (ZEC) is exhibiting signs of entering an extreme bubble phase, according to a recent on-chain analysis. Current trading metrics exceed those recorded during its 2021 bull run peak.

On Tuesday, Ki Young Ju, CEO of on-chain data platform CryptoQuant, posted the sobering analysis on his X account. In doing so, he warned retail investors about the risks. He bluntly stated, “Sorry, but you’re retail if you’re buying Zcash now.”

CryptoQuant CEO Issues Stark Warning

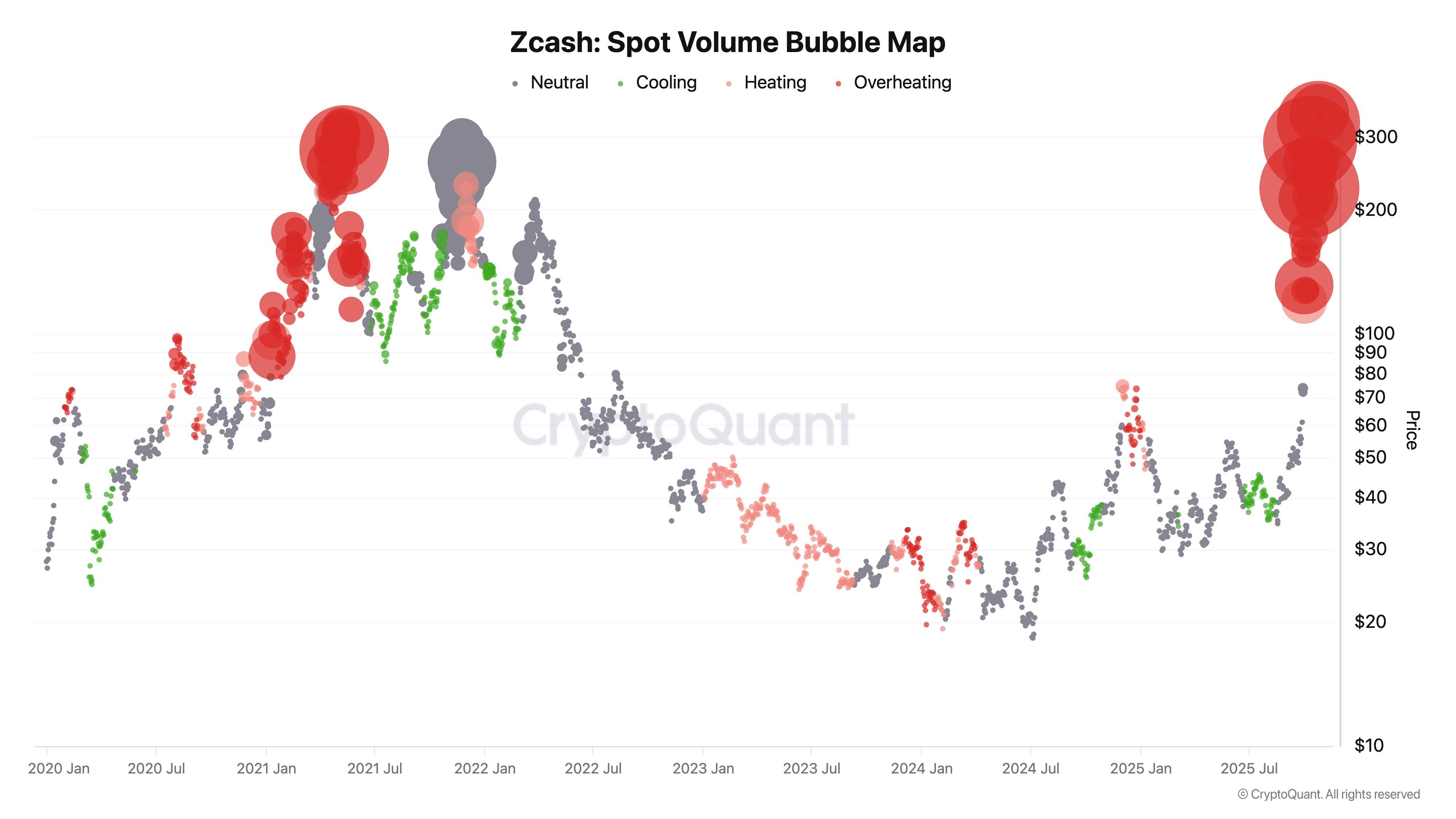

The CEO shared a chart titled ‘Zcash: Spot Volume Bubble Map’ which tracks ZEC’s trading volume against its price since January 2020. In this visualization, the size of the circles indicates trading volume, while the color reflects the volume change rate (cooling, neutral, heating, or hyper-heating).

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

The chart’s core interpretation relies on spotting a Distribution Phase. This phase is late in a bull cycle when trading volume is exceptionally high, but price appreciation is slow. This signifies that new investors are entering the market, leading to a massive turnover, or “handover,” of tokens from seasoned holders.

The chart shows a sharp period of high turnover that lasted about six months during the first half of 2021, when ZEC surged toward $300 per coin. This phase ultimately preceded a market-wide downcycle, which led to a price collapse and major losses for investors who bought ZEC at the end of the rally.

Current Metrics Surpass 2021 Peak

The most alarming finding is that the latest ZEC trading volume and price action register a larger bubble size than the one seen in the first half of 2021. If the broader cryptocurrency market is indeed in the final stage of its cycle, the analyst warns that a repeat of the 2021 collapse is highly possible.

ZEC has attracted massive attention recently, soaring by over 750% in the last three months. The cryptocurrency’s seemingly inexplicable rally has spurred price increases across the entire privacy coin sector.

High-profile figures have amplified the speculative frenzy surrounding ZEC. Former BitMEX CEO Arthur Hayes posted on X on October 26 that he expects the ZEC price to climb to as high as $10,000 per coin. At the time of this report on Tuesday, ZEC is trading around $328, up from $308 when Hayes made his prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OceanPal’s Shift to AI and Blockchain Triggers 22.5% Drop in Share Price

- OceanPal Inc. pivoted to AI via a $120M investment in NEAR Protocol, launching SovereignAI to commercialize blockchain-based AI infrastructure. - The strategy targets 10% NEAR token ownership and leverages NVIDIA tech for confidential AI-cloud solutions, aligning with institutional interest in privacy-focused AI. - Despite continued shipping operations, OceanPal reported a $10.4M net loss and saw its stock drop 22.5% post-announcement, reflecting market skepticism about the strategic shift. - Backed by c

Noomez’s Deflationary Advantage: Why Planned Token Burns Surpass Meme Coin Volatility

- Noomez ($NNZ) introduces a 28-stage presale with automated supply reductions and on-chain verifiability on Binance Smart Chain. - Structured burns and fixed supply contrast with inflationary meme coins like Dogecoin, creating scarcity-driven urgency for investors. - Real-time dashboards and liquidity locks address rug pull risks, aligning with 2025 trends prioritizing transparent tokenomics over speculative narratives. - Gamified airdrops and a 2026 roadmap featuring PancakeSwap listing position Noomez a

To end the government shutdown, the US Senate will vote on the appropriations bill for the 13th time

Universal Digital to Raise $50 Million to Increase Bitcoin Holdings