S&P gives Strategy a B-: The "old system" that can't be awakened

S&P Global Ratings has assigned Strategy Inc. (formerly MicroStrategy) a latest long-term credit rating of B-, with a “stable” outlook.

On the surface, this is a “non-investment grade” rating. But when placed in the context of the crypto industry’s development, this result actually reveals a deeper issue: traditional rating models still have significant gaps in understanding and valuing emerging paradigms such as “bitcoin treasury companies.”

Strategy’s business model is already very clear: it raises funds through various means such as issuing stocks, convertible bonds, preferred shares, and bonds, and continuously purchases bitcoin, now holding approximately 640,000 coins.

This means that the company’s core logic does not rely on profits from its software business, but is committed to building a new type of corporate structure centered on bitcoin assets and supported by capital market financing capabilities. The traditional standards used to evaluate “operating companies” have basically become invalid here.

However, S&P still used its inherent framework in the rating report, emphasizing the following risks: excessive asset concentration in bitcoin, a single business structure, relatively weak risk-adjusted capital strength, insufficient US dollar liquidity, and the “currency mismatch” problem where all debt is denominated in US dollars while assets are mainly in bitcoin.

Traditional Rating Systems: Not Always “Correct”

Historically, credit rating agencies like S&P have not always been accurate during major financial transformation cycles.

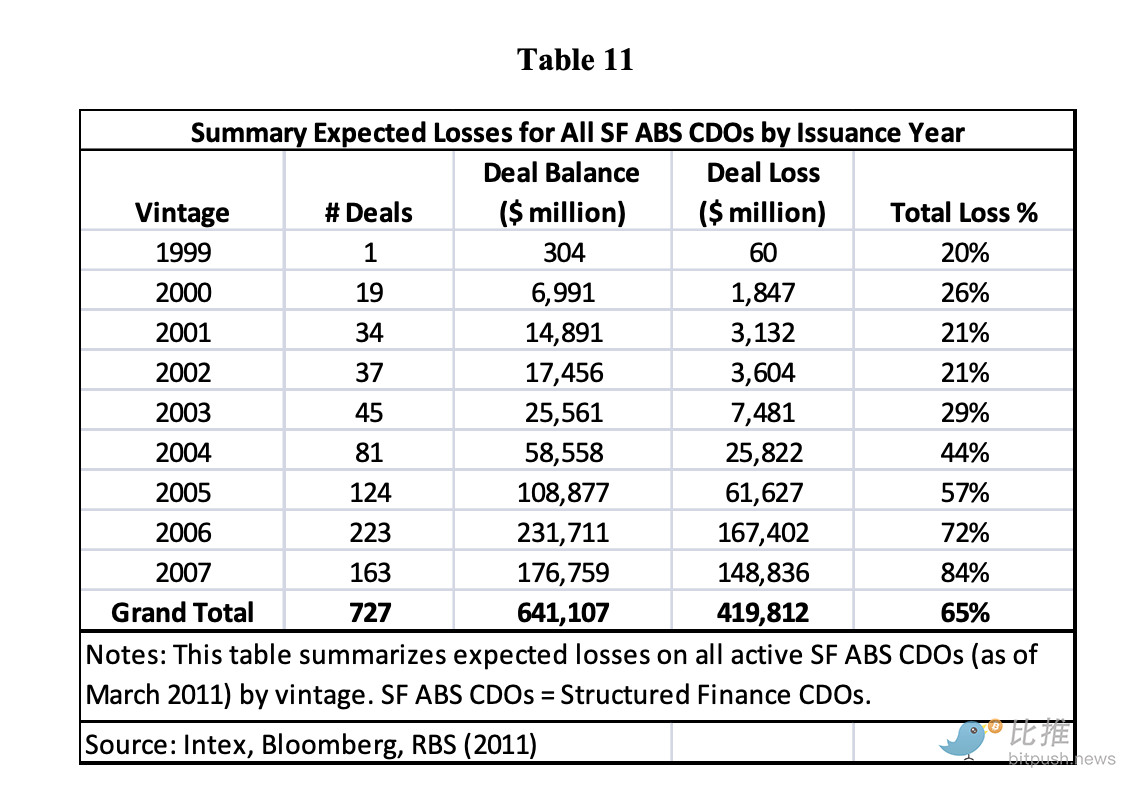

Looking back at the mid-2000s, US structured financial products (especially CDOs backed by subprime mortgages) received many high ratings at issuance, with many even labeled AAA. Research shows that from about 2005 to 2007, the US issued 727 “asset-backed CDOs (SF ABS CDO),” totaling about $641 billions, and after these products collapsed, cumulative write-downs reached about $420 billions.

According to sources such as Wikipedia: “Many CDOs issued from 2005-2007, after receiving the highest ratings, were downgraded to junk or suffered principal losses by 2010.” In these events, financial giants like Lehman Brothers were deeply involved in CDO and MBS assets, and when these asset values plummeted and leverage spiraled out of control, it ultimately led to bankruptcy or acquisition.

In other words: the structured products that rating agencies once “understood” as A (or higher) grade eventually became disaster zones. This demonstrates a fact—when the market changes, old models are prone to misjudgment.

Returning to Strategy, perhaps traditional rating agencies see that: it lacks traditional diversified income, its liquidity may be suppressed by bitcoin volatility, and with debt denominated in US dollars and assets in bitcoin, if bitcoin crashes, the debt repayment chain could be damaged. But at the same time, the industry also sees a fact: the reason the Strategy model works is because the capital market, global bitcoin liquidity, and institutional funds all provide underlying support. The traditional model does not fully incorporate this logic.

The “Old System” That Can’t Be Awakened

It’s not just S&P; many well-known traditional research institutions are still using old frameworks to look at crypto asset companies.

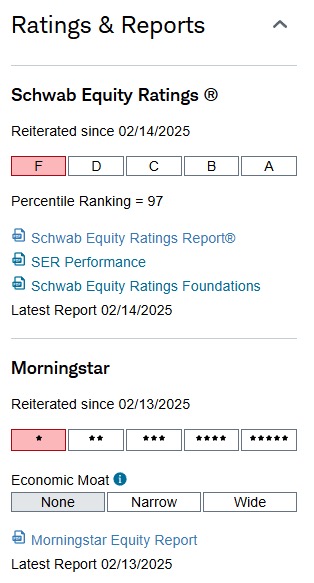

For example, Charles Schwab’s Schwab Equity Ratings system (A to F ratings, F being the lowest expected performance) has almost consistently rated Coinbase (COIN) and MicroStrategy (MSTR) as F over the past 3-5 years.

And what happened during this period?

-

COIN experienced multiple rounds of doubling from 2022 to 2025, yet Schwab still maintained an F rating

-

MSTR has risen over 1000% since 2020, yet Schwab still maintained an F rating

-

Even when MSTR’s actual quarterly performance far exceeded analyst expectations, the rating remained unchanged

-

This is not a one-off, but years of consistently low ratings

In other words:

Prices are changing, the market is changing, the bitcoin narrative is changing, but the model hasn’t changed.

Schwab didn’t “get it wrong”—it just insists, according to its modeling logic, that these companies “do not fit the traditional profit model.”

Similarly, Moody’s and S&P have long kept Coinbase’s credit rating in the speculative range, giving reasons such as:

-

High business volatility

-

Income dependent on market cycles

-

Lack of predictable cash flow

-

Risk exposure is too concentrated

Sound familiar?

This is the same template as the logic for giving Strategy a B-.

Summary

It’s actually not complicated: the root of the problem is that they are still using last-generation valuation models to measure next-generation asset forms.

Traditional financial institutions are not unprofessional; they are just entrenched in their own mature cognitive language. In their system, a quality asset must generate predictable cash flow, a healthy business must operate stably in a low-volatility environment, and its valuation must strictly follow comparable company analysis or income approach models.

However, the emerging crypto treasury-type companies are telling a completely different story. Their core logic is: “We do not rely on traditional operating cash flow to support asset value, but obtain strong financing and market confidence through innovative asset structures.” This is not simply a matter of right or wrong, but a profound paradigm shift.

Therefore, S&P’s B- rating for Strategy is not the key point. The truly symbolic signal is that the new model represented by bitcoin treasuries has developed to the point where the traditional rating system can no longer ignore it and must attempt to “explain” it.

But we must be clear that “explaining” does not equal “understanding,” “understanding” does not equal “acceptance,” and “acceptance” does not mean it will be incorporated into the mainstream framework. The cognitive shift of the old system will be as slow as glacial movement—it will eventually awaken, but never overnight.

And history has repeatedly proven that brand new market structures are often quietly established while the old system is “half-awake and half-asleep.”

Writing bitcoin into the company balance sheet has already shifted from a pioneering experiment to an established fact. Whether the traditional world recognizes it, accepts it, or truly understands it is only a matter of time.

Author: Seed.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unraveling the Reasons for the Dramatic Price Surge of Virtuals Protocol (VIRTUAL)

Fueling the Surge: How Coinbase's x402 Protocol Integration Drove Virtuals Protocol Token to Double its Value

Metaplanet Unveils BTC Focused Capital and Repurchase Strategy

Mt. Gox Delays Bitcoin Repayments to 2026

Crypto Market Crash Wipes Out $79 Billion in 12 Hours