Date: Mon, Oct 27, 2025 | 12:20 PM GMT

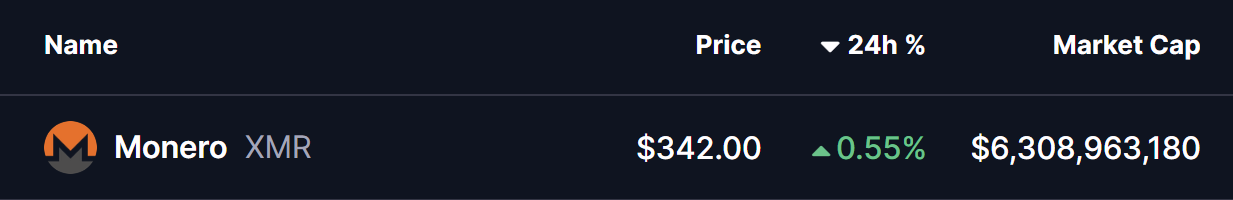

The broader cryptocurrency market is maintaining its positive momentum from the weekend, with Bitcoin (BTC) and Ethereum (ETH) both trading in green — up +1.50%respectively in the past 24 hours. This ongoing strength is fueling optimism across several altcoins , including Monero (XMR), the leading privacy-focused cryptocurrency.

XMR is trading in green with modest gains today, but what stands out more than the price action is its technical chart structure, which signals a potentially significant bullish breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Inverse Head and Shoulders in Play

On the daily chart, XMR has developed a clear inverse head and shoulders pattern — a classic bullish reversal formation that often signals a trend shift from bearish to bullish once the neckline is broken.

The pattern features the typical left shoulder, head, and right shoulder structure. The head of the pattern formed when XMR dropped near the 200-day moving average (MA) around $281, where it found strong support and began a recovery. Since then, buyers have steadily lifted prices toward the $342 mark.

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Now, XMR is approaching a key neckline resistance zone between $344 and $357. This area has historically acted as a barrier, and a confirmed breakout above it could serve as the trigger for a new bullish phase.

What’s Ahead for XMR?

If Monero successfully breaks and closes above the $344–$357 neckline and confirms the move with a retest, the measured projection from the inverse head and shoulders formation points to a potential target around $482.

Such a move would represent roughly a 40% gain from the breakout point, aligning with the pattern’s expected follow-through potential.

However, confirmation is key — a strong breakout candle followed by sustained trading above the neckline will be essential to validate the setup. Failure to do so may keep XMR consolidating within the current range before any decisive trend emerges.