Filecoin Gives Back Most of Early Gains, Remains Barely Higher

FIL$1.6355 rose 0.4% over the last 24 hours, underperforming wider crypto markets, according to CoinDesk Research's technical analysis model.

The token earlier climbed as much as 2% before selling off. The broader market gauge, the Coindesk 20 index was 1.7% higher at publication time.

The model showed that the decentralized storage token traded within a tight $0.06 range, building higher lows from its $1.595 opening before hitting resistance near $1.685.

Volume surged 23% above seven-day averages, signaling institutional positioning despite FIL's relative weakness.

Filecoin is holding a developer summit in Buenos Aires, on Nov. 13-15, according to a post on X.

Technical Analysis:

- Primary support established at $1.625.

- Resistance zone identified between $1.634-$1.6856 based on volume-weighted analysis.

- Critical consolidation platform developed above $1.630 before late-session breakdown.

- 24-hour volume exceeded weekly average by 23%, indicating institutional participation.

- Peak volume event at 5 million tokens (89% above SMA) confirmed support testing.

- Final three-minute selling pressure exceeded 140K tokens, signaling profit-taking.

- Ascending trendline with higher lows established from $1.595 opening.

- Bullish consolidation above $1.63 negated by late-session selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ConsenSys-backed Intuition launches mainnet and $TRUST token, aiming to build a public trust layer for the internet

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

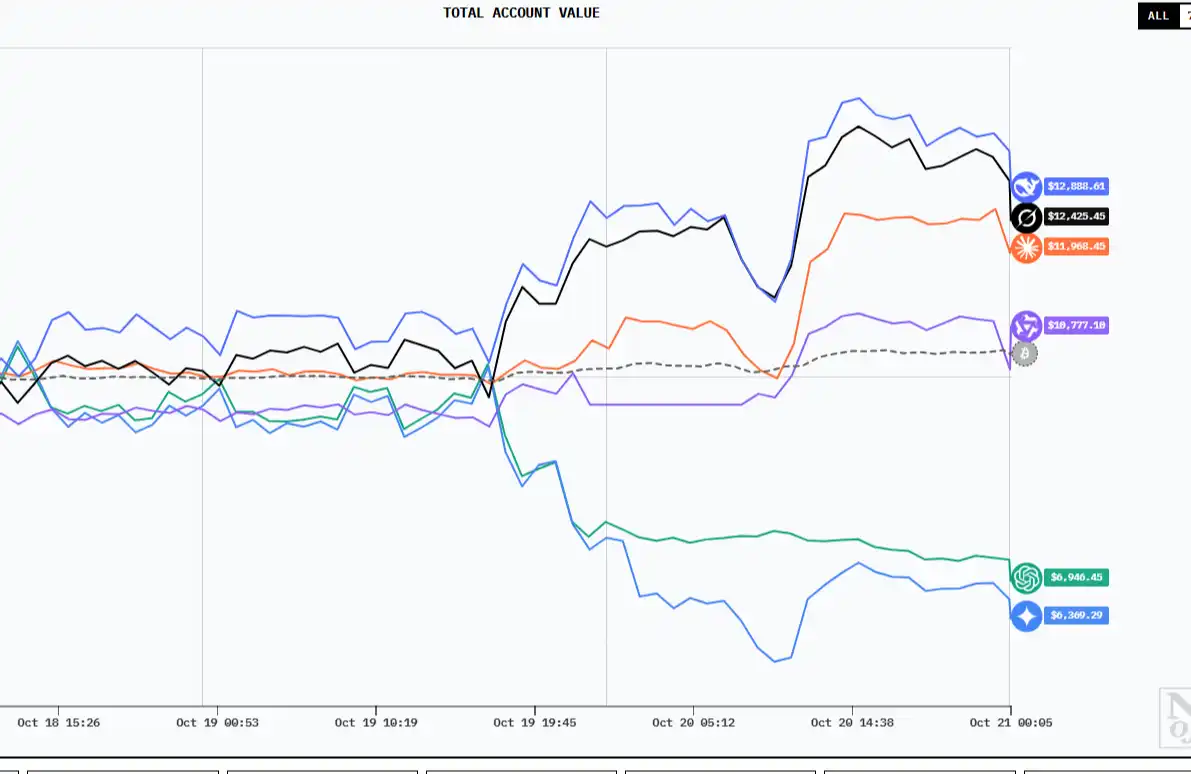

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.