CITIC Securities: Waller may eventually take over the Federal Reserve, potentially triggering a reversal trade in "independence"

Jinse Finance reported that a research report from CITIC Securities stated that the Trump administration is currently in the process of selecting the next Federal Reserve Chair. We believe the main competition is between Waller and Hassett. For Trump, it is a comparison between the "most suitable" and the "most obedient." At present, market probabilities show Hassett in the lead, but Trump has a high level of trust in Bessent. It is recommended to pay attention to the potential expectations gap that may arise if Bessent, who is committed to maintaining the Fed's independence, leads the interview process. In addition, given the precedent of the market "voting with its feet" and the resistance Trump encountered in the Senate when appointing Milan as a board member, we believe Hassett is unlikely to be elected, and Waller may ultimately prevail. This could trigger a "Fed loses independence" reversal trade: bullish for overall US dollar assets and bearish for gold, with the market possibly reducing expectations for rate cuts next year. If Hassett wins, we expect the market to experience a "muscle memory" reaction to the Fed losing its independence: bearish for overall US dollar assets, bullish for gold, and the market may raise expectations for rate cuts next year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale accurately bought the dip in ETH twice, with a total profit of $29 million.

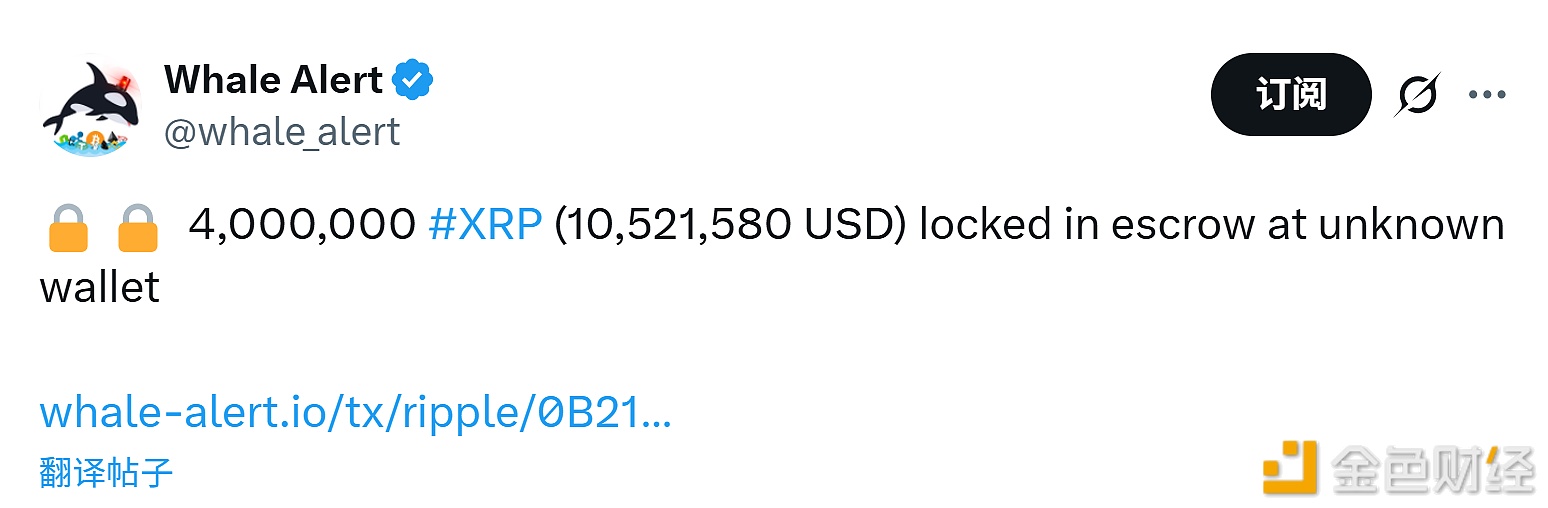

4 million XRP have been locked in an escrow account of an unknown wallet

Spot gold surged $20 in the short term, now quoted at $3992.21 per ounce.

UBS says clients are increasingly focused on hedging downside risks