The Federal Reserve Opens a New Chapter: Cryptocurrency Officially Included in the Washington Agenda

The Federal Reserve held its first Payments Innovation Summit, discussing the application of stablecoins, tokenized assets, and DeFi in the payments sector. The conference proposed establishing Federal Reserve accounts with limited access to reduce risks and explored how to make traditional systems compatible with blockchain. Cryptographic technologies are now becoming a central topic in payment discussions, and institutional investors may prioritize assets like bitcoin and ethereum. Summary generated by Mars AI. The accuracy and completeness of this AI-generated summary are still being iteratively improved.

Article Translation: Block unicorn

Preface

On October 21, the Federal Reserve held its first Payments Innovation Conference in Washington. The meeting lasted all day, bringing together central bank governors from various countries, major asset management companies, large banks, payment companies, and leading crypto infrastructure teams. The agenda covered stablecoins, tokenized assets, DeFi, artificial intelligence in payments, and how to connect traditional ledgers to blockchains. The message from the venue was simple:Crypto technology is now part of the payments conversation.

Why This Time Is Different

For years, the U.S. attitude toward crypto has sounded likeregulation first, thendialogue. This time, a Federal Reserve governor stated at the conference opening that the goal is to embrace disruptivetechnologyin payments and to learn from the experience of DeFi and crypto. This shift in tone is significant. It tells investors that the question has moved from whether this technology isapplicableto how to integrate it into the coresystemsafely.

The “Streamlined” Account Concept

The most concrete news is that the Federal Reserve is developing a limited-access payment account (commonly referred to as a “streamlined account”). This can be seen as a simplified version of a main account, allowing certain non-bank entities that meet legal requirements to directly access the Fed’s payment services under strict supervision.This includes limits, no interest, no credit line,and strict reporting requirements. Currently, many stablecoin issuers and crypto companies rely on commercial banks for settlement and key services. If limited-access Fed accounts become a reality, they could reduce single points of failure. This is not a free pass, nor will it happen overnight, but it is a clear direction of development.

Crypto Industry’s Advice to the Fed

If true institutional scale is to be achieved, three major challenges must be addressed. First, maketraditionalsystems compatible with blockchains for audit and compliance checks. Second,standardize proofs and metadata carried by transactions to meet the needs of regulators and counterparties. Third, create “regulated DeFi” variants where smart contracts automatically enforce compliance, identityverification, and cross-chain controls by default. None of this is just for show. All of this is exactly what large capital pools require.

Why Stablecoins Are at the Core

Stablecoins are already one of the largest real-world use cases for crypto.Their biggest operational risk is reliance on key channels with partner banks. Direct, limited access to the Fed would set higher standards for reserves, reporting, and settlement, and reduce the likelihood of disruptions or de-banking events. This does not eliminate risk, but it does transform the system into a standardized, regulated system that institutions can understand.

Tokenized Assets Enter the Plan

When the world’s largest asset managers, multinational banks, and crypto data providers gather with the Fedto discuss tokenized funds, tokenized cash, and on-chain settlement, what you see is a roadmap. Tokenization is not agimmick. It is a way to accelerate the circulation of traditional assets, offering instant settlement, 24/7 markets, and programmable compliance. The longstanding obstacles have been standards, identityverification, and secure access to payment systems. These three are of utmost importance.

Impact on the Market

Price volatility around such events is significant. Bitcoin may drop several percentage points in a day, while Ethereum and Solana can also see sharp declines or surges due to headlines, then reverse. Structural signals are stronger. The U.S. central bank is now openly discussing how to connect cryptochannelsto the core of payments. When policy clarity improves, capital flows tend to concentrate first on assets best suited for institutional investors. Bitcoin remains the macro gateway. Ethereum is at the core of stablecoins and tokenization. Solana continues to excel in speed and consumer applications. Chainlink positions itself as the data and compliancebridgebetween blockchains and institutions.

None of this guaranteespriceswill rise in a straight line.Butit does determine where new mandates can be allocated when legal and operational mechanisms shift. This usually means Bitcoin first, then Ethereum, followed by a basket of large-cap assets with clear use cases.After that, if liquidity is strong and risk appetite returns,small-cap assetswill start to rise. The same cyclical rhythm, different drivers.

Recent Catalysts

-

Stablecoin rulebooks to standardize reserves and real-time reporting.

-

More tokenized cash products and treasuries, with built-in on-chain identity.

-

DeFi versions that hard-code counterparty checks, asset eligibility, and restrictions, so institutions can participate without changing their mandates.

-

Stories at the intersection of AI and crypto with real economic design, not just branding, especially as emissions tighten.

How to Position

Keep your plan simple and match it to your investment horizon. If investing, focus on assets that institutions can actually buy. For most, the core is Bitcoin and Ethereum, with moderate allocation to Solana, and a small reserve for infrastructure that bridges data and compliance across chains. If trading, assume volatility based on market dynamics, use isolated risk strategies, and set yourstop-loss pointsin advance.

Final Conclusion

The Federal Reserve has brought together cryptocompanies, banks, asset managers, and big tech firms to jointly plan a shared payments system, and has proposed a concrete path for direct, restricted access to the Fed’spayment system. Prices will fluctuate. This indicates thatthe U.S. payment system is preparing to integrate the assets and infrastructure you are already trading. Be patient, assess risk, and focus on assets that true institutions can hold as the payment gates open further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

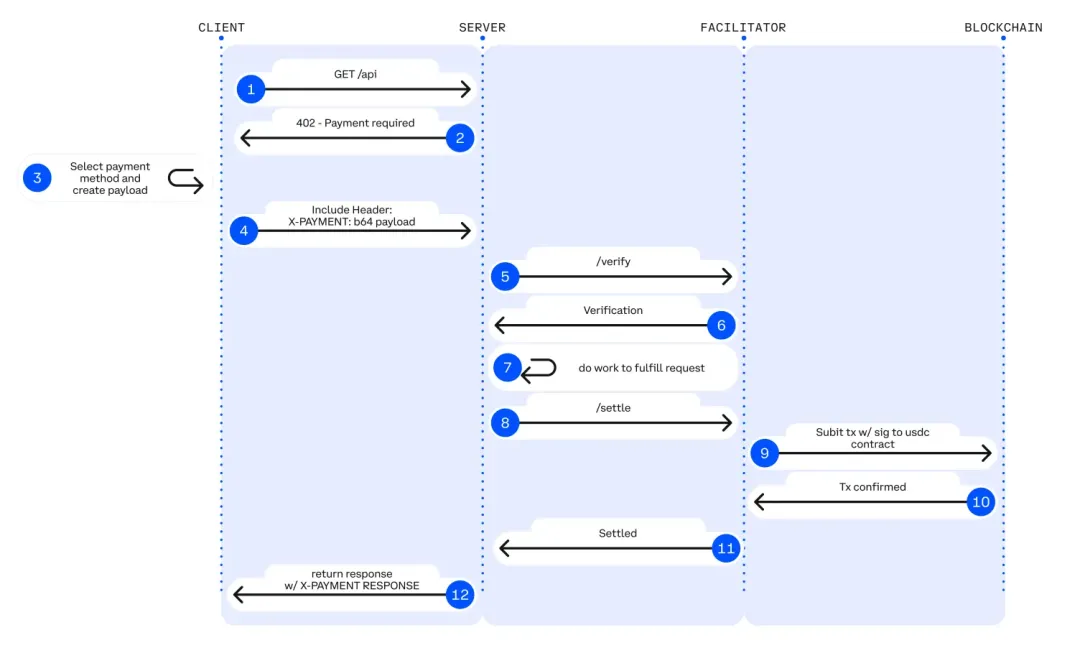

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum