HBAR Price Forms Bullish Crossover – Is A Rally On The Horizon?

HBAR shows early signs of recovery with a bullish MACD crossover and improving RSI. A breakout above $0.178 could drive a rally toward $0.200, confirming bullish momentum.

Hedera’s (HBAR) price has traded sideways over the past few days, showing signs of consolidation after a period of weak investor participation.

Limited market support kept the token stagnant, but momentum appears to be shifting. Technical indicators suggest renewed optimism, hinting that a potential recovery may soon unfold for HBAR.

Hedera Shows Bullish Signs

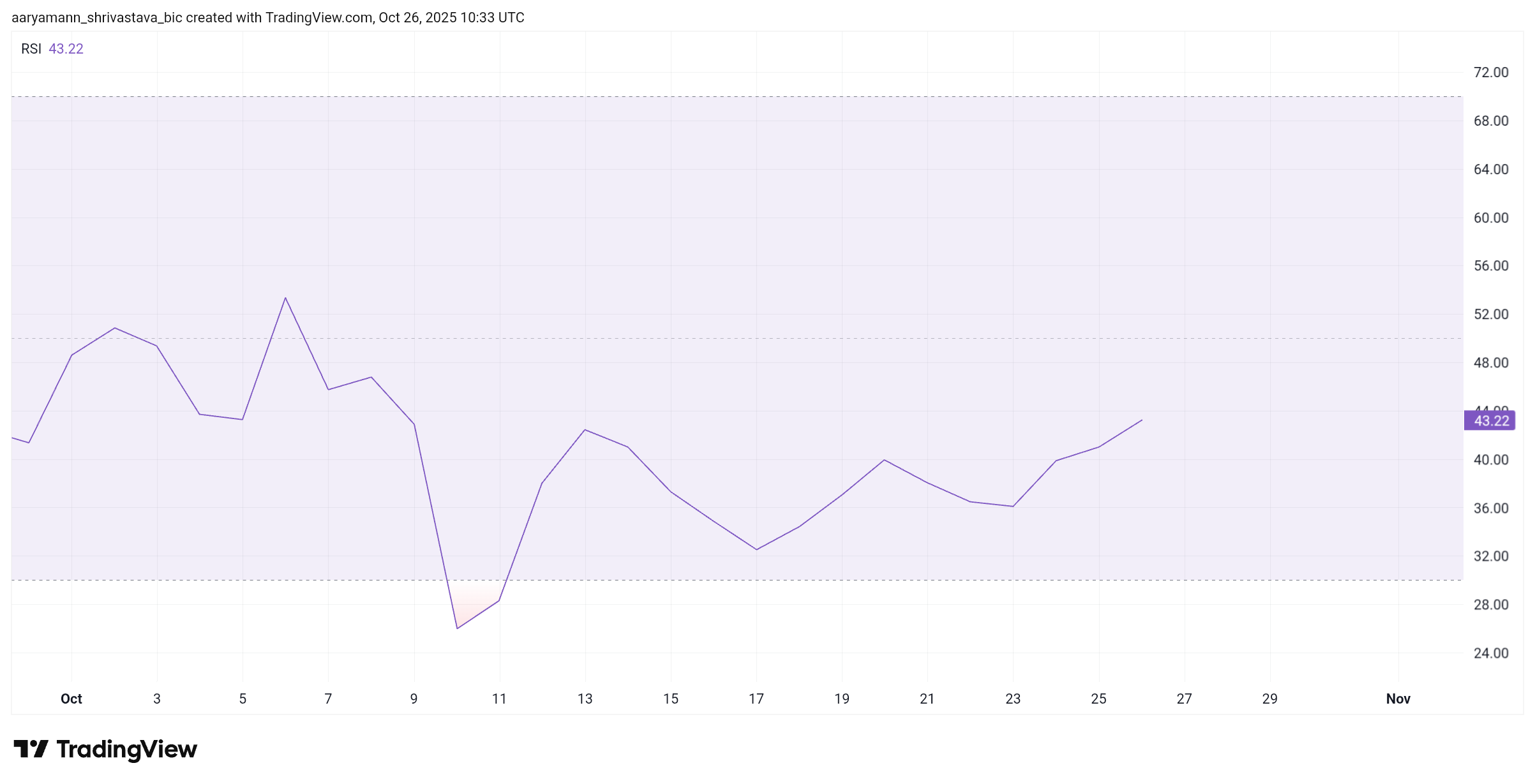

The Relative Strength Index (RSI) is showing an upward trajectory, indicating improving buying pressure on HBAR. This incline signals growing investor confidence after nearly three weeks of muted activity.

However, the RSI remains below the neutral 50.0 mark, suggesting the bullish momentum has not yet been fully confirmed.

A move above the 50.0 threshold would mark a transition into positive territory and signal the end of the recent 20-day bearish phase. This shift could attract fresh capital and trading interest, reinforcing the upward sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

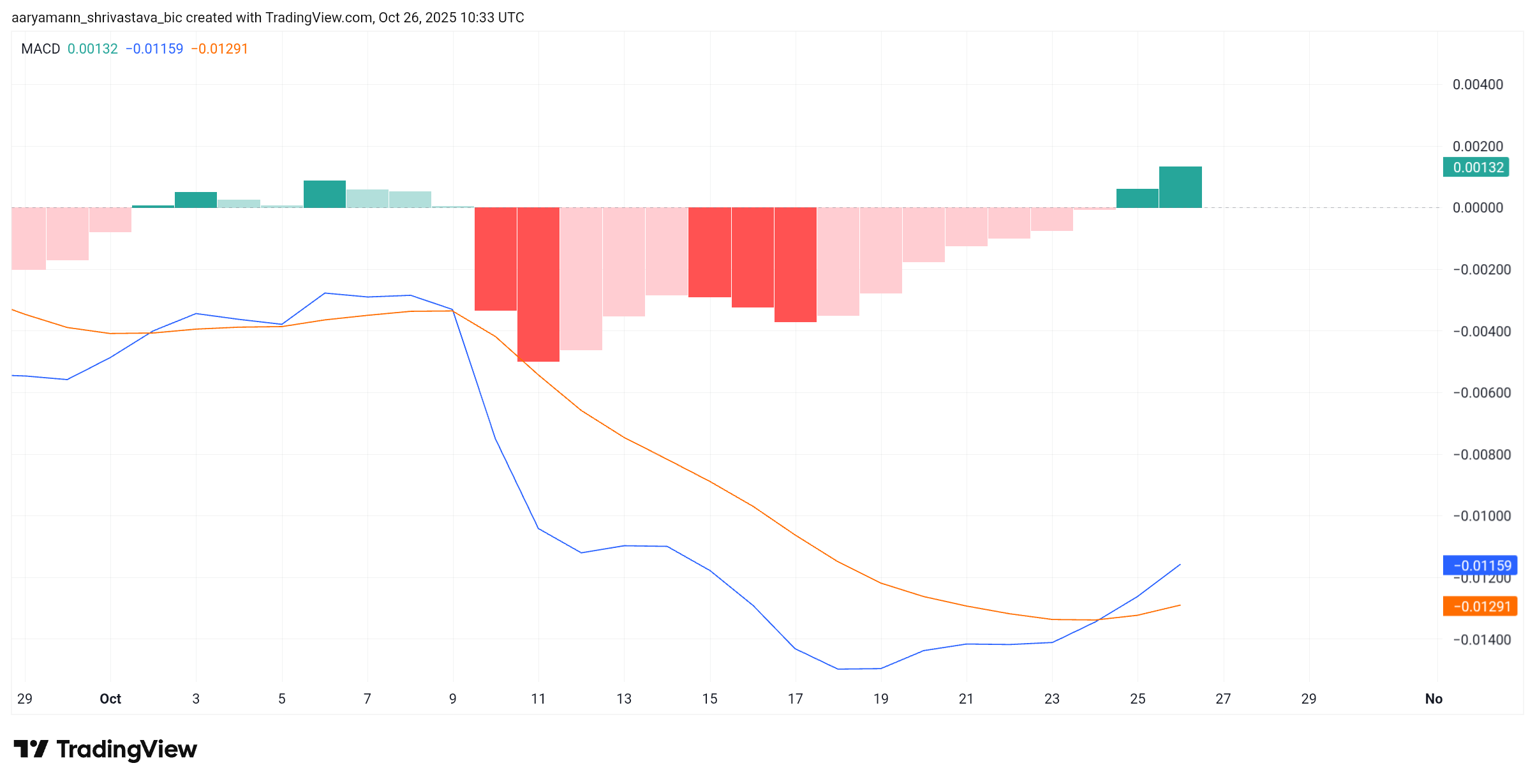

The Moving Average Convergence Divergence (MACD) indicator adds further weight to this potential reversal. In the short term, the MACD has just formed a bullish crossover, with the indicator line crossing above the signal line. This is a classic sign of waning bearish momentum and growing buying interest.

Such a crossover often precedes a price rebound, suggesting that market sentiment is turning more favorable. The shift indicates that HBAR is beginning to align with broader market cues supporting a risk-on environment. If momentum continues building, the cryptocurrency may enter a stronger phase of accumulation.

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR Price Can Breakout

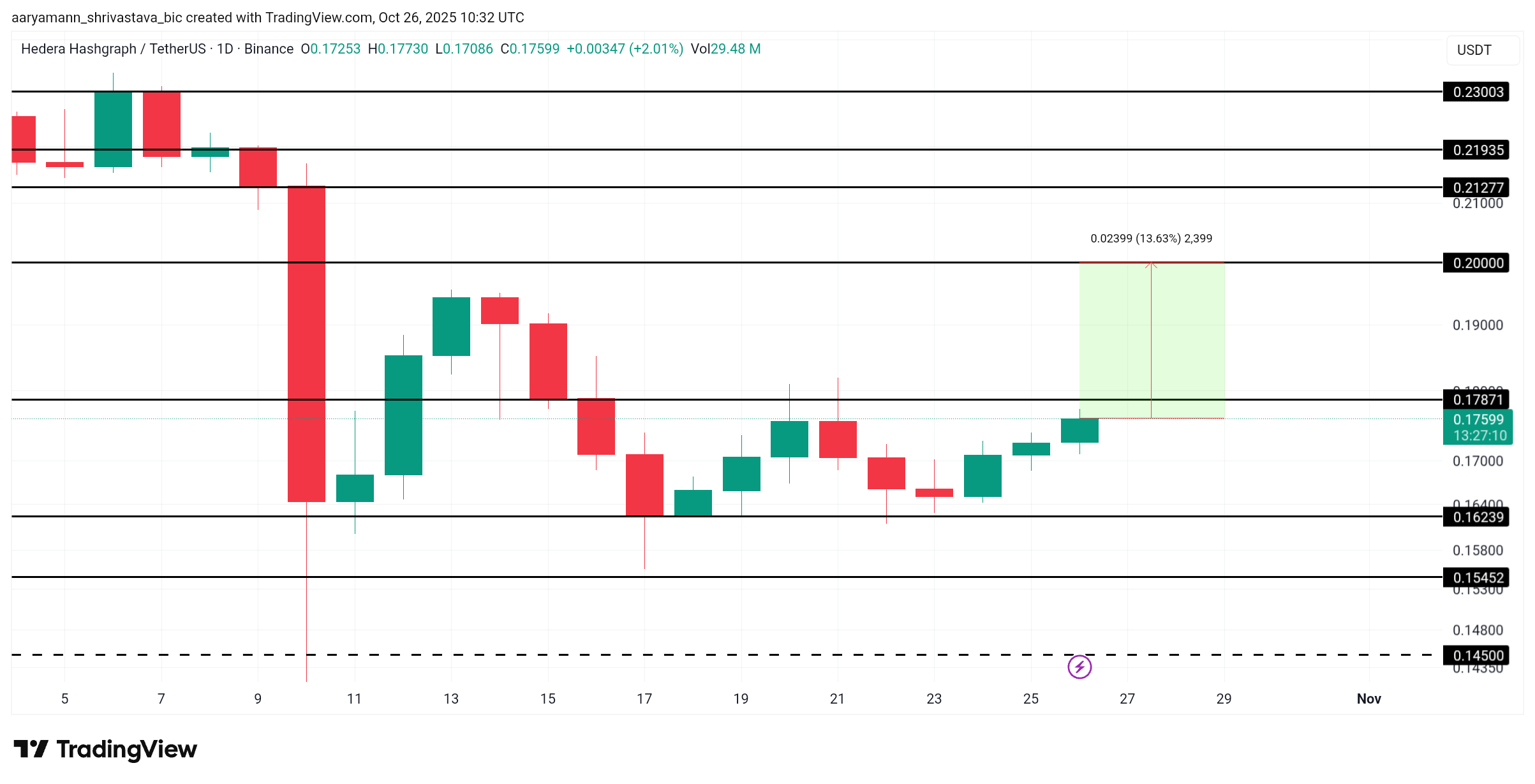

At present, HBAR’s price remains consolidated between $0.178 and $0.162. For the altcoin to initiate a clear breakout, it must close above the $0.178 resistance. Doing so would open the path toward the $0.200 psychological barrier, confirming a potential upward trend.

To reach $0.200, a 13.6% increase from current levels would be required. The bullish crossover on the MACD and the rising RSI suggest this move is achievable, provided investor participation continues.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if selling pressure returns, HBAR may retest support at $0.162, extending its consolidation phase. A breakdown below this level could invalidate the bullish thesis, pushing prices down to $0.154 and signaling renewed weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The Federal Reserve is expected to cut interest rates on Wednesday, S&P Global assigns a "B-" credit rating to Strategy

S&P Global has assigned a "B-" credit rating to bitcoin treasury company Strategy, classifying it as junk debt but with a stable outlook. The Federal Reserve is expected to cut interest rates by 25 basis points, with a possible split in the voting. The Hong Kong Securities and Futures Commission has launched a tender for a virtual asset trading monitoring system. Citi is partnering with Coinbase to explore stablecoin payment solutions. ZEC surged significantly due to halving and privacy topics. Summary generated by Mars AI. The accuracy and completeness of this summary are still being refined and updated by the Mars AI model.

BTC Volatility Review (October 6 - October 27)

Key indicators (4:00 PM Hong Kong time on October 6 -> 4:00 PM Hong Kong time on October 27): BTC/USD -6.4...

Cathie Wood warns: As interest rates rise next year, the market will be "chilled to the bone"

AI faces adjustment risks!

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Must Know

Clearly identify the type of transaction you are participating in and make corresponding adjustments.