Is the ISM Losing Its Power — or Pointing to a 2026 Bitcoin Supercycle?

As macro experts argue over the ISM’s reliability, crypto analysts see deeper implications for Bitcoin’s market cycle. With ISM contraction persisting, many now expect the next Bitcoin peak to come later—potentially stretching well into 2026.

A fierce debate has broken out among macro analysts over the credibility of the ISM Manufacturing Purchasing Managers’ Index (PMI). Experts say this key economic metric is being overused to predict business cycles and Bitcoin market tops.

The clash highlights a growing divide between traditional economic modeling and modern financial conditions-driven analysis, with ripple effects reaching deep into crypto market forecasting.

ISM Debate Splits Macro Analysts as Crypto Traders Reassess the 2026 Bitcoin Peak

CFA Julien Bittel, a macro strategist at Global Macro Investor (GMI), dismisses many of Wall Street’s go-to indicators as outdated or misinterpreted.

“Delinquency rates, ISM, PMIs, job openings, retail sales — none of these are leading indicators…Everything is downstream to changes in financial conditions,” Bittel wrote.

Bittel explained that GMI’s proprietary US Coincident Business Cycle Index integrates forward-moving elements within the data, including early employment signals, and that it began turning higher in mid-2022, months before ISM and other metrics rebounded.

According to Bittel, the labor market’s gradual cooling is actually a positive sign, paving the way for lower rates and renewed economic expansion.

However, macro strategist Henrik Zeberg presents a contrary opinion, calling for caution around treating survey-based indicators as reality.

“ISM is NOT the business cycle or the economy. It is a damn survey! In July 2022, many called for a recession based on the same GMI score. We did not see one. Maybe the score needs calibration?” Zeberg wrote.

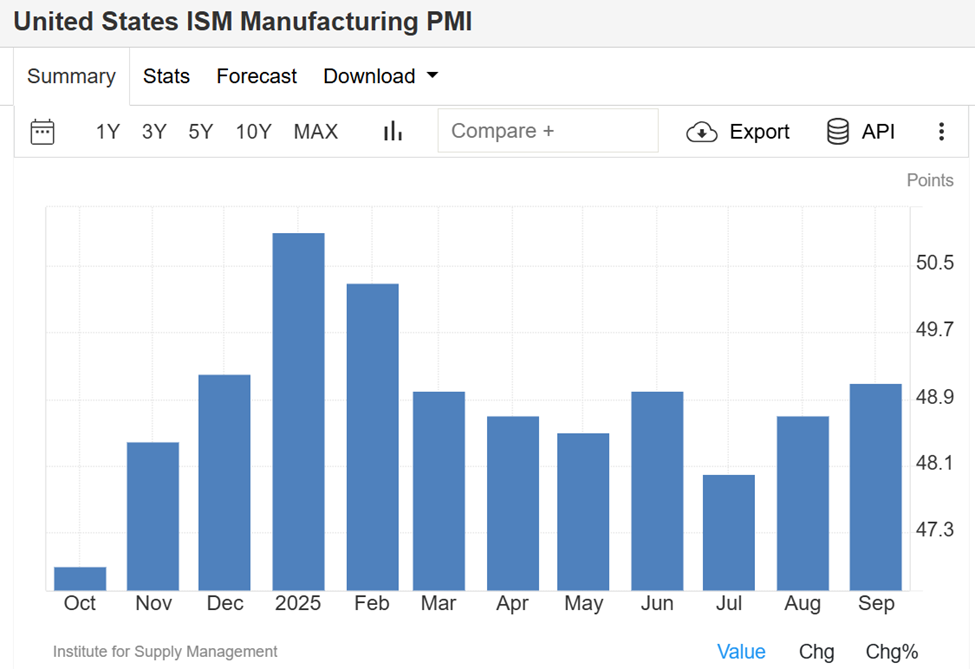

Their public disagreement births a wider discussion about how much weight the ISM PMI still deserves. The index measures US manufacturing activity and has remained below the neutral 50 mark for more than seven months, signaling contraction. However, it has not coincided with a full-blown recession.

US ISM Manufacturing PMI. Source:

US ISM Manufacturing PMI. Source:

ISM-Bitcoin Correlation Suggests a Longer Bull Market Could Extend Into 2026

Historically, the ISM’s moves have also correlated with major Bitcoin cycle tops, a connection first popularized by macro investor Raoul Pal.

NEW: Raoul Pal believes Bitcoin is now following a five-year market cycle, due to an extended debt maturity period and its close correlation with the ISM manufacturing index. 🤔Using an ISM-Bitcoin chart and a 5.4-year SIN curve, Pal predicts Bitcoin will likely peak around Q2…

— Bitcoin News (@BitcoinNewsCom) September 27, 2025

That correlation has now captured the attention of the crypto community. Analysts like Colin Talks Crypto and Lark Davis argue that the ISM’s prolonged stagnation could mean Bitcoin’s bull market will stretch far beyond its typical four-year rhythm.

“All three past Bitcoin cycle tops have broadly aligned with this index,” Colin noted.

The analyst suggested that a cycle top could be mid-2026 for the Bitcoin price if the relationship holds. Entrepreneur and Bitcoin investor Davis agreed, noting that while everyone expects a Q4 2025 peak, the ISM has not shown real expansion yet, meaning this cycle could go way deeper into 2026.

Everyone's expecting this cycle to peak in Q4 this year.But I think we're going way deeper into 2026.Here's why:The classic 4-year business cycle usually have 2 years of expansion and 2 years contraction. That should’ve lined up with a Q4 2025 top.But this time, the ISM…

— Lark Davis (@TheCryptoLark) October 1, 2025

A weaker ISM often implies delayed economic recovery and longer market expansions. Despite current headwinds from tariffs to sluggish global demand, the extended contraction phase may lengthen the broader business cycle rather than end it.

While this could translate to a more gradual, durable uptrend for the Bitcoin price, it warns against expecting an early peak as the 2025–2026 cycle debate shapes into a consequential narrative linking traditional economics and digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Institutions Wager on Altcoins’ 100x Growth as CPI Sparks Risk-On Market Mood

- Altcoin prices may surge as investors shift focus to U.S. CPI data and risk-on sentiment, with Solana (SOL) and Ripple (XRP) highlighted as potential 100x plays. - Coinbase's $375M Echo acquisition and Pave Bank's $39M Series A funding underscore institutional confidence in blockchain infrastructure despite market volatility. - Solana's $195 rebound, 55% transaction volume surge, and $400M staking ETF inflows position it as a high-growth altcoin amid rising institutional demand. - Fed rate cut expectatio

Asia's rapid growth in stablecoins sets technological advancement in contrast with regulatory prudence

- Kaia DLT Foundation drives Asia's multi-currency stablecoin growth amid $46T 2025 global transaction volumes, outpacing traditional payment giants. - Major players like Western Union (Solana), PayPal (Paxos) and Visa (Stellar) expand stablecoin offerings, with Visa reporting $2.5B annualized volumes in Q4 2025. - China's PBOC warns of stablecoin risks to monetary sovereignty, while Hong Kong positions itself as a digital asset hub through regulated initiatives like Red Date's cross-border solutions. - Re

Bitcoin News Update: Metaplanet Initiates Share Repurchase to Narrow Disparity Between Stock Price and Bitcoin Holdings

- Metaplanet Inc. will hold a shareholder meeting on Dec 22, 2025, to address its mNAV ratio drop below 1.0x. - The company authorized a ¥75B share buyback (13.13% of shares) funded by a $500M loan secured against 30,823 BTC ($3.5B). - New capital policies prioritize buybacks when shares trade below intrinsic value and issue perpetual preferred shares for BTC purchases. - Shares rose 2.3% after the announcement, following a 74% decline from June highs, as the firm aims to accumulate 210,000 BTC by 2027.

Ethereum Updates Today: Ethereum Holds $3,930 as Key Support Following Drop Below $4,000

- Ethereum fell below $4,000 on Oct. 28, marking a 3.59% drop and ending a five-day rally, its largest decline since October 2025. - Traders monitor $3,930 support, with breakdowns risking a test of $3,870–$3,880, while $3,945–$4,000 remains a key technical battleground. - Long-term optimism persists as Ethereum’s CD 5 Index rebounds, but near-term stability hinges on overcoming resistance near $4,000. - Upcoming Fusaka upgrade aims to boost smart contract efficiency, potentially driving ETH demand and alt