Elon Musk’s SpaceX Transfers $134 Million Worth of Bitcoin

SpaceX is back on the blockchain radar. Elon Musk’s aerospace company just moved over $133 million worth of Bitcoin—a hefty 1,215 BTC—into new wallets, according to data from Arkham Intelligence. The transfers, coming only days after a similar move, have sparked speculation across crypto circles about whether SpaceX is reshuffling its treasury or preparing for something bigger.

SpaceX Moves Over 1,200 BTC in Major Transfer

Elon Musk’s SpaceX quietly moved more than 1,200 Bitcoin—worth roughly $133 million—on Friday, according to blockchain analytics firm Arkham Intelligence. The firm confirmed that 1,215 BTC were sent to several separate wallet addresses, marking the second large transfer by the company in just a few days.

Arkham detailed that SpaceX shifted 300 BTC (around $33 million) and another 915 BTC (worth $100.7 million) to new destinations. These wallets are not currently labeled under SpaceX, unlike previous addresses associated with the company.

Following a Week of Heavy Bitcoin Activity

This move follows earlier transactions earlier in the week, also involving similarly sized amounts. Prior to the transfers, SpaceX held approximately 8,285 BTC, valued near $914 million at recent market prices above $110,000 per Bitcoin . This places the company as the fourth-largest private Bitcoin holder, according to BitcoinTreasuries.net.

A Look Back at SpaceX’s Bitcoin Holdings

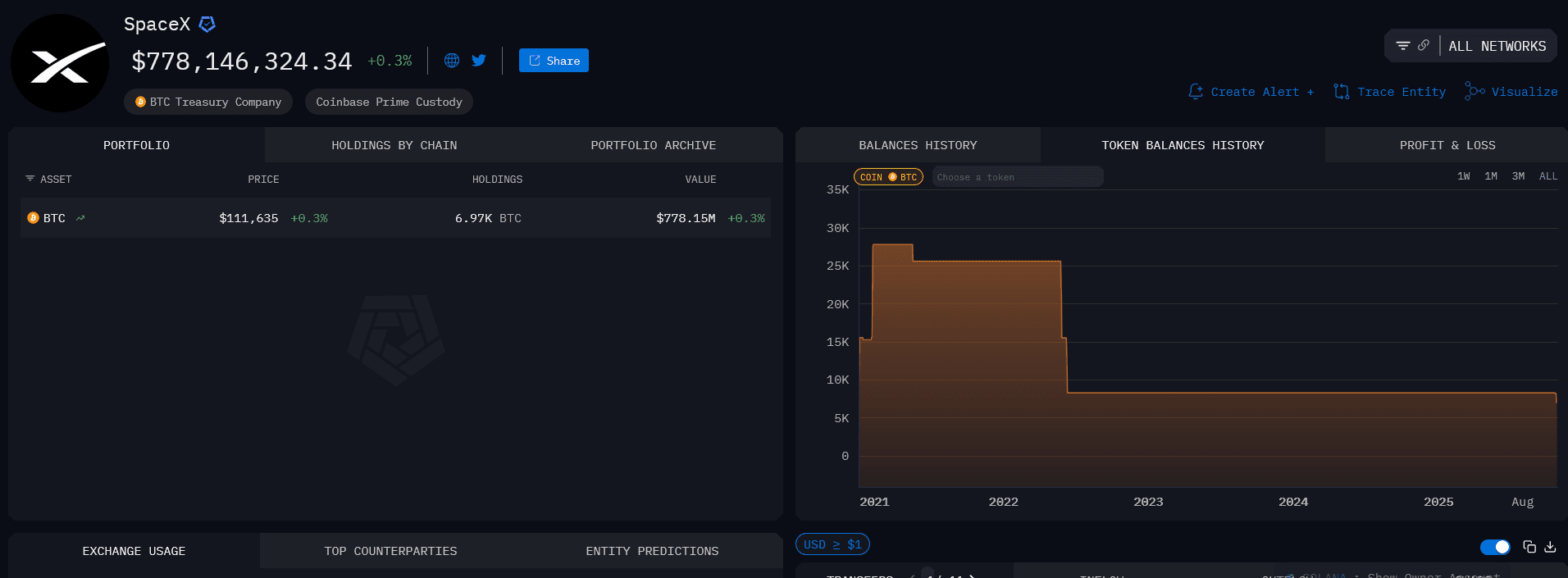

SpaceX’s crypto holdings have fluctuated dramatically over the past few years. In 2022, addresses linked to the firm reportedly held up to 25,000 BTC. However, that number dropped sharply to around 8,285 BTC by mid-2022. After that, the company remained inactive on the blockchain for nearly three years—until earlier this year, when it resumed movement of funds through consolidation transactions.

Motives Behind the Transfers Remain Unclear

So far, there’s no indication whether SpaceX is selling, reorganizing, or securing its Bitcoin holdings. The firm has made no public statement about the purpose of these transfers. With Bitcoin’s recent price surge and renewed institutional interest, analysts are watching closely to see whether this signals strategic repositioning or routine internal restructuring of treasury wallets.

What This Could Mean for the Market

Large movements of Bitcoin by high-profile firms like SpaceX or even Elon Musk often stir speculation in the crypto community. While the intent remains unknown, the scale and timing—amid Bitcoin’s rally above $110,000—suggest that SpaceX is actively managing its digital assets once again. Whether it’s for security, liquidity, or upcoming sales, one thing’s clear: SpaceX’s Bitcoin activity has officially resumed after a long silence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Review (October 6 - October 27)

Key indicators (4:00 PM Hong Kong time on October 6 -> 4:00 PM Hong Kong time on October 27): BTC/USD -6.4...

Cathie Wood warns: As interest rates rise next year, the market will be "chilled to the bone"

AI faces adjustment risks!

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Must Know

Clearly identify the type of transaction you are participating in and make corresponding adjustments.

BlackRock’s Stance Leaves Altcoin Enthusiasts on Edge

In Brief BlackRock's Bitcoin spot ETF boosted confidence, defying expectations of Bitcoin's end. Altcoin ETFs could eliminate current institutional investor limitations, spurring market growth. Lack of BlackRock's altcoin ETF may limit long-term support, risking market disillusionment.