Solana News Update: BONK's Institutional Investment Mirrors MicroStrategy's Approach to Bitcoin

- Bonk Holdings (BNKK) acquired 2.26T BONK tokens ($32.7M), securing 3% supply via Solana multisig wallet as first DAT. - Institutional strategy includes 10% revenue share from BONK.fun ($100M+ daily volume) and plans to double holdings by year-end. - Price stabilized at $0.00001466 with institutional adoption (e.g., Sharps Technology) drawing parallels to MicroStrategy's Bitcoin treasury model. - Rebranding from Safety Shot and planned 1T token burn aim to reinforce price floors amid mixed trading volume

BONK, a meme coin built on Solana,

This acquisition, executed through crypto broker FalconX and held with Fireblocks, fits into Bonk Holdings' broader plan to weave digital assets into its business model. CEO Jarrett Boon expressed strong belief in BONK's future potential, pointing to the company's 10% revenue share in BONK.fun—a decentralized platform with daily trading volumes exceeding $100 million, as noted by

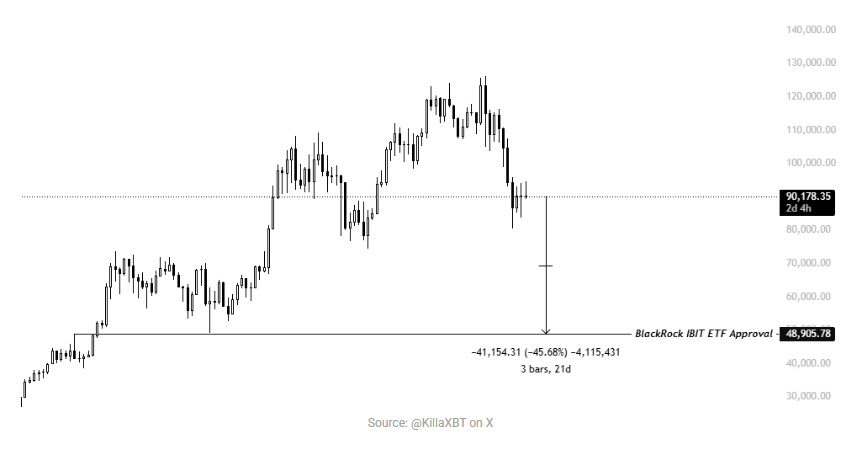

Market experts are monitoring BONK's price, which settled at $0.00001466 after a turbulent October, with support at $0.00001054 and resistance around $0.0000187, according to Coinotag. The recent accumulation by Bonk Holdings, along with increased institutional involvement—such as Sharps Technology staking SOL in BonkSOL—has fueled optimism for a potential rally. Some analysts compare this strategy to MicroStrategy's approach with its

The October 2025 rebranding of Bonk Holdings from Safety Shot further demonstrates its dedication to digital assets, as it divests non-essential assets to concentrate on high-growth opportunities. This move reflects a wider trend of corporate crypto adoption, with companies like SharpLink utilizing

A major upcoming event for BONK is the planned burn of one trillion tokens, which could decrease supply and help maintain price support. Still, traders remain wary, as lower trading volumes indicate uncertainty. On-chain analysis from

Looking ahead, BONK's potential for a breakout will depend on continued institutional backing, increased trading activity, and favorable on-chain data. For now, its adoption by corporate treasuries and platforms like BONK.fun highlights its growing significance in the digital asset world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why

What’s the Latest on Chainlink (LINK)? Analysis Firm Assesses the Likelihood of a Recovery

Tether’s Offer to Buy Juventus Has Received a Response