Bitcoin News Update: Bitcoin's Divergence from Gold Challenges 'Digital Gold' Narrative as ETFs Propel Institutional Embrace

- Bitcoin surged 62% in 2025, outperforming gold, Tesla, and tech stocks as top global asset. - October's near-zero correlation with gold (0.1) shattered "digital gold" narrative, highlighting structural market timing differences. - $3B Bitcoin-to-ETF conversions via BlackRock's IBIT ($88B AUM) accelerated institutional adoption through SEC-approved in-kind redemptions. - Rumble-Tether Bitcoin tipping integration ($775M investment) expands crypto's utility beyond stores of value into content monetization.

Bitcoin’s explosive growth in 2025 has made it the world’s best-performing asset, climbing 62% since the start of the year and surpassing gold, Tesla, and leading tech equities. This impressive rally has reignited discussions about Bitcoin’s function as a macro hedge, especially after its almost nonexistent correlation with gold in October challenged the “digital gold” comparison.

The gap between

At the same time, institutional interest in Bitcoin surged, as

Market activity also included

On the innovation side, Bitcoin’s use cases continued to grow. Rumble, a video-sharing service, teamed up with

Forecasts for Bitcoin’s price remain divided. While

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

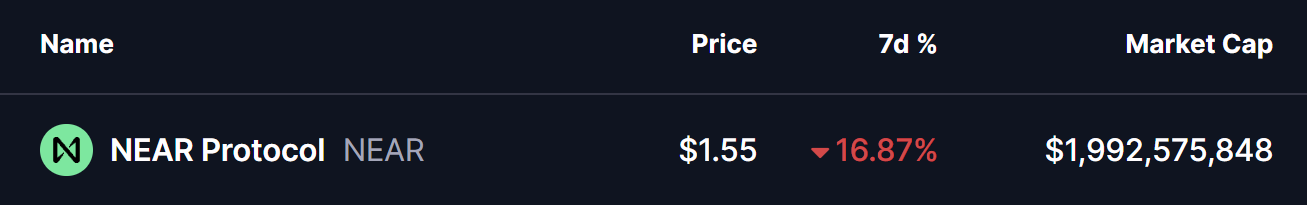

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027

PEPE Holds $0.054322 Support as Price Trades in a Tight Range