CMO Announces Upcoming POLY Airdrop: Insights into Polymarket Token Predictions

Platform's Chief Marketing Officer Verifies Plans for Launching POLY Token with Accompanying Airdrop

Key Points

- Polymarket, a leading prediction platform, is planning to launch a native token, POLY.

- The platform’s traction among investors is increasing, and the Intercontinental Exchange invested $2 billion in it.

Polymarket, a prominent prediction platform, is preparing to introduce its native token, POLY.

Matthew Modabber, the Chief Marketing Officer (CMO) of Polymarket, has confirmed that the POLY token’s launch is in progress.

Polymarket’s POLY Token Launch

Modabber revealed that Polymarket is planning to launch the POLY token. This announcement follows a surge in the prediction market’s trading and an increase in investor interest.

In early October, Shayne Coplan, the founder of Polymarket, hinted at the potential launch of the POLY token.

Modabber confirmed this information during an interview on the Degenz Live podcast. He indicated that Polymarket took its time before discussing the POLY launch to ensure the team’s thoroughness.

The CMO stated that the platform’s goal is to release a token with genuine utility and longevity, and they plan to keep POLY around indefinitely.

Polymarket’s Focus on US App Launch

Polymarket did not rush the roll-out of POLY due to its focus on launching its app in the United States.

“Why rush a token if we need to prioritize the U.S. app, right?” Modabber said. Coplan confirmed last month that the platform received approval to resume operations in the country after a three-year hiatus due to regulatory uncertainty.

Once the app’s debut in the US is complete, more attention will be given to the token launch. In the meantime, crypto enthusiasts have started discussing the possible distribution of the POLY token.

Some suggest that token distribution will be allocated based on trading volume, meaning the platform’s most active users will receive the largest share.

Polymarket’s growing popularity among investors is evidenced by the Intercontinental Exchange’s $2 billion investment in the platform.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

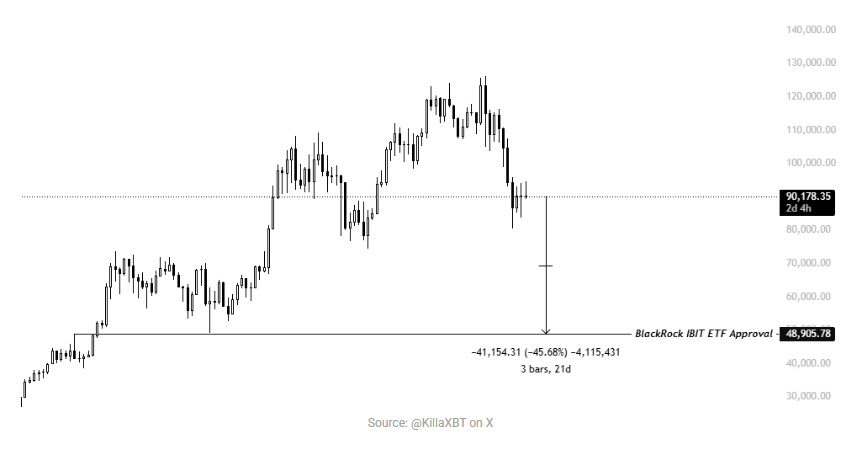

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why

What’s the Latest on Chainlink (LINK)? Analysis Firm Assesses the Likelihood of a Recovery

Tether’s Offer to Buy Juventus Has Received a Response