Bitcoin News Update: Early Bitcoin Holders Transfer $16.6 Million to Counter Quantum Computing Risks

- A 14-year-old Bitcoin wallet (18eY9o) moved $16.6M in a single transaction, reigniting concerns over quantum computing threats to legacy P2PK addresses. - Experts warn quantum machines could crack Bitcoin's encryption within 4-5 years, with 25% of Bitcoin ($554B) at risk, particularly older wallets. - Companies like SEALSQ and Xanadu are advancing post-quantum solutions, but analysts stress urgent action is needed by 2026 to secure crypto infrastructure. - Institutional adoption of custodial products and

A Bitcoin wallet that has been inactive for 14 years

This transaction reflects a larger pattern of early Bitcoin adopters—often called "OGs"—either cashing out or reallocating their coins as Bitcoin nears significant price thresholds. Recently, over 80,000 BTC associated with a major 2011-era holder was sold via

Quantum computing has become a major worry for the cryptocurrency sector. Recent progress by Google in quantum technology has increased concerns that quantum computers might break Bitcoin’s elliptic curve encryption within four to five years, according to Pierre-Luc Dallaire-Demers, the founder of post-quantum security company Pauli Group. Deloitte has calculated that about 25% of all Bitcoin—roughly $554 billion—could be exposed to quantum attacks, especially older wallets. The risk is not limited to cryptocurrencies; experts warn that much of the internet’s security infrastructure could also be threatened.

The need to fix these weaknesses is urgent, as the Bitcoin network is slowly moving toward quantum-proof solutions. Firms like SEALSQ Corp. have introduced hardware-based post-quantum cryptography, while Canadian companies such as Xanadu and 1QBit are working on large-scale quantum computing projects. Still, experts warn that switching to quantum-safe systems could require 6 to 12 months, making it crucial to act before 2026.

Interest from large investors in Bitcoin has changed as well, with major holders increasingly turning to custodial services like BlackRock’s ETF. While many early users still value self-custody, the emergence of institutional investment products has changed the traditional landscape, according to a

The reactivation of the 18eY9o wallet underscores the vulnerability of older Bitcoin systems. As quantum computing technology progresses, the urgency to implement quantum-resistant measures grows—posing significant consequences for the future of decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

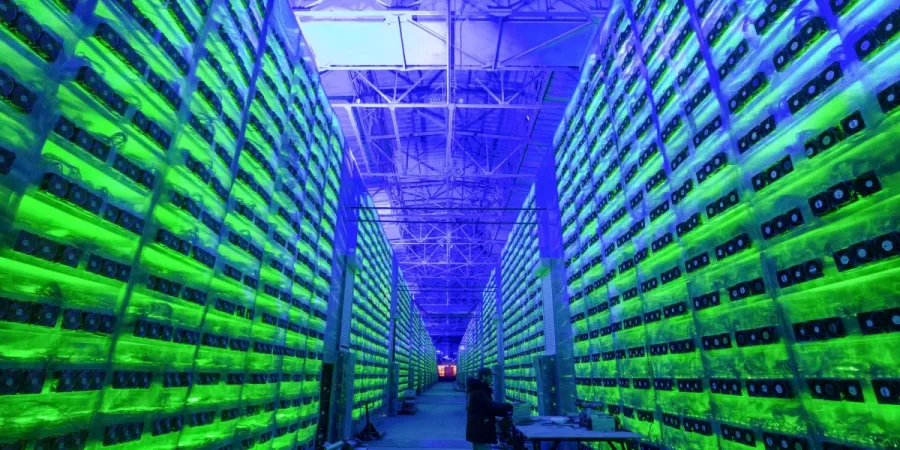

China Becomes World’s Third Biggest Bitcoin Mining Hub

Miami's Cohesion Compared to New York's Discord: The Battle for World Cup Hosting

- Miami's outgoing mayor warns NYC's political infighting and fragmented governance could jeopardize its 2026 World Cup bid. - New York's mayoral race reveals deep divisions over housing and safety, complicating coordinated infrastructure upgrades needed for the tournament. - While NYC invests $2.6B in hospital modernization, critics highlight delays in stadium and transportation projects critical for World Cup hosting. - Miami's unified governance model, enabling rapid sports/tourism infrastructure develo

Bullish Industries Support FLM, Yet Core Fundamentals Remain Uncertain

- Flamingo Finance (FLM) gains traction amid bullish trends in renewables, aerospace, and crypto sectors, driven by technical indicators and sectoral capital inflows. - Market optimism is reinforced by First Solar's $286 price target and FTAI Aviation's 16–97% upside potential, highlighting durable competitive advantages in infrastructure and margins. - Crypto regulatory shifts, including Crypto.com's U.S. bank charter filing, signal maturing digital asset ecosystems that could enhance FLM's tokenomics int

Cardano Latest Updates:

- BullZilla ($BZIL) emerges as top presale with 100x return potential via 24-stage burn mechanism and $0.00527 listing price projection. - Cardano (ADA) signals 60% price surge with golden cross pattern, while Monero (XMR) dominates privacy sector at $306.74 amid heightened surveillance. - Institutional interest shifts toward utility-deflationary projects like BullZilla and MoonBull ($MOBU), which mirrors BZIL's model with 9,256% ROI potential. - November 2025 marks critical inflection point as $19B Octobe