Key Market Intelligence on October 24th, how much did you miss out on?

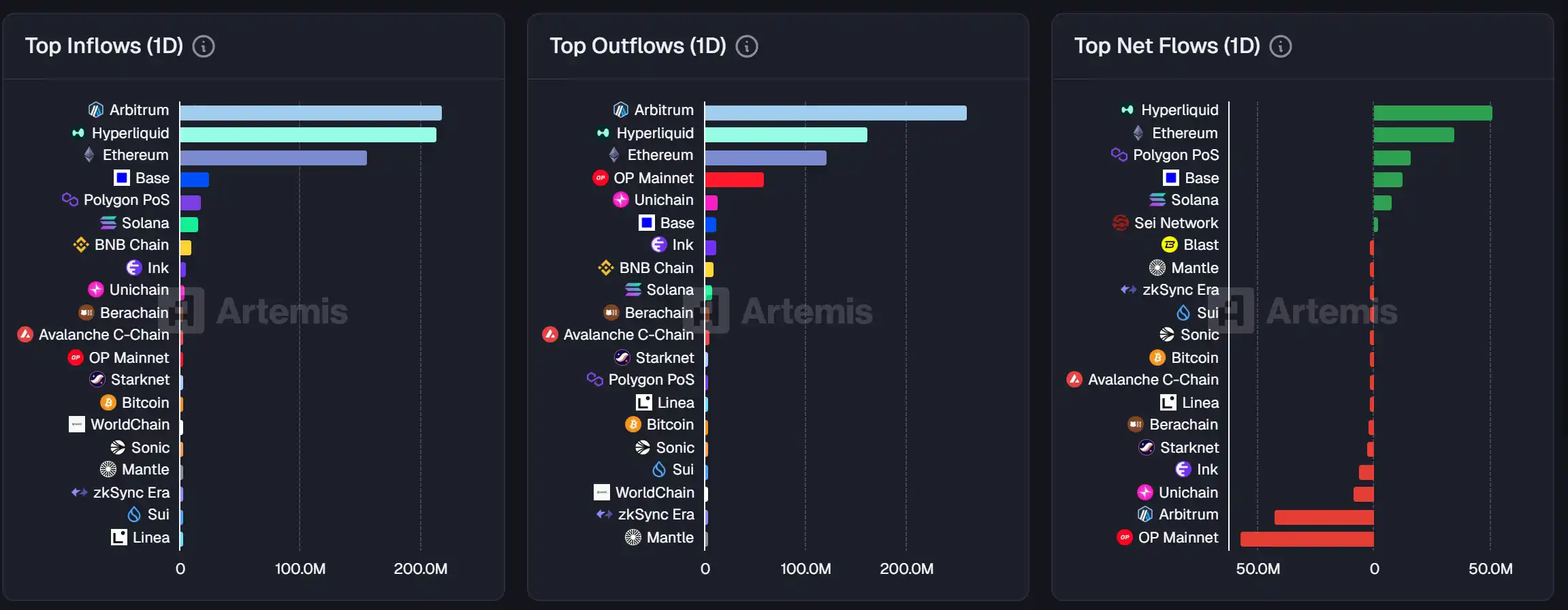

1. On-chain Flows: $51.1M USD flowed into Hyperliquid today; $56.9M USD flowed out of OP Mainnet 2. Largest Price Swings: $BBT, $SAROS 3. Top News: x402 Protocol's token PING surpasses a $32M USD market cap with a 802% 24-hour increase

Top News

1. x402 Protocol Token PING Surpasses $32 Million Market Cap, 24-hour Surge of 802%

2. Base Ecosystem Tokens See Uptrend, PING, CLANKER, and VIRTUAL Lead in Popularity

3. Jupiter to Launch New Platform, First Project to Start in November

4. Binance Alpha to List APRO(AT), Phase One Airdrop Threshold at 220 points

5. CLANKER Market Cap Exceeds $36 Million, Nearly 50% Surge in 24 hours

Trending Topics

Kaito

Here is the Chinese-to-English translation of the original text:

[MET]

MET has rapidly become a market focus due to its listing and active trading. The token has now landed on multiple exchanges such as OKX, Bybit, KuCoin, with a market cap of approximately $6.7 billion. The community is generally optimistic about its innovative liquidity pool technology and active community support. However, some voices are also concerned about its founder facing a class-action lawsuit for alleged "pump and dump" activities. Despite the controversy, the overall market sentiment remains positive, with many users celebrating the airdrop and looking forward to the project's future development.

[HYPERLIQUID]

Decentralized exchange platform Hyperliquid (token $HYPE) sparked discussions by listing on Robinhood—Robinhood's move to list ahead of Coinbase and Binance is seen as a strategic action. In addition, Hyperliquid Strategies Inc. has submitted a $1 billion funding application, with the market speculating that it may be used to increase holdings of $HYPE, further boosting its popularity. The platform's innovative DeFi integration, as well as the dynamics of whales depositing USDC and leveraged shorting BTC, have also fueled discussion. The overall sentiment is positive, with the market having confidence in its long-term growth.

[MEGAETH]

MEGAETH has become a central topic of discussion due to its upcoming Token Generation Event (TGE). The market is paying attention to its innovative mechanisms such as "Sequencer Rotation" and "Proximity Markets," aiming to achieve low latency and value capture. Its token sale adopts an English auction format, with an estimated valuation of 50 billion USD (based on Hyperliquid's presale data). However, some people have raised concerns about its transparency and fundraising allocation. Nevertheless, many still see it as a potential project and compare it to Ethereum, discussing its potential impact on the crypto ecosystem.

[MONAD]

MONAD's mainnet is about to launch, accompanied by an airdrop, making it a hot topic today. Discussion focuses on the ecosystem deployment on the mainnet, comparison with MegaETH, and the development expectations of new DApps. The community is also watching its presale valuation and strategic partnerships, seen as essential drivers of future innovation and growth.

[BNB]

BNB's trading activity has significantly increased as CZ receives a pardon from Trump. The market widely views this as a significant positive for BNB and the broader crypto market. Additionally, BNB has been listed on Coinbase and Robinhood, further boosting capital inflows and sentiment. The BNB community is also looking forward to the ongoing hackathon and the launch of new trading features, believing that these initiatives will help expand BNB's global influence and utility.

Featured Articles

1. "Rhythm Interview with Stable CEO: Stablecoin Chain Race Accelerates, Where is Stable stronger than Plasma?"

Stablecoins are undergoing a narrative transition from a medium of exchange in the crypto market to a core component of global payment infrastructure. Recently, BlockBeats had an in-depth conversation with Stable CEO Brian Mehler, discussing their technical architecture choices, ecosystem partnership strategies, their collaborative relationship with Tether, response to global regulatory trends, and the practical logic of stablecoin's enterprise-side applications, attempting to portray the true picture of this "underrated" stablecoin chain.

2. "Like the 30x Big Golden Dog of Inscriptions, what is the x402 Protocol?"

Yesterday, a special Gold Dog was born on Base, and it is $PING. Based on the cost of minting and the current coin price, a successful Mint results in approximately 18x gains. What sets $PING apart is that its minting process is reminiscent of the inscription from 2 years ago. The cost of minting $PING once is about $1, and if successful, you can receive 5000 $PING. The minting page for $PING is similar to the inscription from years past, lacking a fancy frontend and giving off a more hardcore vibe.

On-chain Data

On-chain fund movement on October 24th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy Retains Nasdaq-100 Spot, MSCI Delisting Risks Remain

Phantom integrates Kalshi prediction markets as crypto wallets expand into event trading

Why the $150,000 Bitcoin Prediction in December is Misleading

CryptoTicker News: Fed Rate Cut, Stablecoin Banks and XRP ETF Hits $1B