How Investors Stockpiled Stellar (XLM) Despite Falling Prices in October

While market sentiment around Stellar (XLM) stays bearish, on-chain data reveals quiet accumulation. Rising TVL, major exchange outflows, and network upgrades point to renewed investor conviction amid short-term price weakness.

The unexpected price decline of Stellar (XLM) in October boosted demand, even though the token has not yet recovered its previous losses. On-chain data and the project’s latest updates reflect confidence among certain investors, while overall market sentiment remains pessimistic.

Investor accumulation of XLM throughout October indicates long-term conviction rather than short-term price chasing. The following factors provide a clearer explanation.

Exchange Reserves Plunge While TVL Hits Record High

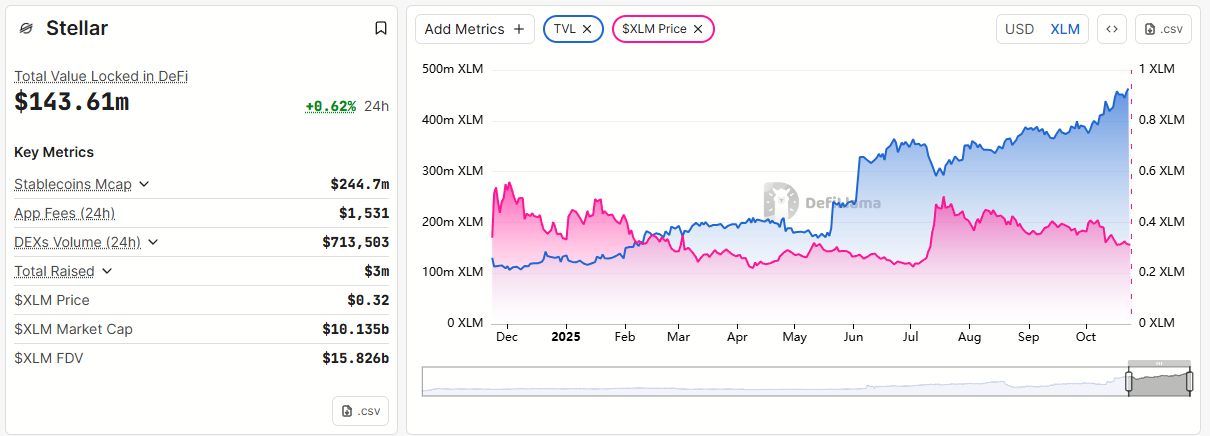

According to DeFiLlama, the total value locked (TVL) on the Stellar chain, measured in XLM, has surged to an all-time high of over 456 million XLM locked across various DeFi protocols.

Stellar TVL. Source:

Stellar TVL. Source:

Comparing XLM’s price performance with its TVL since last December highlights investors’ faith in the network’s ecosystem.

Specifically, since December, XLM’s price has dropped by 50%, but the amount of XLM locked in DeFi protocols has increased more than fourfold.

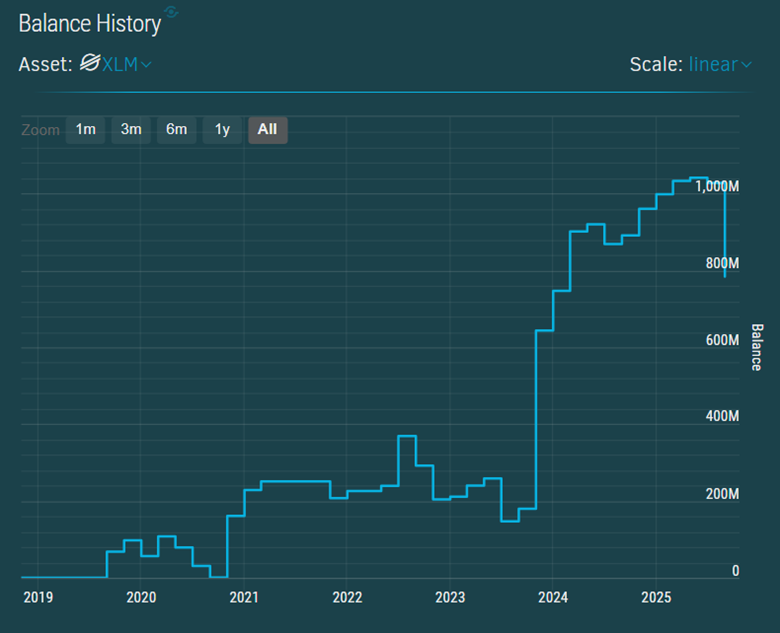

Another positive sign comes from Binance wallet data. The exchange’s official XLM address (GBA…GPA) recorded over 240 million XLM withdrawn from the exchange over the past two months, the largest outflow since 2024.

XLM supply on Binance. Source:

XLM supply on Binance. Source:

Combining these two data points suggests that many XLM investors were heavily accumulating during October. They may have moved tokens off exchanges for long-term storage or to deploy them in DeFi.

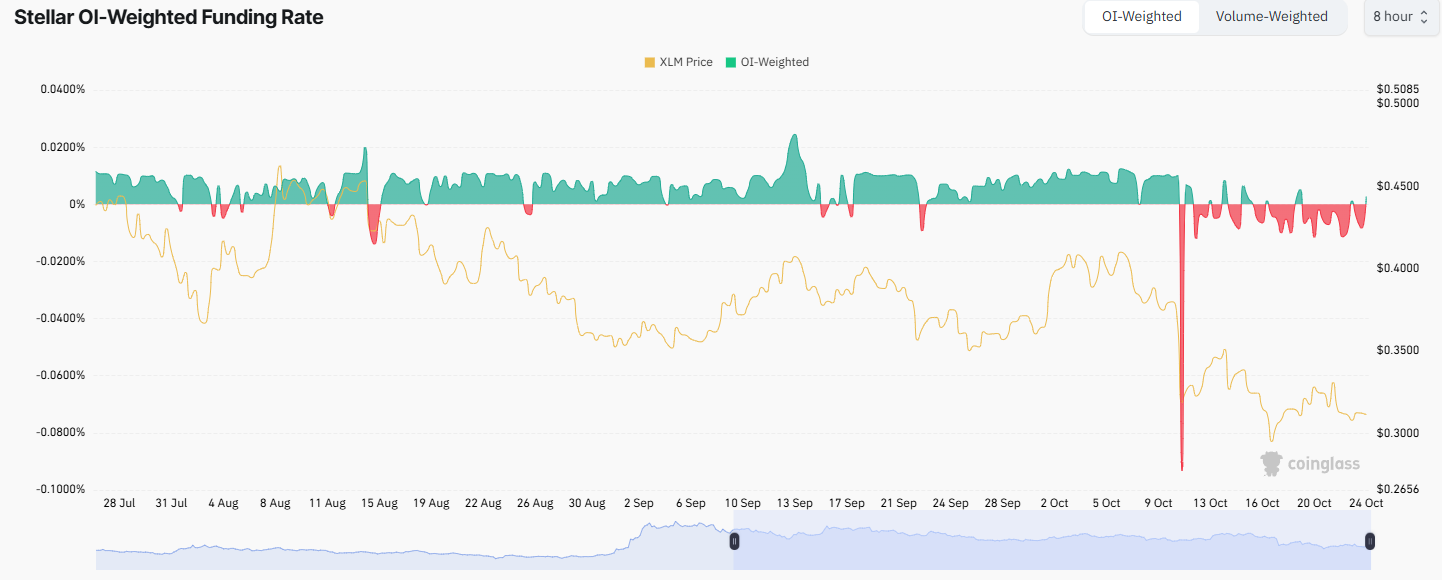

However, the overall picture is not entirely optimistic. Data from CoinGlass shows that the funding rate for XLM futures contracts has remained negative for the past two weeks, reflecting ongoing bearish sentiment among traders.

Stellar (XLM) Funding Rate. Source:

Stellar (XLM) Funding Rate. Source:

The OI-weighted funding rate has fluctuated below zero since October 11, indicating that traders are paying to maintain short positions. The drop below $0.20 has made market sentiment even more pessimistic.

While the TVL and exchange reserve data suggest long-term optimism, the negative funding rate reveals short-term selling pressure on exchanges. As a result, XLM’s price could continue to fall. Yet, for some investors, that weakness presents an opportunity.

Several investors believe that XLM below $0.20 represents an attractive entry point before a potential bull run similar to 2017.

XLM Price Prediction. Source:

XLM Price Prediction. Source:

“What’s coming next? The mass adoption rally — it’s written all over this chart. Two clean accumulation phases. Buy zone holding. The breakout won’t warn you,” investor X Finance Bull predicted.

Finally, Stellar’s vitality stems from its core upgrades and real-world use cases.

Validators on the Stellar network recently voted to upgrade the Stellar Mainnet to Protocol 24, fixing a bug in the state storage feature. At the same time, the value of real-world assets (RWA) on Stellar rose by 26.3% over the past month, reaching $638 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity and Institutional Participation: Advancing the Transition with Infrastructure Suited for Institutions

- Global clean energy market is projected to reach $1.8 trillion by 2033, driven by policy support, tech innovation, and institutional capital. - U.S. Inflation Reduction Act spurred $14B quarterly clean manufacturing investments by Q1 2025, boosting solar and battery production. - Institutional-grade trading platforms like CleanTrade achieved $16B notional value in 2025, enhancing liquidity through derivatives and AI/blockchain tools. - North America leads scalability with 220 GW solar capacity (7% of U.S

Aptos Stablecoin Growth Surges with $386M Added

Aptos leads all chains with $386.2M in new stablecoin supply in 24h, signaling strong adoption and growing ecosystem momentum.How This Signals a Shift in ActivityWhat the Market Might See Next

Zero Knowledge Proof Dominates Headlines With the Delivery of Its First Proof Pod, While AVAX and DOT Fight Off Market Pressure!

Avalanche Price Shows Weak MomentumPolkadot News: Technical Indicators Turn BearishZero Knowledge Proof Delivers Its First Proof Pod!Wrapping UpFAQs

Digital Asset ETPs See $716M Inflows as Bitcoin Leads

Digital asset ETPs gained $716M in inflows this week, led by Bitcoin and Ethereum, pushing total assets under management to $180B.Ethereum, XRP, and Chainlink See Strong DemandOutflows Hit Hyperliquid