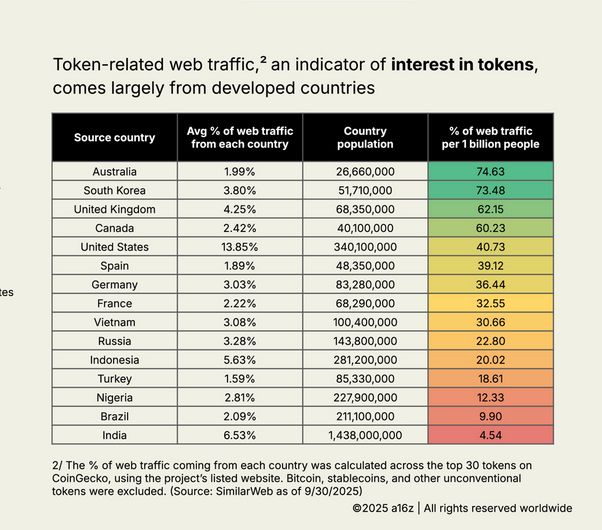

Australia ranks first for crypto interest per capita, according to a16z Crypto data .

The team measured token-related web traffic for the top 30 CoinGecko tokens, excluding Bitcoin and stablecoins to focus on altcoin research.

The approach highlights how Australia crypto users engage with discovery and trading pages.

The a16z Crypto data puts Australia at 74.63% per 1 billion people for token-related web traffic.

South Korea follows at 73.48%, while the United Kingdom records 62.15% on the same metric.

These numbers reflect how Australia crypto interest concentrates on token pages relative to population.

Australia’s Surging Crypto Interest Tops Global Charts. Source: X

Australia’s Surging Crypto Interest Tops Global Charts. Source: X

By comparison, the United States logs 40.73% of token-related web traffic per billion people.

This gap signals different usage patterns across markets. It also shows how policy, access, and education shape Australia crypto users versus peers.

Australia crypto users focus on tokens beyond Bitcoin and stablecoins

The a16z Crypto data removed Bitcoin and stablecoins to isolate research around altcoins.

As a result, Australia crypto interest appears in segments where fundamentals, narratives, and listings shift quickly. Users check token profiles, liquidity details, and exchange availability.

Moreover, token-related web traffic indicates heavier attention to speculation and short-cycle themes.

CoinGecko tokens provide a clean window into where attention flows each day. Therefore, Australia crypto users often examine newer categories and sector rotations.

Still, the metric reflects traffic, not portfolio size or performance. It shows that Australia crypto interest regularly lands on token pages.

It also confirms a consistent pattern that the a16z Crypto data captured across regions.

Developed vs. developing markets: trading vs. mobile wallet usage

According to a16z Crypto data, users in developed markets lean toward trading and speculation.

Consequently, token-related web traffic concentrates on price pages, exchange links, and comparisons. Australia crypto users fit this profile in the dataset.

In contrast, users in developing markets show higher on-chain activity, signaled by mobile wallet usage. Here, people rely on wallets for transfers, savings, and app access. The split highlights functional differences rather than engagement gaps.

This divide helps interpret Australia crypto interest. High token-related web traffic suggests more research around tradable assets.

Meanwhile, the mobile wallet usage signal explains adoption modes where wallets, not exchanges, sit at the center.

Australia crypto market outlook: Statista 2026 forecast

Statista projects the Australia crypto market to grow 19.85% annually, reaching A$1.2 billion (about $780 million) in 2026.

The model spans exchange services, brokerage, and related tooling. It aligns with the present Australia crypto interest captured by the traffic study.

Additionally, Statista estimates 11.16 million Australia crypto users by 2026. That figure implies nearly 41% participation across the country. Participation includes buying, selling, holding, or interacting with digital assets.

These projections mirror today’s token-related web traffic. A higher per-capita share often precedes wider onboarding.

Here, the Statista 2026 forecast sits beside the a16z Crypto data to frame likely demand.

Sentiment snapshot: Swyftx survey on Gen Z and Millennials

A Swyftx survey reports that 40% of Gen Z and Millennial Australians regret not investing in crypto a decade ago.

The datapoint reflects sentiment in these cohorts. It also helps explain renewed Australia crypto interest in education and research.

This sentiment aligns with increased reading of CoinGecko tokens pages. Users compare categories, token mechanics, and liquidity. They also watch local regulatory updates that shape access.

Industry players continue to expand services while rules evolve. Recent coverage noted Gemini growing in Australia with a wait-and-see approach to pending regulation.

The detail adds context to how Australia crypto users find compliant on-ramps.

Editor at Kriptoworld

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 24, 2025 • 🕓 Last updated: October 24, 2025