Solo Bitcoin miner scores $347K — 'pure self-soverignty in action'

A solo Bitcoin miner has become the latest lucky person to win the “Bitcoin mining lottery,” pocketing a $347,455 block reward.

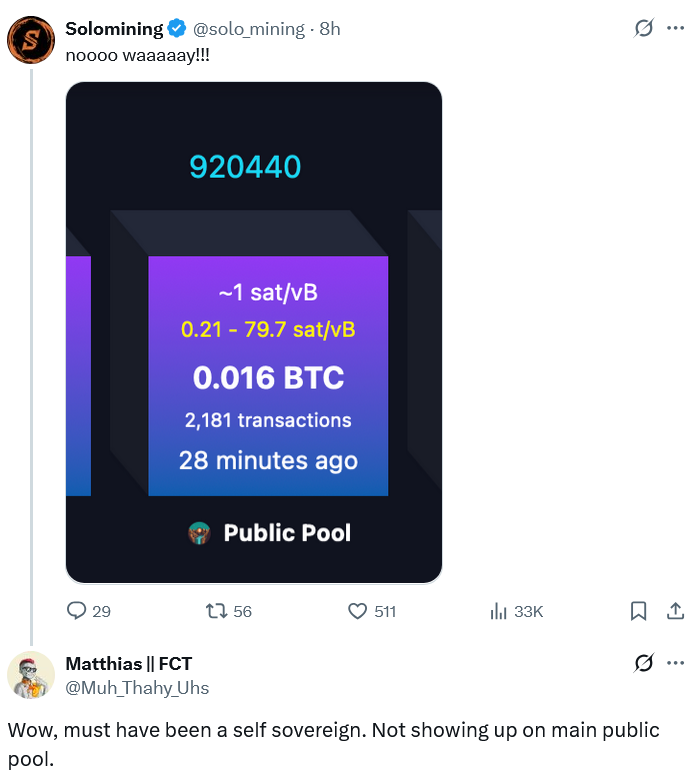

Bitcoin node infrastructure company Umbrel said the solo miner won the block via the Public Pool Bitcoin mining pool — earning the 3.125 Bitcoin (BTC) block reward and a 0.016 BTC transaction fee on top.

It took place at block height 920,440, on Thursday at 7:32pm UTC, Mempool.space data shows.

While solo Bitcoin miners winning blocks isn’t uncommon, this one was more impressive as the miner secured the block entirely on their own by running a solo mining pool as opposed to the more common practice of pooling hash power with others.

“No middlemen. No third-parties. Just pure self-sovereignty in action,” Umbrel said, while the Bitcoin Bazaar X account added:

“A solo block has been mined by a solominer, mining on his own mining pool, hosted on an Umbrel Server. Total sovereignty. We need more of this.”

Source: Matthias

Solo Bitcoin mining is a win for decentralization

The increase in solo Bitcoin miners solving blocks is a good thing for Bitcoin’s decentralization as it gives smaller miners a better chance to compete against the large industrial-scale miners, many of which are publicly traded.

Pocket-sized Bitcoin miners are still cheaper than iPhones

It comes amid a rise in smaller-sized Bitcoin miners, such as Bitaxes in recent years, which sell from $155 to over $600, depending on the machine’s terahash-per-second capacity.

Related: Trump on CZ pardon: I’m told ‘what he did is not even a crime’

While the pocket-sized machines combined only contribute a small boost to Bitcoin’s hash rate, many of these machines have been open-sourced to fight the “secrecy and exclusivity” of larger Bitcoin miners, which typically use the closed-sourced Bitcoin ASICs, a BitMaker spokesperson told Cointelegraph in 2023.

Magazine: Mysterious Mr Nakamoto author: Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

VIPBitget VIP Weekly Research Insights

This year's market has been driven primarily by the growth of DATs, ETFs, and stablecoins. Strong institutional inflows indicate that mainstream U.S. capital is now entering the crypto market. However, after the October 11 black swan event, the market underwent a significant correction due to deleveraging. Even so, several indicators now suggest that a bottom may be forming. Our recommended assets are BTC, ETH, SOL, XRP, and DOGE.

Zcash (ZEC) Value Soars in Late 2025: Regulatory Transparency and Institutional Embrace Drive Growth in Privacy-Oriented Cryptocurrency

- Zcash (ZEC) surged 1,100% in November 2025 to $9.24B, driven by regulatory clarity, institutional adoption, and rising privacy demand amid CBDC concerns. - Grayscale's Zcash ETF filing and EU's 2027 privacy coin phaseout highlight regulatory duality, with optional transparency features attracting institutional investors. - Cypherpunk and Reliance Global's ZEC investments, plus $197M Grayscale holdings, signal privacy coins' shift from niche to mainstream financial assets. - Market dynamics show $2B daily

XRP News Today: XRP Faces Impending Death Cross: Falling Below $1.82 Could Lead to a 15% Decline

- XRP faces bearish pressure as a death cross forms, signaling potential 15% price correction below $1.82 support. - Analysts highlight $1.90–$2.08 consolidation zone as critical for stability, with $1.65 Fibonacci level as potential bottom. - Recent ETF launches briefly boosted XRP to $2.25, but weak volume and lack of institutional buying limit upside. - Broader crypto fragility and regulatory uncertainties amplify risks for XRP holders amid technical breakdown threats.