I. Complete Record of Whale Operations: Accurately Grasping Market Pulse

Amid intensified volatility in the cryptocurrency market, a trader known as the "100% Win Rate Mysterious Whale" has become the market focus due to their precise timing and astonishing profitability. According to on-chain data monitoring, this trader executed a series of precise operations between October 15 and 24, demonstrating remarkable market judgment.

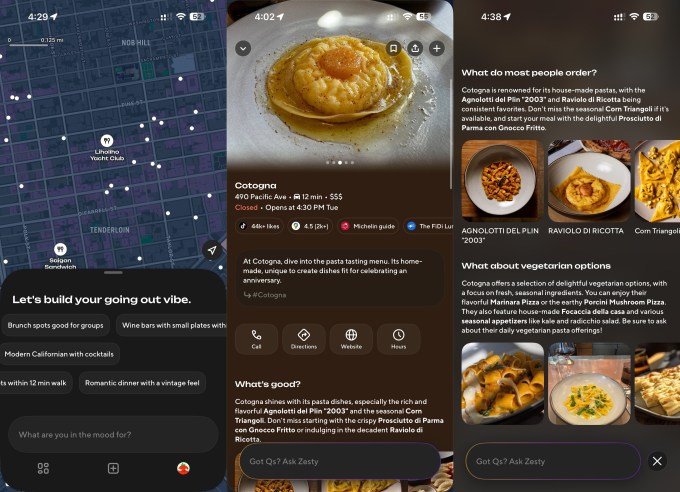

Table 1: Key Operations Timeline of the Mysterious Whale (October 15-24)

Date | Operation | Asset | Direction | P&L (10,000 USD) | Cumulative P&L (10,000 USD) |

October 15 | Large Short Position | BTC | Short | +268.3 | +268.3 |

October 16 | Reversal Long | BTC | Long | - | +268.3 |

October 17-21 | Continuous Position Increase | BTC/ETH | Long | - | +268.3 |

October 22 | Closed Long Positions | BTC/ETH | Close | +604.0 | +872.3 |

October 22-23 | Switched to Short | BTC | Short | +83.5 | +955.8 |

October 23 | Test Small Position | BTC | Long | Unknown | +955.8 |

October 24 | Closed Long Positions | BTC/ETH/SOL | Close | +177.4 | +1133.2 |

October 24 | Opened New Long | ETH | Long | Holding | +1133.2 |

Perfect Record Achieved

● According to on-chain analyst Ai Yi (@ai_9684xtpa), since October 14, this "100% Win Rate Mysterious Whale" has maintained a perfect record of 12 consecutive profitable exits, with a cumulative profit of 12.634 million USD, setting the most impressive personal trading record since the second half of 2025.

![[October 11 Insider Whale] Twelve consecutive wins harvest 12.6 million, profiting from both long and short positions and leading market followers image 0](https://img.bgstatic.com/multiLang/image/social/20a04ab54fc76048b7a1a30ed8c4bd911761294784872.png)

Accurately Grasping News Events

● At 01:45 on October 24, after the news of the China-US leaders' meeting was released, Bitcoin briefly broke through the 111,000 USD mark. The whale reacted quickly, closing their BTC, ETH, and SOL long positions at the market high, earning 1.774 million USD in a single operation.

● Specifically, the BTC long yielded 1.271 million USD, the ETH long yielded 357,000 USD, and the SOL long yielded 146,000 USD.

Rapid Position Switching

● Less than five hours after closing the long positions, the whale opened a 5x leveraged ETH long at 7:00 am the same day, holding 7,375.45 ETH worth about 28.42 million USD, showing continued optimism about the market's future trend.

II. Whale Group Behavior and Market Impact

Synchronized Actions of Related Addresses

Meanwhile, an address associated with this mysterious whale, "0xc2A" (known as the "1011 Insider Whale"), also carried out similar operations.

● According to monitoring, this address has placed 57.3 million USD worth of ETH limit long orders in the 3,800 to 3,840 USD range. Its current holdings include: 801.19 BTC (4x long, worth 88.15 million USD) and 2,228.94 ETH (5x long, worth 8.65 million USD).

Table 2: Comparison of Major Recent Whale Operations in the Market

Whale Type | Representative | Operation Characteristics | Recent Moves | Market Impact |

Insider Whale | Trump-Related Whale | Precise Timing, High Leverage | Opened 234 million USD short | Triggered Follow-up Selling |

High Win Rate Whale | 100% Win Rate Mysterious Whale | Flexible Switching Between Long and Short | 12 Consecutive Wins | Sentiment Indicator |

Buy High Sell Low Type | ETH Trading Whale | Chasing Rallies and Dips, Frequent Trading | Lost 29.14 million USD | Increased Market Volatility |

Long-Short Switch Type | 0xc2a3 Address Whale | Quickly Switches After Profit | Closed Long, Switched to 163 million USD Short | Signals Market Reversal |

Impact on Price and Trading

● The operations of this mysterious whale have exerted direct trading pressure on the market, especially on relevant tokens on the Hyperliquid platform. Their large-scale closing of positions often leads to short-term liquidity crunches, while new positions tend to attract followers, intensifying instantaneous market volatility.

● Data from the Hyperliquid platform shows that the current total whale holdings on the platform reach 5.241 billion USD, with a long-short ratio of 0.83 and short positions accounting for 54.62%. This indicates that whales as a whole are bearish on the short-term market. However, the contrarian long positions of this mysterious whale stand in stark contrast to the overall whale group, creating a more complex market game.

On-Chain Fundamental Changes

On-chain data confirms that long-dormant whale addresses are becoming active again, increasing their trading activity, which historically has usually led to higher short-term volatility and selling pressure.

● Since the beginning of 2025, more than 892,000 BTC from long-inactive wallets (inactive for 12 months to 5 years) have been moved, indicating that large holders are actively adjusting their positions.

Several whale investors have recently made large-scale adjustments to their short positions, totaling hundreds of millions of USD.

● The most notable is an investor known as the "Insider Whale," who has transferred about 588 million USD worth of 5,252 BTC to major exchanges including Coinbase, Binance, and Kraken. Such large capital inflows usually indicate the holder's intention to sell or hedge positions.

III. Expert Opinions and Market Sentiment Analysis

Divergent Analyst Views

Regarding the operations of this mysterious whale and its impact on the market, industry analysts and institutions have offered different interpretations:

● 'Crypto Detective' Blockchain Detective: This analyst has tagged a wallet associated with former BitForex CEO Garrett Jin as a recently active "insider" whale. In now-deleted social media posts, Jin admitted the association but claimed the funds belonged to clients, not himself. Regarding market impact, Blockchain Detective believes: "Such operations reflect that the crypto market still suffers from severe information asymmetry, and some participants may use undisclosed information to gain excess profits."

● 'Technical Analyst' CryptoNobler: This analyst takes a more critical stance, considering the whale's actions as "pure market manipulation," suggesting they may be deliberately selling BTC holdings to push prices down to their short position targets. CryptoNobler points out: "These whales use their capital advantage and market influence to create price swings and harvest retail traders. This is especially prominent in the unregulated crypto market."

● 'Platform Observer' Steven.HL (Founder of Yunt Capital): From a platform mechanism perspective, he believes that the existence of derivatives trading platforms like Hyperliquid provides fertile ground for whale manipulation: "The pre-market phase is easily manipulated for multiple reasons, including only one oracle determining market price, sparse order book depth allowing temporary manipulation, and many people hedging risks, making it easy to guess where large liquidations are."

● 'Independent Analyst' Ai Yi: As an analyst who has been tracking this mysterious whale, Ai Yi points out: "This whale demonstrates the ability to flexibly switch between long and short, unlike those who relied solely on shorting for profits around October 11. In this round of 12 consecutive wins, he adopted a 'dual long-short' strategy, quickly adjusting direction according to market changes."

IV. Risk Warnings and Investment Advice

Potential Risks Cannot Be Ignored

Although the mysterious whale's operations are impressive, investors should remain rational when referencing such information and fully recognize the risks involved:

● Risk of Following the Crowd: Whale operations are highly professional and forward-looking, and their success may rely on information advantages or top-tier algorithmic strategies unavailable to ordinary investors. Retail traders who blindly follow may easily become "bag holders" due to information lag and lack of execution ability.

● Platform Mechanism Risk: Derivatives trading platforms such as Hyperliquid have experienced multiple price manipulation incidents. Common mechanism issues include: only one oracle determining market price, sparse order book depth that can be temporarily manipulated, and lack of restrictions on large leverage.

● Market Liquidity Risk: When multiple whales adjust positions simultaneously, it may trigger drastic changes in market liquidity, making it difficult for retail investors to close positions at ideal prices. Especially during periods of heightened volatility, large asset transfers by whales to exchanges often accelerate price movements, increasing trading costs and closing difficulties for retail investors.

Investment Advice and Dynamic Tracking

For ordinary investors, the following strategies are recommended:

1. View Whale Moves Rationally: Treat whale operations as one of the market sentiment indicators, not the only trading signal. Understand the possible logic behind their actions, but never follow blindly.

2. Strictly Control Leverage: In the current volatile market environment, significantly reduce leverage usage to avoid forced liquidation due to short-term sharp fluctuations.

3. Diversify Investment Targets: Do not over-concentrate on individual cryptocurrencies, especially those with high whale activity. Consider diversified asset allocation.

![[October 11 Insider Whale] Twelve consecutive wins harvest 12.6 million, profiting from both long and short positions and leading market followers image 1](https://img.bgstatic.com/multiLang/image/social/41e5d1ea953744c460d0cf212fd2c61b1761294785118.png)