Solana Price Eyes Bullish Crossover as New Addresses Hit Monthly High

Solana’s network growth and bullish MACD signal hint at recovery potential. A breakout above $192 may send SOL toward $200, but losing $183 risks deeper losses.

Solana (SOL) has struggled to regain its footing after several failed recovery attempts over the past few days. While the altcoin has avoided forming new lower lows, it remains confined within a bearish setup.

However, improving on-chain metrics and technical signals suggest a potential shift in sentiment that may soon favor the bulls.

Solana Holders Surge

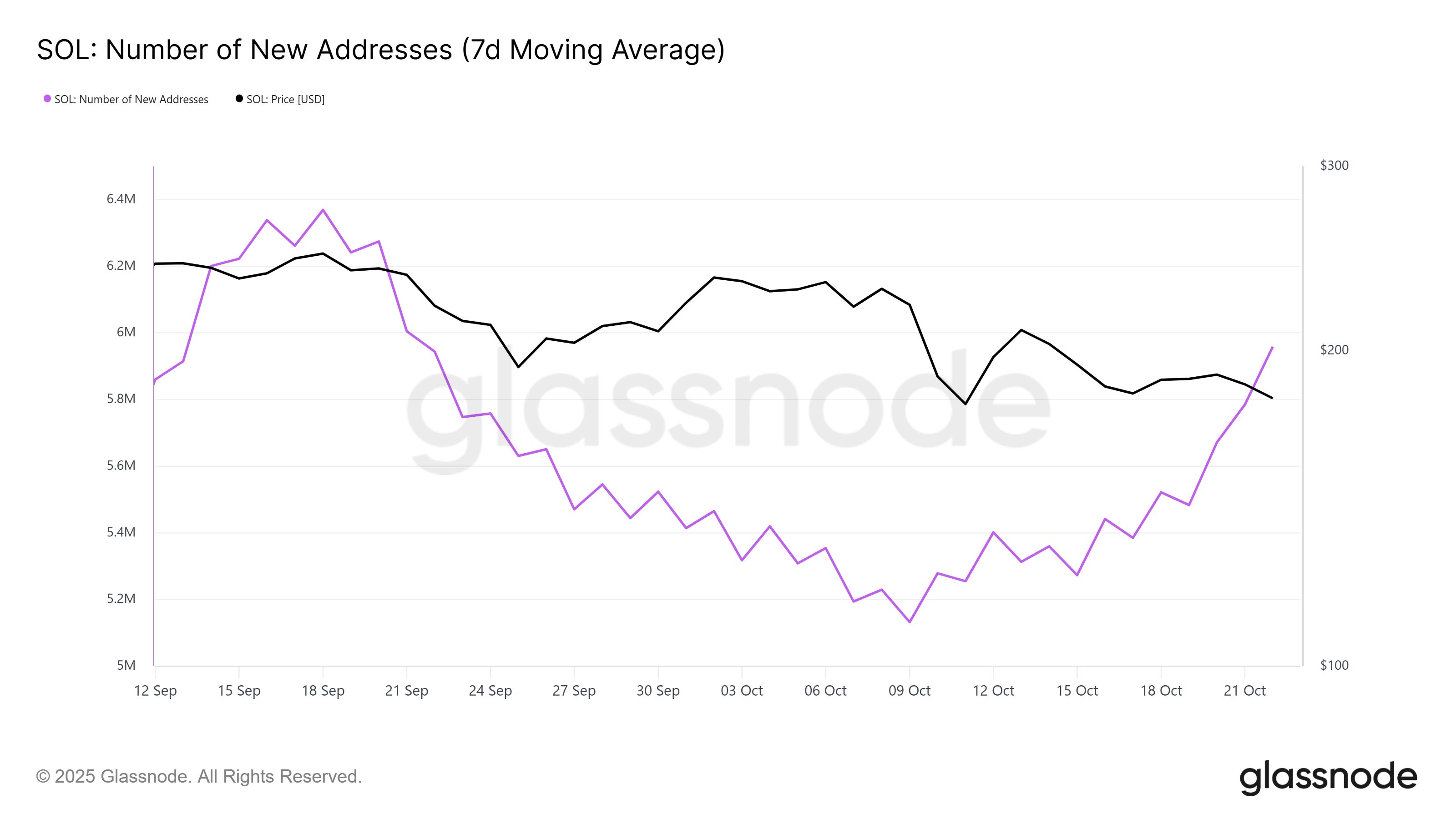

Solana’s network activity shows encouraging signs of growth, with new wallet addresses rising notably in recent days. This uptick indicates renewed investor interest and expanding participation in the ecosystem. When new addresses surge, it often reflects growing confidence in the network’s utility and long-term prospects, both essential for sustained price growth.

The current increase in new address creation marks a monthly high for Solana, underlining strong network fundamentals despite price stagnation. If this momentum continues, SOL could see increased liquidity and greater market demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana New Addresses. Source:

Glassnode

Solana New Addresses. Source:

Glassnode

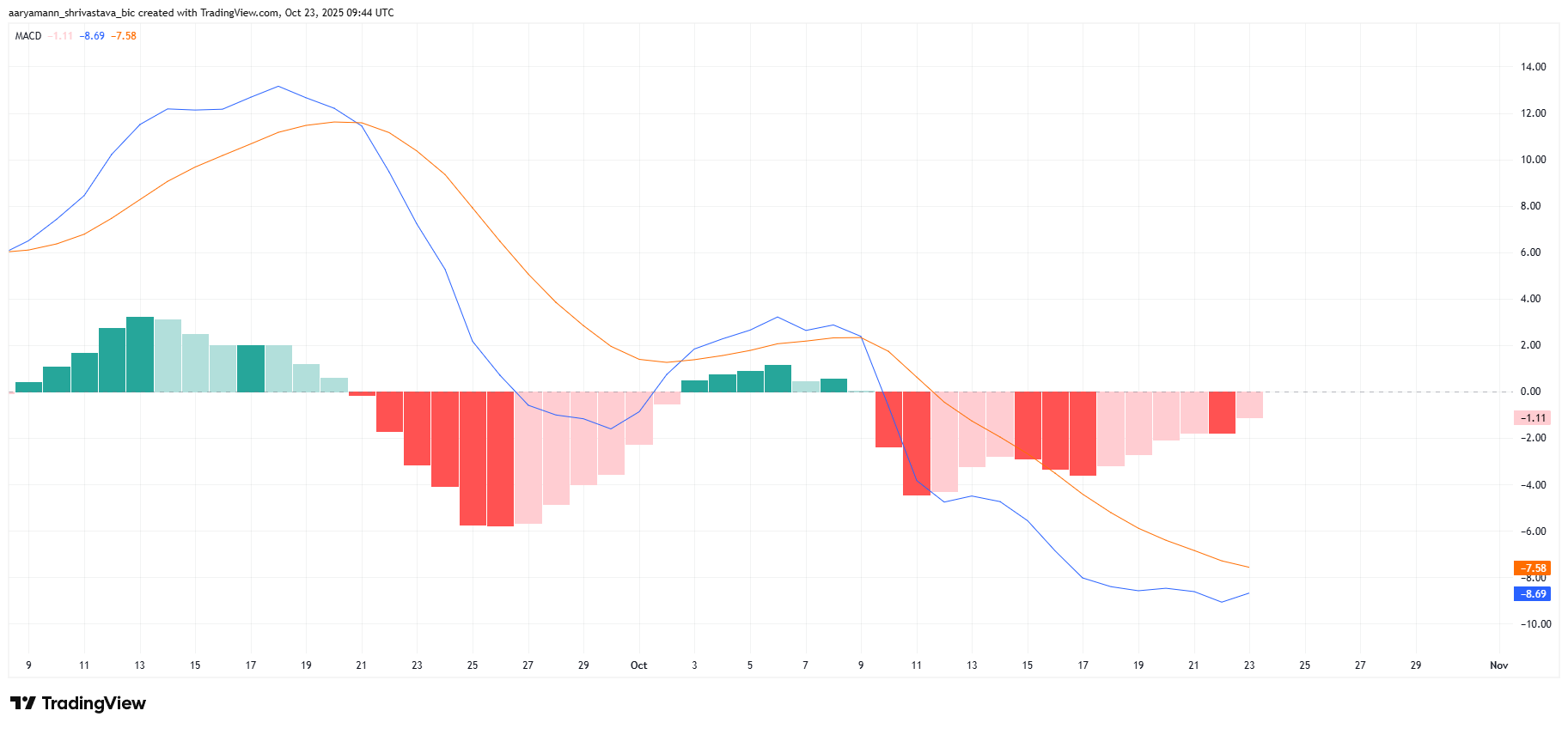

From a technical perspective, Solana’s Moving Average Convergence Divergence (MACD) indicator is inching closer to a bullish crossover. The MACD line nearing the signal line suggests that downward momentum is weakening. If the crossover is confirmed, it would signal a potential reversal and mark a turning point in SOL’s price trajectory.

A confirmed bullish crossover often leads to renewed optimism among traders and investors. Such momentum shifts can attract short-term speculators seeking to capitalize on price swings while reinforcing long-term confidence.

Solana MACD. Source:

TradingView

Solana MACD. Source:

TradingView

SOL Price May Be Looking At A Rise

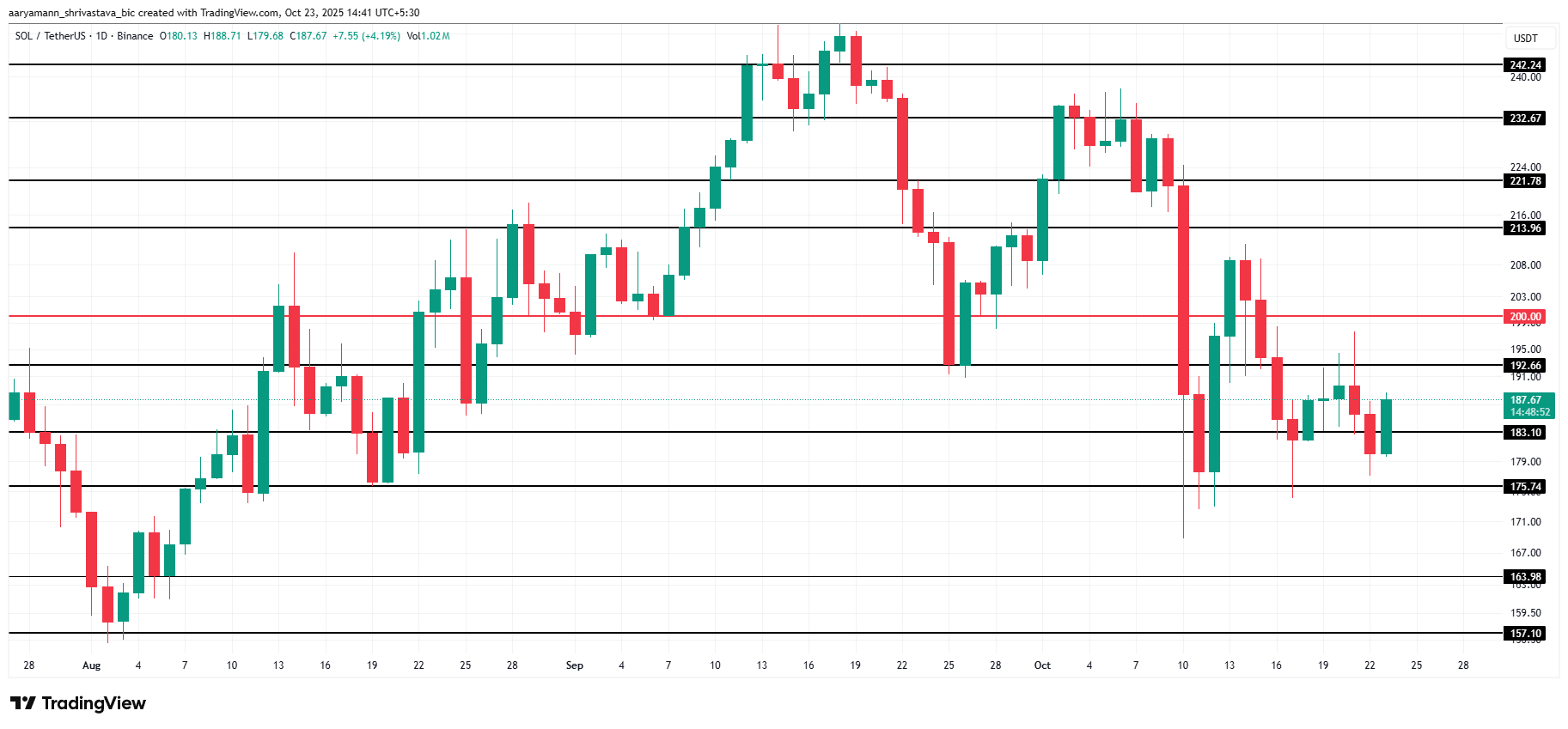

Solana’s price stands at $187 at the time of writing, holding firm above the $183 support level. The altcoin remains range-bound, struggling to break through the key $192 resistance. However, price stability above support suggests growing resilience in the face of selling pressure.

If Solana’s bullish indicators gain traction, the price could climb past $192 and target $200 or higher. Strengthening support levels combined with improving investor sentiment could help SOL establish a sustainable uptrend.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Conversely, if momentum fails to build, Solana may drop below $183 to test $175. A further decline could extend losses toward $163. This would effectively invalidating the bullish outlook and signaling continued market weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.