ETHZilla takes 15% stake in Satschel to expand tokenization

ETHZilla is acquiring a key piece of financial infrastructure with its stake in Satschel, aiming to merge its tokenization expertise with a fully regulated marketplace for private credit and real estate.

- ETHZilla invests $15 million in Satschel to advance regulated tokenization of real-world assets.

- The move follows ETHZilla’s pivot from Ethereum accumulation to becoming an on-chain alternative asset manager.

- The firm positions its Nasdaq-listed stock, ETHZ, as an “alternative asset investment” offering exposure to Ethereum, DeFi yields, and tokenized assets.

According to a press release dated Oct. 23, ETHZilla has made a strategic $15 million investment to acquire a 15% stake in Satschel, Inc., the parent company of the regulated platform Liquidity.io, at a $100 million valuation.

The deal grants ETHZilla exclusive rights to list Ethereum Layer 2 tokens on Liquidity.io’s regulated alternative trading system, a platform that combines an SEC-licensed framework with blockchain technology to tokenize and trade real-world assets.

“We are in the process of combining Liquidity.io’s regulated securitization platform and token marketplace with ETHZilla’s blockchain-native asset management platform to build a next-generation asset manager. Looking ahead, we believe that ETHZilla has a clear path to deliver to investors access to cash flow-generating assets in attractive industry sectors through a seamless on-chain experience,” ETHZilla CEO McAndrew Rudisill said.

Tokenization takes center stage in ETHZilla’s evolving strategy

The move comes just a day after ETHZilla made it clear that Ethereum accumulation is no longer its end game. Instead, it is pivoting to become an “on-chain alternative asset manager,” actively deploying its resources to build tokenization infrastructure.

ETHZilla’s thesis hinges on the transformative potential of converting physical assets into ERC-20 tokens. The company believes this process shatters the traditional barriers of finance. Tokenization unlocks previously illiquid markets like private equity and commercial real estate, enabling fractional ownership and 24/7 trading with near-instant settlement.

This composability, where a tokenized building can interact with a decentralized lending protocol, is something ETHZilla notes is impossible within the siloed systems of traditional finance. They project the on-chain asset market could swell from $4.6 trillion to $100 trillion within five years.

Deeper ambitions

Concurrently, ETHZilla is positioning its Nasdaq-listed stock, ETHZ, as a novel “alternative asset investment” for institutions. The pitch is that it offers a triple play: exposure to Ethereum’s growth as core infrastructure, income from staking and DeFi yield strategies, and now, a direct path to returns from tokenized real-world assets, all wrapped in a GAAP-compliant, audited vehicle.

For retail investors, the firm promises access to asset classes that once required accredited investor status and million-dollar minimums, focusing on “real yield from actual assets generating actual returns.”

This ambitious expansion builds upon a significant treasury. According to data from EthereumTreasuries.net, ETHZilla remains a major corporate holder, currently ranking as the seventh largest with over 100,000 ETH in its reserves. This places it behind giants like BitMine Immersion Technologies, which holds over 3 million ETH .

ETHZilla’s stock jumped 3% following the announcement, according to Yahoo Finance data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review

BTC Volatility Weekly Review (November 10 - 17): Key indicators (from 4:00 PM Hong Kong time on November 10 to November 17...)

Q3 earnings season: Diverging strategies among 11 Wall Street financial giants—some are selling off, while others are doubling down

Technology stocks led by Nvidia have become a key reference signal for global capital allocation strategies.

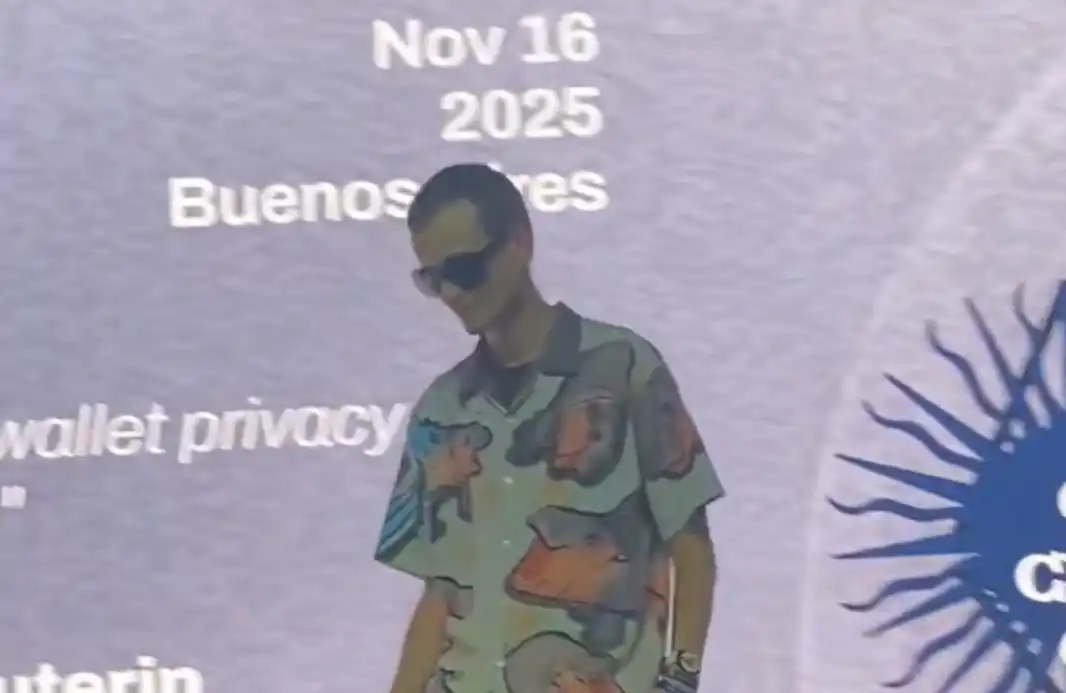

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

Compliance Privacy: What is Kohaku, Ethereum’s Latest Major Privacy Upgrade?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."