ERC-8004: The Rise of Digital Assets and the Machine Economy

Amid the wave of AI and blockchain integration, the release of ERC-8004 marks the entry of the machine economy into the era of trust.

Original Title: DIGITAL ASSETS: ERC-8004 and the Rise of the Machine Economy

Original Author: Laurence Smith, Fintech Blueprint

Translation: Peggy, BlockBeats

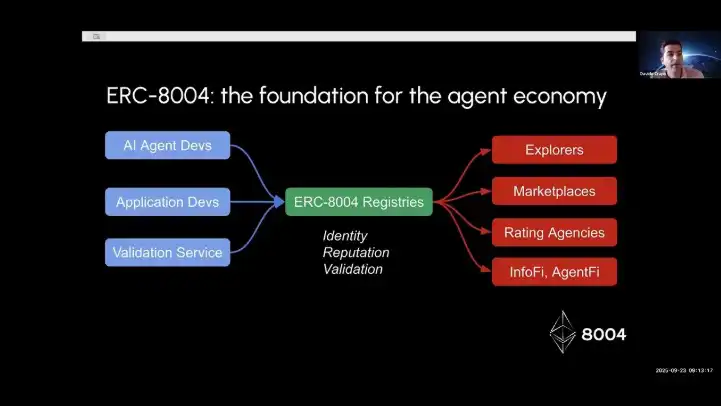

Editor's Note: Amid the wave of AI and blockchain integration, the release of ERC-8004 marks the entry of the machine economy into the "era of trust." Led by the Ethereum Foundation's dAI team and Consensys, and jointly launched with heavyweight institutions such as MetaMask, Google, and Coinbase, this protocol provides on-chain identity, reputation, and verification mechanisms for AI agents for the first time, breaking the long-standing isolation among autonomous software.

This article delves into how ERC-8004 builds open infrastructure for agent discovery and collaboration, and explores its potential in emerging AI crypto ecosystems such as Tempo and Thinking Machines. With over a hundred teams already building on it, ERC-8004 is not just a technical standard but also the trust foundation of the machine economy.

The following is the original content:

ERC-8004: A Protocol Standard for Building Trust Among AI Agents

Last week, the Ethereum Foundation's dAI team and Consensys released the ERC-8004 protocol, which allows AI agents to discover, verify, and transact with each other. Signatories include MetaMask, Ethereum Foundation, Google, Coinbase, EigenLayer, ENS, and The Graph.

Until now, autonomous software—including robots, models, or smart contracts—has operated in silos. The emergence of frameworks like A2A (Agent-to-Agent) and MCP (Model Context Protocol) enables communication between agents.

A2A provides a shared language for software agents to send structured messages, while MCP, launched by Anthropic, allows AI models to exchange context and coordinate tasks. Both help achieve interoperability, but still lack a "trust" mechanism. In other words, they cannot determine the true identity of an agent, whether its records are reliable, or whether its outputs are verifiable.

ERC-8004 introduces a set of neutral on-chain registries, solving this problem through on-chain identity, reputation, and verification mechanisms.

Each agent receives a portable on-chain identity, namely an ERC-721 token—an NFT representing the machine. This token points to a registration file that describes the agent's name, skills, wallet, and endpoint. Since it is standardized and based on neutral infrastructure, any marketplace or browser can index it.

Agents can leave feedback for each other, tag by task, and associate it with proof of economic payment (x402—short for EIP-402, a cryptographic receipt binding on-chain payments to off-chain interactions). For higher-trust use cases, validators can confirm outputs through hardware enclaves, proof-of-stake mechanisms, or zkML verification. In short, this is an open rating and audit layer for autonomous agents.

This standard lays the foundation for machine-to-machine economic activity. It builds a world without human intermediaries, allowing agents to trust each other in negotiation, transaction, and collaboration. This continues the blockchain logic of disintermediation in currency and contracts—removing platform middlemen between AI agents.

Reportedly, over a hundred teams are already building according to this specification.

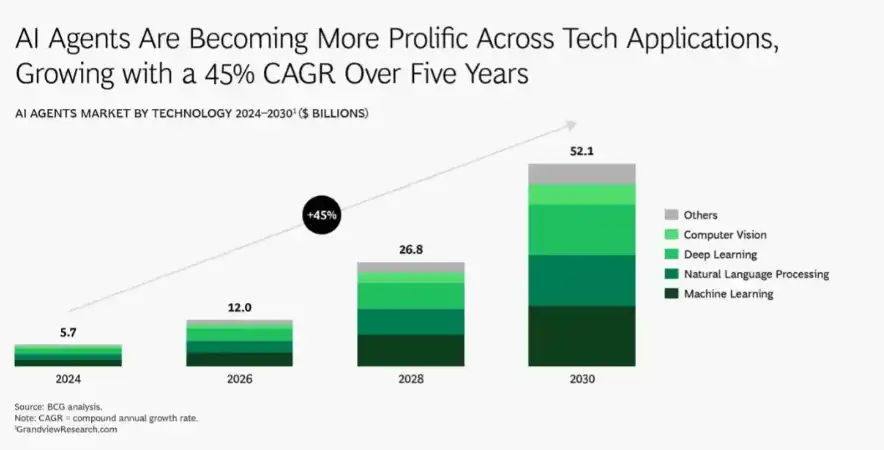

Massive Investment in AI and Crypto Infrastructure

The release of ERC-8004 comes at a time when AI economic infrastructure is seeing massive investment. Payment-oriented Layer 1 blockchain Tempo has just completed a $500 million funding round, with a valuation of $5 billion; AI startup Thinking Machines, founded by former OpenAI executives, has raised $2 billion, with a valuation of $12 billion.

We are witnessing the largest funding rounds in the history of AI and crypto.

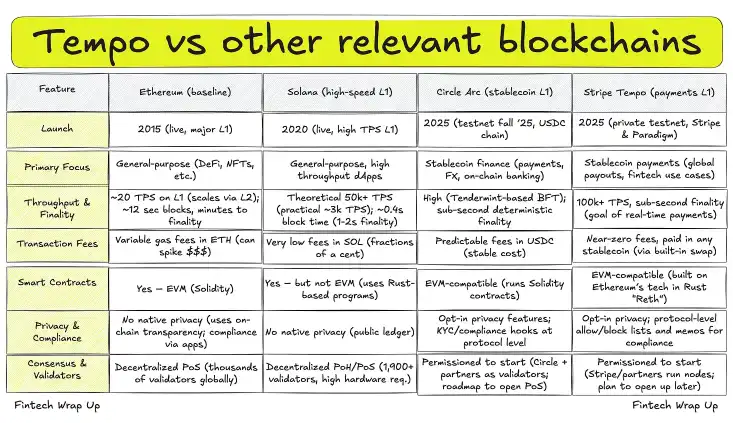

Tempo is building a closed payment network optimized for stablecoins and real-world finance. Essentially, this is the enterprise version of Ethereum's vision: a global transaction settlement channel with high throughput and low fees. In Tempo's world, agents can process payments at machine speed, but its internal private ecosystem is controlled by its validators and fee model.

ERC-8004 can provide an open discovery and reputation layer for this ecosystem. Tempo does not need to define which agents or merchants can transact; instead, it can integrate the ERC-8004 registry so that any agent with a verified and public on-chain identity can access its payment network. This would transform Tempo from a closed settlement layer into a programmable settlement layer, interoperating with the broader Ethereum agent economy.

Thinking Machines is positioned at a higher level. Although its goals are not yet clear, its existing products focus on training models to enhance their resilience and flexibility. This helps deploy autonomous agents on the internet that can reason, collaborate, and transact. Currently, these agents still exist in closed, vertically integrated environments.

By adopting ERC-8004, Thinking Machines can build training tools for the open economy: each model or agent can be discovered and verified on-chain, possess an ERC-721 identity token, and establish real economic reputation through x402-verified interactions. In practice, this means a Thinking Machines agent could contract with a data provider agent on Ethereum, pay via Tempo or other chains, and return the results on-chain, all without human intervention.

In short, ERC-8004 can unlock programmable markets. It empowers autonomous agents to sign contracts, settle, and build reputations on-chain—precisely the elements that DeFi provides for humans.

For fintech, the short-term impact is limited; few enterprises will replace APIs with agents overnight. But once agents can prove identity, reputation, and payment, they can handle a variety of tasks—from credit scoring to trade execution—without platform intermediaries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: The Cornerstone of the New Digital Civilization

Is the Halving Myth Over? Bitcoin Faces Major Changes in the "Super Cycle"

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.