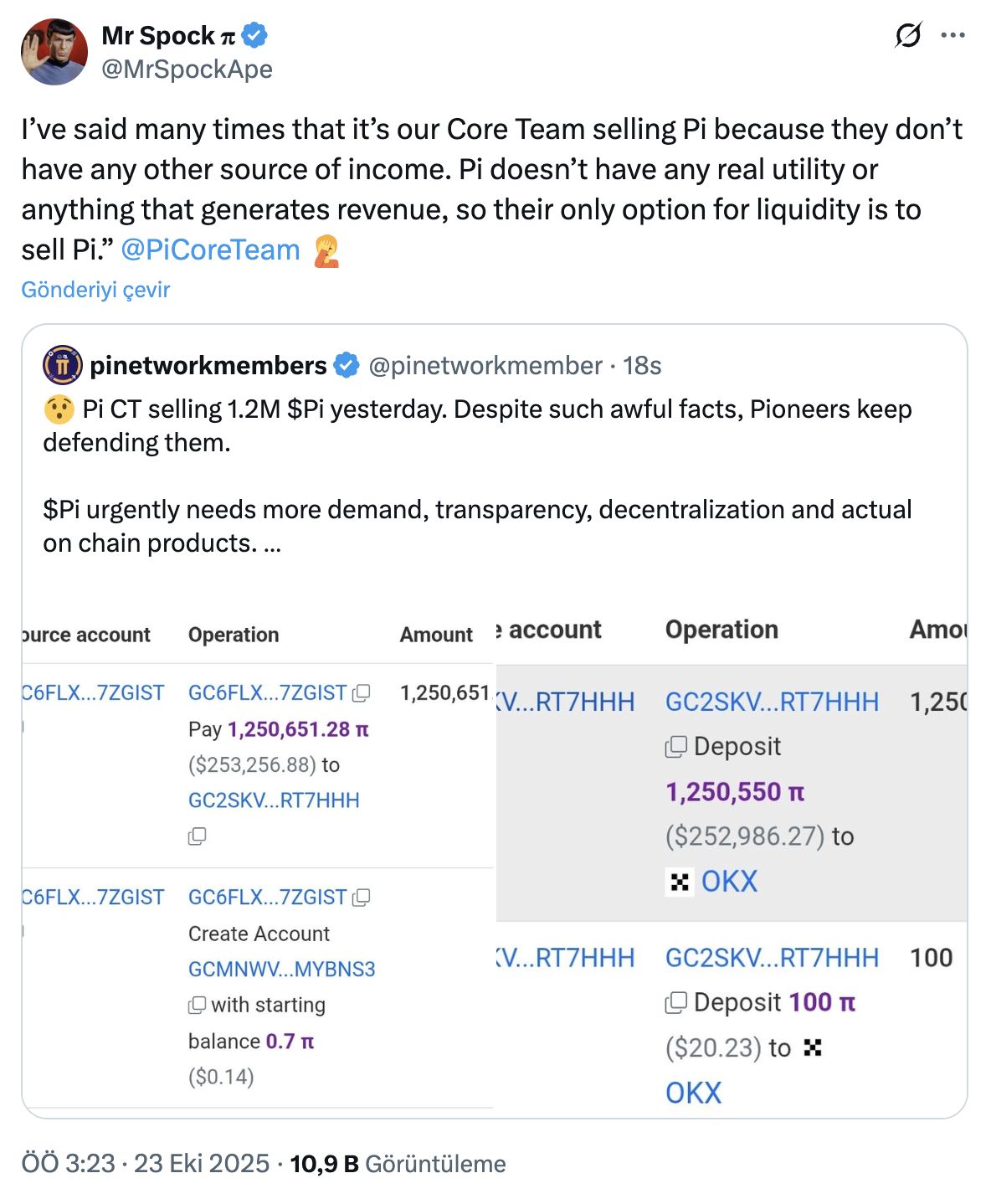

Recent claims have rocked the cryptocurrency world, pointing fingers at the Pi Network team for possibly being behind the increasing selling pressure. Project insider Mr. Spock claims the team released 1.2 million PI coins due to a lack of income. This assertion has stirred controversy within the Pi community, raising questions about the project’s financial sustainability.

The Core Team Accused of Driving Sales

Renowned within the Pi community, Mr. Spock took to his X account to allege that the core Pi Network team was behind the sharp price drop of Pi coins. He suggested that due to the absence of a revenue-generating product or a robust ecosystem, the team resorted to selling their coin holdings to generate liquidity. Mr. Spock emphasized that cashing in their PI assets was the team’s sole financial recourse.

Other active members within the community shared similar views. A commentator noted that only the core team holds enough PI to influence the coin’s price, shifting it from $3 to $0.20. They stressed that individual users, known as Pioneers, lack the volume to execute such significant sales.

Previously, allegations of fund mismanagement by the Pi Network’s management have surfaced. In court documents from 2020, the project, valued at $20 million, reportedly suffered due to internal managerial conflicts.

Price Drops Despite Development Efforts

Experiencing a near 30% depreciation in value over the past month, and an approximate 90% drop from its peak, Pi Coin has eroded investor trust. Mr. Spock described the project’s direction as uncertain, suggesting the risk of it being a public rug-pull attempt.

Some Pioneers believe sales might be driven by project development costs. It’s speculated that additional liquidity was required to fund updates on the Pi Network Protocol 23 and tools for developers on the test network. Despite technical advancements, like integrating a decentralized exchange (DEX) and automated market maker (AMM) on the test network, the steps failed to alleviate negative market sentiment. Meanwhile, testing continues on SPi, a potential Pi-backed stablecoin.