Key Market Information Discrepancy on October 23rd, a Must-See! | Alpha Morning Report

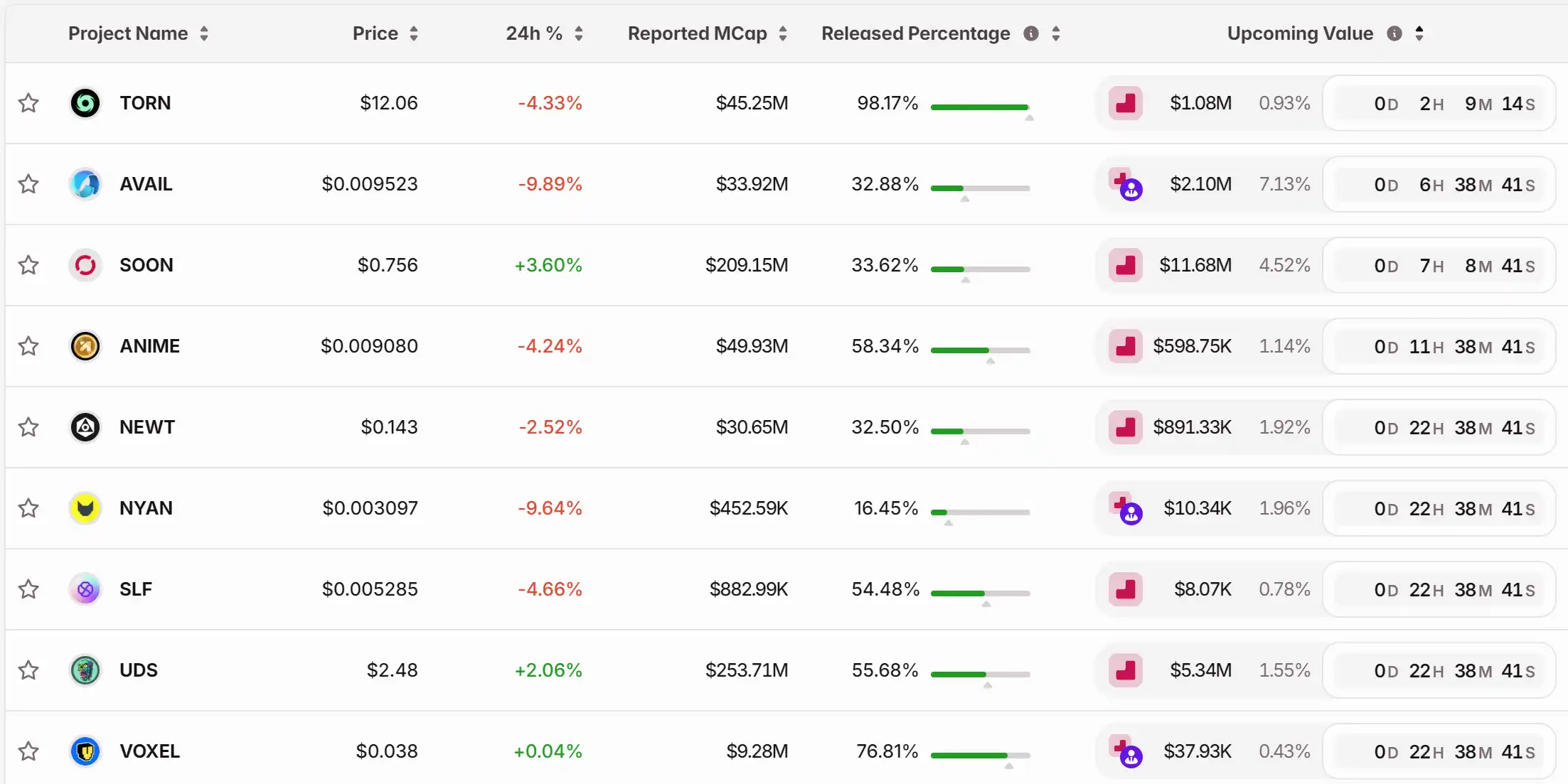

1. Top News: Polymarket Plans to Seek Funding at a Valuation of $12-15 Billion 2. Token Unlock: $TORN, $AVAIL, $SOON, $ANIME, $NEWT, $NYAN, $SLF, $UDS, $VOXEL

Top News

1. Polymarket Plans to Raise Funds at a Valuation of $12-15 Billion

2. Crypto Giants Gather at Capitol Hill, Market Structure Regulation Takes Center Stage

4. ENA Sees Brief 10% Price Plunge, Liquidates Associated Address on Hyperliquid Linked to Andrew Kang

5. Kraken Reports $648 Million in Q3 Revenue, a 114% Year-over-Year Growth

Articles & Threads

1. "120,000 Bitcoins Seized? In-Depth Analysis of the Regulatory Dilemma Behind the 'Prince Group' Case"

Amid tightening global cryptocurrency regulations, a cross-border "online pursuit" spanning Cambodia and the US/UK has captured everyone's attention. In October 2025, the US Department of the Treasury and the Department of Justice joined forces to launch the largest-ever cryptocurrency enforcement operation against the Cambodian Prince Group, freezing up to 120,000 bitcoins.

2. "From Liquidation Storms to Cloud Outages: Cryptocurrency Infrastructure's Crisis Moments"

Amazon Web Services (AWS) faced another major outage, severely impacting cryptocurrency infrastructure. The AWS issue in the US East Region (Northern Virginia data center) resulted in outages for Coinbase and dozens of other major crypto platforms including Robinhood, Infura, Base, and Solana. AWS has acknowledged "increased error rates" affecting Amazon DynamoDB and EC2, core databases and computing services relied upon by thousands of companies. This outage provides immediate and stark validation for this article's central argument: cryptocurrency infrastructure's reliance on centralized cloud service providers has created systemic vulnerabilities that repeatedly manifest under stress.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a

Clean Energy Market Fluidity and Investment Prospects: How REsurety's CleanTrade Platform is Transforming Corporate Strategies for Energy Transition

- REsurety's CleanTrade platform, CFTC-approved as the first SEF for clean energy , standardizes VPPAs, PPAs, and RECs to address market inefficiencies like fragmented pricing and low liquidity. - The platform attracted $16B in notional value within two months by offering real-time transparency, reducing counterparty risk, and enabling precise decarbonization tracking for corporations. - ESG funds leverage CleanTrade's swaps and liquidity tools to hedge price volatility, aligning with 77% of sustainable in

Hyperliquid (HYPE) Price Rally: Key Factors Behind Institutional Embrace in 2025

- Hyperliquid's HIP-3 upgrade enabled permissionless perpetual markets, driving $400B+ trading volume and 32% blockchain revenue share in 2025. - Institutional adoption accelerated via 90% fee reductions, TVL of $2.15B, and partnerships with Anchorage Digital and Circle's CCTP V2. - HYPE's deflationary model (97% fees fund buybacks) and $1.3B buyback fund fueled price surges, mirroring MicroStrategy's Bitcoin strategy. - Regulatory alignment with GENIUS Act/MiCAR and USDH stablecoin compliance strengthened