Citi Gives “Buy” Rating to Strategy Amid Bitcoin Upside—Warns of High Volatility Risk

Bitcoin-focused company Strategy—formerly known as MicroStrategy—has received a “Buy” rating from Citi, with analysts highlighting significant upside potential for the stock. At the same time, the bank warned that the company’s heavy reliance on Bitcoin could expose investors to sharp price swings.

In brief

- Citi analysts rate Strategy a “Buy,” predicting major upside if Bitcoin climbs to the bank’s $181K forecast level.

- Strategy’s stock could benefit from Bitcoin’s momentum but remains vulnerable to sharp price corrections.

- The company holds over $77B in Bitcoin, solidifying its lead as the largest corporate BTC holder worldwide.

- Analysts warn MSTR’s valuation depends heavily on Bitcoin’s performance, amplifying both gains and losses.

Strategy Shares Could Climb as Bitcoin Nears Citi’s $181K Forecast

In a note released Tuesday, Citi analysts said Strategy’s Nasdaq-listed shares (MSTR) could continue to rise if Bitcoin reaches $181,000 over the next 12 months, which aligns with the bank’s latest price forecast for the cryptocurrency.

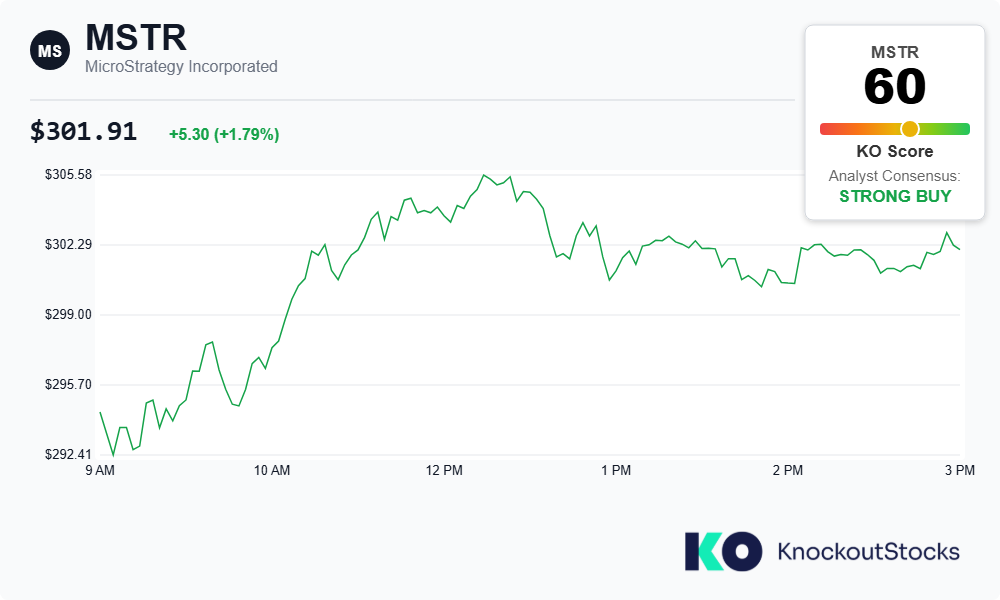

The stock closed at $301.91, up 1.7% on the day, according to Yahoo Finance—still below its 2024 record high of $473.83. Bitcoin, meanwhile, traded at $111,490, down more than 11% from its all-time high of $126,080, according to data from CoinGecko.

Citi said MSTR’s net asset value (NAV) premium could remain in the 25%–35% range, reflecting its historical 2.5x–3.5x Bitcoin yield multiple. However, this prediction is contingent on the cryptocurrency maintaining positive momentum.

Besides, the report emphasized that Strategy’s performance is closely tied to Bitcoin’s price movements and overall investor sentiment toward the digital asset market.

Citi Warns of High Risk in Strategy’s Bitcoin-Leveraged Stock

Citi cautioned that Strategy’s stock remains highly risky due to its leveraged exposure to Bitcoin. Analysts noted that the company’s valuation is almost entirely dependent on the cryptocurrency’s performance. As a result, any sustained downturn in the coin’s price could lead to amplified losses for MSTR investors .

The stock presents significant risks due to its positioning as a leveraged proxy for Bitcoin. Its value is nearly 100% tied to the sometimes-volatile cryptocurrency, meaning that even a moderate decline in Bitcoin’s price can lead to magnified losses for MSTR shareholders.

Citi analysts

Strategy began accumulating Bitcoin in August 2020 to seek higher returns amid global economic uncertainty during the COVID-19 pandemic. Since then, the company has become the largest corporate holder of BTC, positioning itself as a proxy investment vehicle for investors seeking exposure to the leading cryptocurrency without directly holding it.

Strategy’s BTC Stash Surpasses $77 Billion, Cementing Its Industry Lead

Earlier this month, Strategy hit $77.4 billion in BTC holdings and currently commands 640,418 Bitcoin. Its co-founder and chairman, Michael Saylor, remains one of Bitcoin’s strongest corporate advocates, often describing it as a superior store of value for both companies and investors.

Here are other firms with notable BTC holdings :

- MARA Holdings, Inc. (MARA) holds about 53,250 BTC, ranking among the largest institutional Bitcoin holders in the United States.

- Nasdaq-listed XXI owns 43,514 BTC.

- Metaplanet Inc. (MTPLF) comes fourth with 30,823 BTC — often referred to as Japan’s MicroStrategy for its aggressive accumulation strategy.

- Bitcoin Standard Treasury Company (CEPO) manages 30,021 BTC.

- Bullish (BLSH) holds 24,300 BTC, integrating Bitcoin within its broader digital finance operations.

- Riot Platforms, Inc. (RIOT) boasts 19,287 BTC and remains one of North America’s largest Bitcoin mining companies.

- Trump Media & Technology Group Corp. holds 15,000 BTC.

While several companies have followed Strategy’s example, analysts caution that such concentrated exposure to digital assets may not be suitable for every business model. Citi’s latest note highlights that the rewards of BTC-linked strategies can be substantial—but so can the risks when market volatility returns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?