The man with the LUNA tattoo makes a comeback with 500 million in a single quarter

The LUNA tattoo remains, but Galaxy Digital has changed

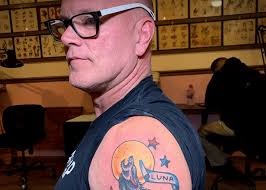

In 2022, Michael Novogratz tattooed the LUNA logo on his arm. At that time, he was one of the most active evangelists in the crypto industry, holding the asset management platform Galaxy Digital, and was at the peak of the last crypto bull market.

However, in May 2022, LUNA crashed to zero within a week, wiping out $60 billion in market value. This event, known as the "death spiral," nearly destroyed the entire Terra ecosystem and put Galaxy in the spotlight.

For most companies, such an event would be enough to ruin a career. But Galaxy did not fall. Three years later, it made a surprising comeback with an impressive report card—net profit of $505 million, a single-day stock price increase of nearly 9%, and a market cap returning to $16.5 billion.

This is not just a comeback, but a statement made with results.

Reflection Begins with a Letter

After the LUNA crash, most companies chose to remain silent. But Novogratz chose to sit down and write a letter.

In the letter, he admitted to misjudging the project's risks and reflected on the prudence that an investment institution should have. He wrote that the tattoo would not be covered up but would serve as a permanent reminder: "Venture capital requires humility."

This marked the beginning of Galaxy's transformation. Since then, the company has gradually reduced its reliance on "short-term market trends," re-examined its core competencies, and sought to win market trust in a more sustainable way.

Profitable "Redemption"

In Q3 2025, Galaxy Digital delivered its most impressive financial report in its seven-year history:

-

Net profit: $505 million (16x year-on-year growth)

-

Adjusted gross profit: $728 million (143% quarter-on-quarter growth)

-

Trading revenue: $295 million (annualized up to $1.2 billion)

-

Assets under management: exceeded $9 billion

-

Core institutional client treasury asset injection: $4.5 billion

-

Stock price rose 8.7% in a single day, total market cap reached $16.5 billion

This was not the result of a "single coin surge," but rather the combined efforts of Galaxy's three major business segments.

Over the past three years, Galaxy has completed a comprehensive internal business restructuring, building a clearer and more robust core business system:

1. Trading and Market Infrastructure

Serving institutional clients, including market makers, family offices, digital asset treasuries, etc.

The company provides trade execution, lending, derivatives, and spot clearing services. In Q3 2025, trading business revenue reached $295 million, a year-on-year increase of over 140%.

2. Asset Management

Providing institutional clients with digital asset allocation, ETF, staking, and custody services.

As of Q3, assets under management exceeded $9 billion, with core growth coming from a group of "treasury clients" who added bitcoin and ethereum to their balance sheets.

These clients brought in more than $4.5 billion in asset injections, generating over $40 million in stable annual management fees for the company.

3. Technology and Infrastructure Services

This is one of Galaxy's most important strategic pivots: no longer just a "financial product provider," but becoming an "infrastructure owner."

In 2025, Galaxy launched a large-scale data center project called "Helios", serving AI companies and Web3 infrastructure projects. The first phase of the project secured $1.4 billion in financing, providing 800 megawatts of power to AI company CoreWeave, equivalent to the electricity consumption of a small city.

Once completed, Helios is expected to generate annual revenue of $1 billion, making it comparable in scale to the trading business and becoming the company's "third pillar."

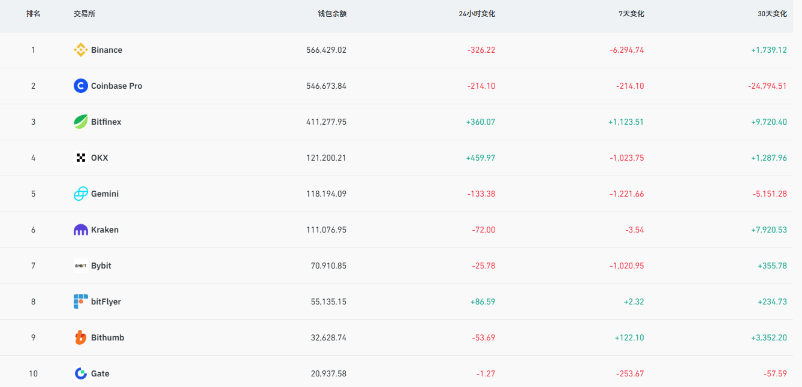

Key Financial Data Overview (Q3 2025)

| Net Profit | $505 million | 16x year-on-year growth | Record high performance |

| Adjusted Gross Profit | $728 million | 143% quarter-on-quarter growth | Significant improvement in income quality |

| Trading Revenue | $295 million | Year-on-year increase over 140% | From institutional orders and lending services |

| Assets Under Management | $9 billion+ | Steadily rising | Treasury clients driving AUM growth |

| Treasury Client Asset Injection | $4.5 billion | Added June–September | Provides long-term management fee income |

| Helios Data Center Financing | $1.4 billion | First phase completed | AI era infrastructure bet |

| Expected Helios Revenue | Annualized $1 billion+ | To be released from 2026 | Comparable in scale to trading business |

The Team Behind Has Wall Street Backgrounds

Galaxy's dramatic turnaround is inseparable from its star leadership team—this core group, known in the industry as the "Galaxy Fleet," perfectly blends the stability of Wall Street veterans with the pioneering spirit of the crypto world:

| Michael Novogratz | Founder & CEO | Former Goldman Sachs partner, personally led risk control reconstruction and strategic pivot after the LUNA incident |

| Christopher Ferraro | President & CIO | Asset allocation expert, restructured Galaxy's profit model and research system |

| Erin Brown | COO | Fintech background, led platform system efficiency and client experience optimization |

| Alex Ioffe | CFO | Responsible for capital structure, financial restructuring, and financing arrangements |

| Michael Daffey | Chairman of the Board | Former Goldman Sachs executive, promoted corporate governance and compliance implementation |

By mid-2025, Galaxy was officially listed on Nasdaq. This company, once brought to its knees by the crypto bubble burst, is now regaining the attention of traditional capital markets.

"If we haven't completely reinvented ourselves by 2030, then we've lost." This statement from Novogratz at an internal meeting is not only a spur to employees but also a forward-looking judgment for the entire crypto industry.

Today, Galaxy has successfully shaken off its dependence on the price volatility of a single crypto asset, forming a sustainable growth flywheel by building three business pillars: trading, asset management, and technology services. The arrival of the AI era has further amplified the potential of its forward-looking infrastructure layout.

Galaxy's strategic transformation is not only reflected in its internal business restructuring but also in its carefully constructed partner ecosystem:

| Partner | Type/Role | Cooperation Highlights | Strategic Impact on Galaxy |

| CoreWeave | AI cloud computing giant | Leased all phase two capacity of Helios; transformed mining site into$7 billion AI data center | Expected to contribute $10 billion in revenue; positions Galaxy as a "crypto-AI hub" |

| DWS | Traditional asset management giant | $4.6 billion strategic investment in Helios; jointly issued euro stablecoin | Injects institutional capital, enhances regulatory compliance; stablecoin processes $194 billion annually |

| Flow Traders | Market maker | Jointly issued the first fully regulated euro stablecoin | Expands the DeFi-TradFi bridge; Q3 trading volume +140% |

| Robinhood | Retail crypto platform | Advisory support for Bitstamp acquisition; potential ETF collaboration | Expands retail market; complements GalaxyOne platform |

| SEC & BlackRock | Regulator/ETF giant | Cooperated with SEC on ethereum tokenization; benefited from BlackRock ETF inflows | Ensures compliance; platform asset scale +62% |

This partner network, valued at over $6 billion, not only provides financial support but, more importantly, establishes cross-sector trust endorsements for Galaxy. As Novogratz said in his October 2025 tweet: "Our allies have enabled Galaxy's transformation from a bitcoin mining operation to an AI empire."

Conclusion

The collapse of Terra Luna almost made Galaxy the epitome of failure in the crypto industry. But today, it is one of the very few companies that managed to return to profitability and enter the mainstream market after a crash. Galaxy has successfully built a bridge connecting various fields, which is the key support for its spectacular turnaround in the post-LUNA era.

Galaxy's comeback is also inseparable from Novogratz's continued high-profile presence. This "Wall Street defector" who always carries the story of his LUNA tattoo knows better than anyone: in the crypto world, personal influence itself is a strategic asset.

We have found that since the beginning of this year, Novogratz's media exposure has increased significantly: from the Tokyo WebX Summit to the New York Robin Hood Investment Conference, from CNBC financial programs to in-depth YouTube interviews, his presence is seen at every important occasion. This high profile is not a personal performance, but a precise strategy—in the two weeks of intensive interviews after the Q3 financial report release, Galaxy's stock price was "successfully" pushed up by 10%.

Just as the crypto industry itself relies on consensus and attention, Novogratz has demonstrated through action: in the battlefield of the attention economy, the visibility of corporate leaders is itself a core competitive advantage.

And that LUNA tattoo on his arm is still there.

It is no longer just a mark of failure, but more like a medal, reminding everyone moving forward in the industry:

Only those who have gone through the lows and dare to leave a mark truly deserve the spotlight.

Author: Seedly.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?