Hollywood’s Next Financier: You

Hollywood has hit a breaking point. Audiences are fatigued by franchise sequels and reboots. YouTube has overtaken Disney as the world’s largest distributor. And Gen AI tools like Sora 2 can soon turn anyone into a filmmaker. Yet one thing hasn’t changed: how films get financed. And that’s why we keep getting fewer original films.

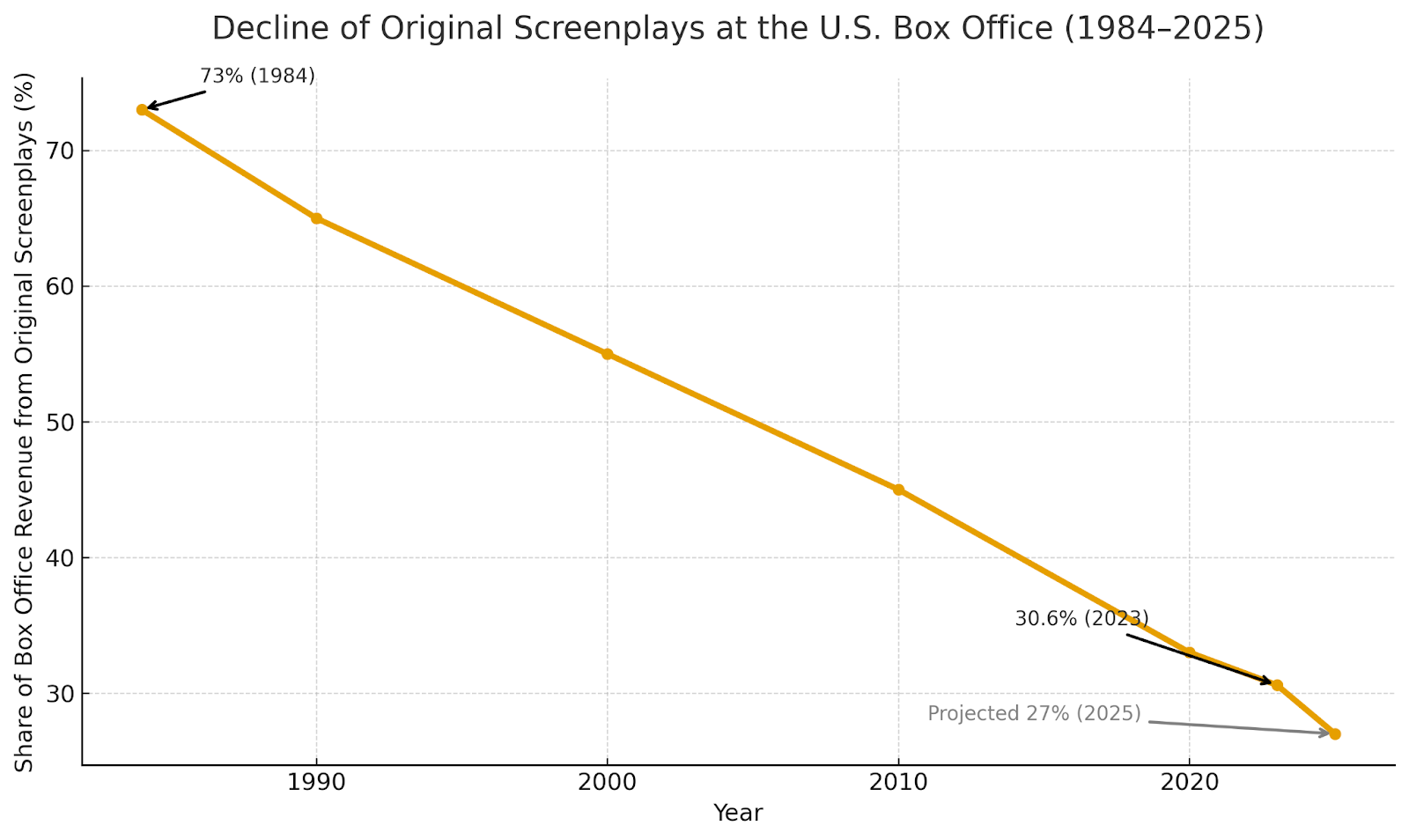

Decline of original screenplays at the US box office (1984-2023)

Source: The Numbers and Box Office Mojo

For decades, filmmakers have had only two ways to raise capital: courting wealthy “patrons of the arts” or signing away IP in restrictive studio deals. These small circles still control who the next David Lynch will be, or which film becomes the next Napoleon Dynamite, while everyday fans — the people who live and breathe these films — have never had a seat at the table. (Fewer than 1% of Americans meet SEC “accreditation” standards to invest in most private ventures, including film.)

That’s finally changing, thanks to tokenization. The promise of "decentralization in film” has arrived, quietly and legally this time. A few years ago, “Web3 Film” had the right dream but the wrong tools: people were slicing films into NFT frames, touting complex tokenomics and skirting securities laws. None of it worked. Projects like Stoner Cats, Ashton Kutcher’s NFT cartoon, became cautionary tales after the SEC cracked down for selling unregistered securities to unaccredited investors.

Today, the difference is compliance. Through licensed platforms operating under SEC exemptions such as Reg CF, production companies can take on thousands of unaccredited investors (even in the U.S.) to back real film projects and share in the upside. Security tokens issued on blockchain rails make it possible to distribute dividends transparently and cost-effectively — and, eventually, trade investors’ stakes on secondary markets.

And it’s already working. Tens of thousands of investors have contributed more than $30 million to premium productions from some of Hollywood’s most respected names. This year, Robert Rodriguez (Sin City, Spy Kids) raised $2 million from 2,000 fans to invest in new action films — and every investor got to pitch him a film as part of the slate. Pressman Film — the company behind American Psycho, Wall Street and The Crow —raised $2 million for a slate of bold, original films, and is already starting to return capital within six months. And Eli Roth (Hostel, Inglorious Basterds) launched a fan-owned horror studio that maxed out its $5 million Reg CF campaign in July. He was tired of studios deeming his ideas too gory, even though the most profitable film of 2024 was the unrated slasher, Terrifier 3.

Tokenized fan investing is opening up new paths for capital and creativity. Filmmakers can now tap their audiences for capital instead of taking the studio deal, allowing them to retain more ownership of their IP and take creative risks without interference from the suits or the algorithm. For fans, tokenization opens up access to a previously inaccessible opportunity: investing in film as an alternative asset class. Ultimately, these projects tend to perform better — not just creatively but financially — as audiences with skin in the game drive buzz and box-office returns.

The timing couldn’t be better. With IPOs slowing and private markets swelling, tokenization is unlocking billions in household capital and opening doors to previously gatekept opportunities across private credit, venture capital and now, film. The GENIUS Act has brought long-awaited regulatory clarity to digital assets, while institutions from BlackRock to Visa are embedding blockchain infrastructure into the mainstream economy. Tokenization has quietly graduated from crypto casino to financial plumbing, and entertainment is proving to be one of its most relatable (and needed) use cases.

There may be no better Trojan horse for mainstream adoption of tokenization than culture real-world assets (RWAs). Few industries are as ripe for disruption as film, and none as universally relatable, considering nearly all of us end our day watching Netflix (and then complain about the content). But when the audience can invest in the projects they want to see, whether from established filmmakers or up-and-coming creators, we won’t just get new financing models. We’ll get better movies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How CFTC-regulated platforms such as CleanTrade are transforming clean energy into a new category of tradable assets

- CFTC-approved CleanTrade transforms clean energy derivatives into standardized, liquid assets via its SEF platform, unlocking $16B in trading volume within two months. - By standardizing VPPAs/RECs and offering real-time analytics, CleanTrade bridges sustainability and profitability for institutional investors seeking ESG-aligned opportunities. - Early adopters like Cargill leverage CleanTrade to hedge energy costs while addressing fragmented markets, accelerating a $125T global clean energy derivatives

The Emergence of a Vibrant Clean Energy Market: How REsurety's CleanTrade Platform is Transforming Institutional Investments and ESG Approaches

- REsurety's CleanTrade platform, CFTC-approved for clean energy swaps, is transforming the market by enabling institutional trading of renewable assets with liquidity and transparency. - It addresses historical illiquidity in VPPAs/RECs through standardized contracts and real-time pricing, reducing transaction times and enabling $16B in notional value within two months. - The platform integrates ESG metrics with financial analysis, supporting 84% of institutional investors' growing demand for decarbonizat

COAI's Significant Recent Drop: Should Investors See This as a Chance to Buy or a Cautionary Signal?

- COAI's sharp stock decline sparks debate over short-term volatility vs. structural risks in South Africa's coal sector. - Weak domestic coal supply chains, US tariffs, and governance gaps amplify operational risks for export-dependent COAI. - Unclear AI policy implementation and media credibility issues deepen investor skepticism about COAI's transparency and adaptability. - Structural challenges including infrastructure bottlenecks and low AI adoption rates suggest the decline may reflect systemic indus

3 Future-Proof Cryptos to Add to Your Portfolio for 2026 — LINK, AVAX, and ALGO