Whales Are Back: Chainlink (LINK) Enters “Ideal Accumulation Zone”

Chainlink’s on-chain data and whale accumulation hint at a potential bullish cycle. Analysts say LINK could soon outperform Bitcoin if key resistance levels break.

The altcoin market is witnessing renewed interest in Chainlink (LINK) as large wallets are reportedly accumulating heavily.

On-chain data, technical analysis, and sentiment indicators indicate that LINK may be entering a new bullish cycle — potentially outperforming Bitcoin in the coming period. But is this the start of a new “super wave,” or just a flicker before the storm?

Big Money Flowing In, On-Chain Indicators Turn “Green”

Over the past 30 days, Chainlink (LINK) has notably increased development activity and network engagement.

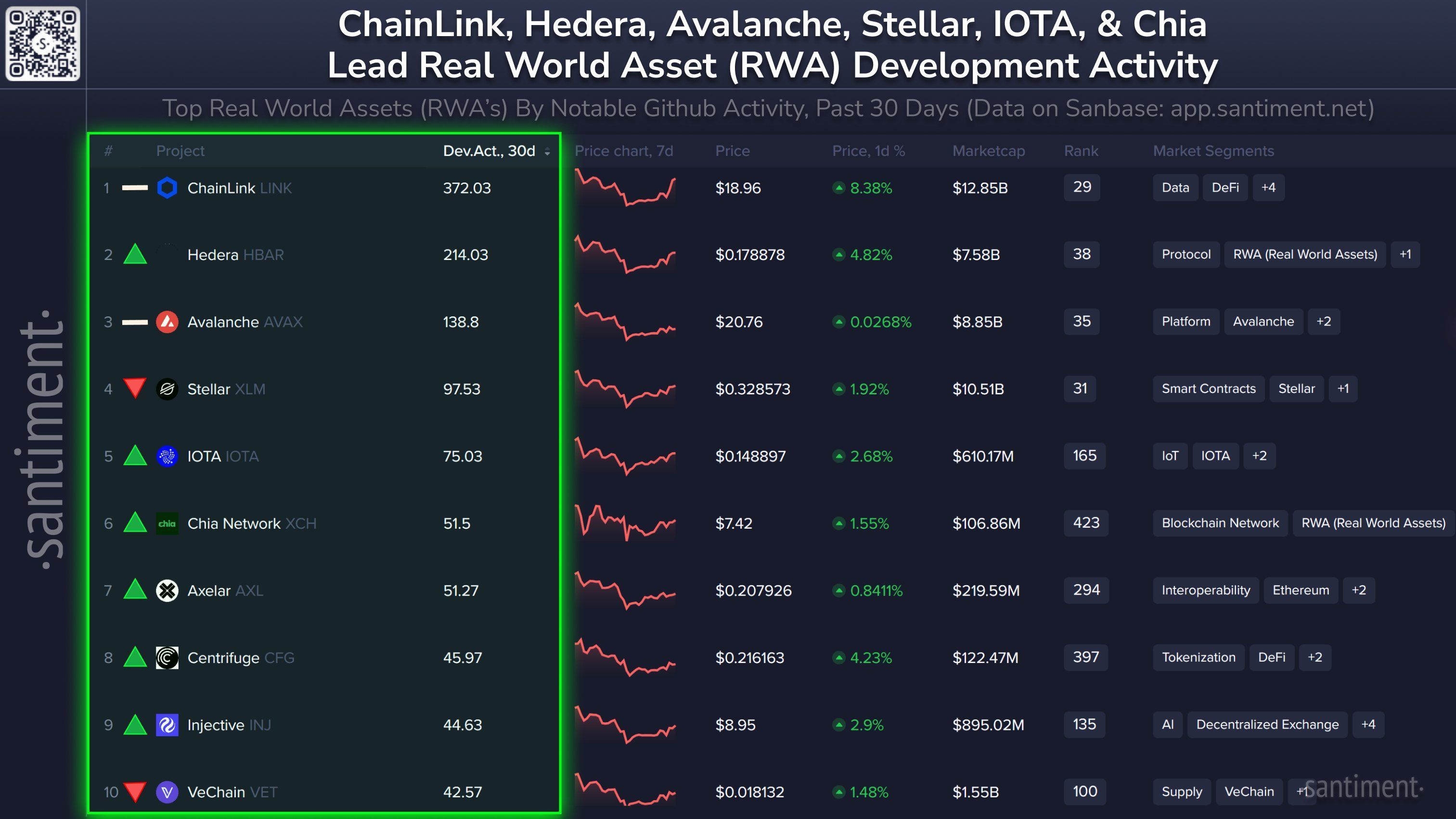

Data from Santiment shows that Chainlink ranks among the top 10 RWA projects with the highest development activity. This highlights the network’s growing importance in the Real World Assets (RWA) ecosystem, where demand for off-chain data and oracle solutions has become essential.

Chainlink is among the Top 10 RWA projects with the highest development activity. Source:

Santiment

Chainlink is among the Top 10 RWA projects with the highest development activity. Source:

Santiment

On-chain data from Santiment also reveals that LINK’s 30-day MVRV ratio (measuring the average profit/loss of wallets active in the past month) dropped below -5% on October 17, 2025, a level analysts often describe as an “ideal accumulation zone.” In other words, most short-term investors are currently at a loss, which historically tends to be the phase when whales start accumulating.

30-day MVRV ratio of LINK. Source:

Santiment

30-day MVRV ratio of LINK. Source:

Santiment

In fact, LINK has recently witnessed several large-scale accumulation transactions. Whales have been withdrawing LINK from exchanges, which are widely interpreted as long-term holdings.

Whale LINK withdrawals. Source:

Ted

Whale LINK withdrawals. Source:

Ted

Although LINK recently retraced to the $16–$17 range, it has firmly held the $18 support level. According to another analyst, if the price breaks above $20, overall market sentiment could quickly shift back to bullish.

Expert Insights: A New Bull Cycle or Hype Effect?

Several technical analysts, such as Daan, point out that Chainlink has historically outperformed the altcoin index (TOTAL2) during strong market rallies since 2021. Each time a similar accumulation pattern appears, LINK is often among the first tokens to lead the next wave. Michaël van de Poppe, sharing the same view, noted that the LINK/BTC price structure shows signs of a major breakout ahead.

LINK & TOTAL2. Source:

Daan Crypto Trades

LINK & TOTAL2. Source:

Daan Crypto Trades

At this point, three major factors seem to converge to create a potential bullish scenario for LINK. First is whale accumulation, which signals growing long-term confidence. Second, the robust on-chain foundation and Chainlink’s expanding role in RWA applications provide sustainable demand for the token. Third, a positive technical setup with strong support zones and profoundly negative MVRV ratios suggests a possible price reversal.

However, these signals don’t necessarily guarantee an immediate bull run. The altcoin market still depends heavily on Bitcoin’s overall trend; if BTC experiences a sharp decline, LINK will also likely be affected. Moreover, optimistic projections such as LINK hitting $100 remain speculative, relying largely on overall liquidity and capital inflows across the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network (PI) Retesting Its Key Breakout – Could a Rebound Be Near?

Bitcoin News Update: Bitcoin Drops 30%, Revealing 'Panda Phase'—A Mild Bear Market Lacking a Definite Bottom

- Bitcoin fell 30% to $87,080, its steepest two-month drop since 2022, driven by ETF outflows, leverage liquidations, and stablecoin declines. - Institutional confidence waned as asset managers paused accumulation, while retail investors exited en masse, worsening liquidity and market sentiment. - The Crypto Fear & Greed Index hit record lows at 15, reflecting panic amid Fed policy uncertainty and Bitcoin's 0.72 correlation with the Nasdaq 100. - Deribit's $1.76B call condor bet hints at cautious optimism,

Lowe's CEO's Approach to DEI: Embedding Diversity into Operations Rather Than Symbolic Actions

- Marvin Ellison, former Target part-timer and one of eight Black Fortune 500 CEOs, led Lowe's to $20.81B Q3 revenue through operational discipline and AI-driven innovation. - His Total Home strategy integrating services and store productivity, plus 50+ AI models for inventory/price optimization, drives growth amid retail challenges. - Ellison prioritizes action-based DEI reforms like leadership-focused hiring over credentials, rejecting performative gestures post-2020 George Floyd protests. - Despite rais

Bitcoin News Update: Unveiling Layered Risks as Connections Between Crypto and Traditional Finance Deepen

- Bybit temporarily halted CME-linked crypto futures trading after CME Globex disruptions, exposing vulnerabilities in centralized infrastructure linking traditional and digital markets. - CME Group faced scrutiny for technical glitches suspending Bitcoin futures, despite record 9% monthly growth in crypto derivatives volume and 132% YoY expansion in notional value. - Analysts highlight cascading risks from centralized system failures, urging diversified risk strategies as institutional adoption of 24/7 cr