Gold Just Had Its Worst Day in 12 Years — Will Bitcoin Benefit?

Gold’s record-breaking rally has abruptly reversed, and Bitcoin appears to be the unexpected beneficiary. As analysts point to signs of capital rotation, the rivalry between the two stores of value may be entering a new and defining phase.

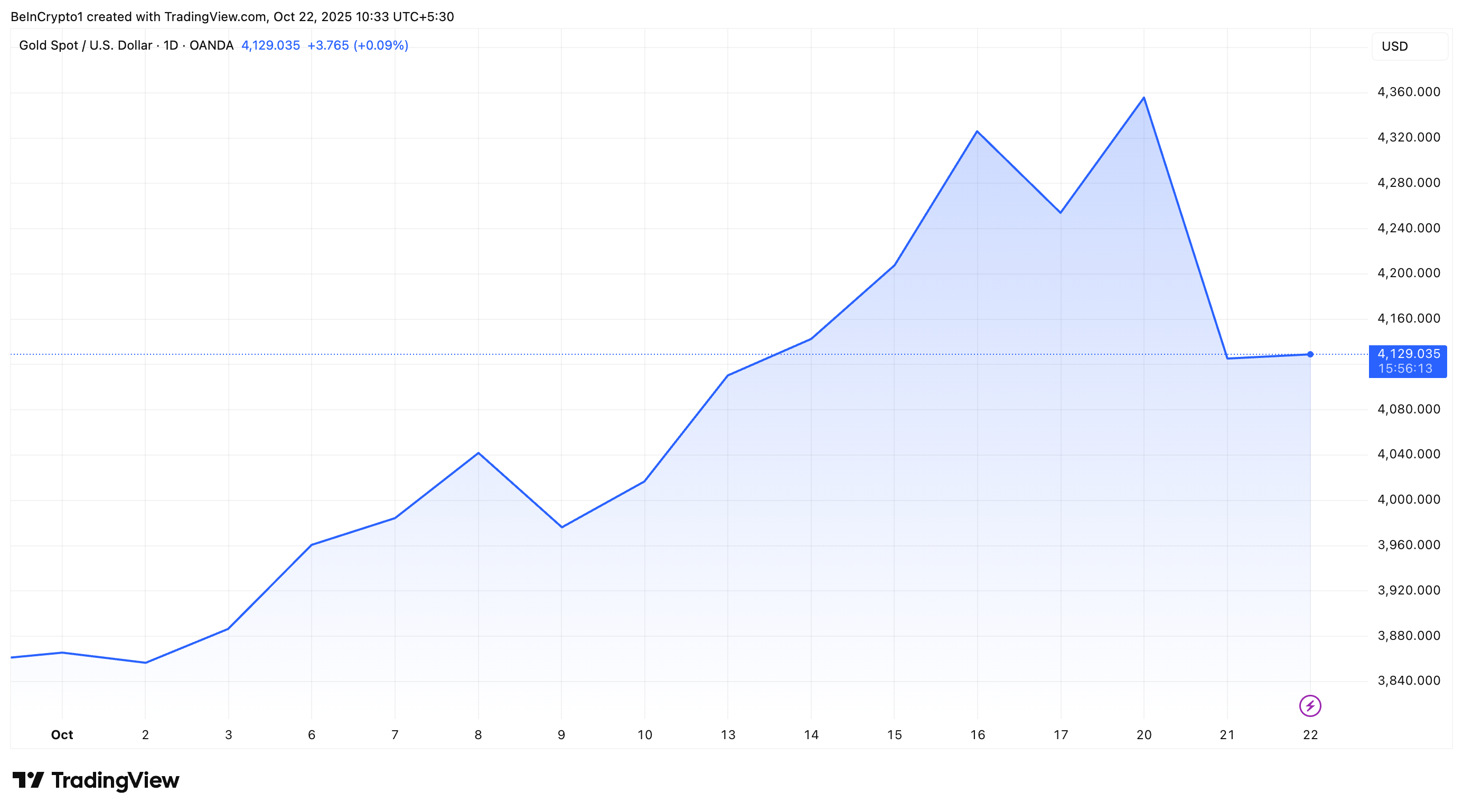

After reaching record highs, gold is undergoing a notable correction. On October 21, the precious metal experienced its steepest one-day drop in over 12 years.

Meanwhile, Bitcoin (BTC) has rallied, fueling speculation among analysts that capital may be rotating out of gold and into the leading cryptocurrency.

Is Gold’s Rally Over?

gold had continued to trend higher this month. Even as the crypto market reeled from tariff-driven volatility following President Trump’s announcement, the traditional safe-haven asset attracted strong demand.

In fact, long queues were seen forming outside bullion dealers as investors rushed to purchase physical gold. Amid this surge, gold hit a new all-time high of $4,381 per ounce on Monday.

However, during gold’s record run, analysts warned of a potential market top and an imminent correction. Their warnings proved timely.

On Tuesday, gold prices plunged more than 6%, marking their sharpest one-day decline since 2013. At press time, gold was trading at $4,129 per ounce, down roughly 5% over the past 24 hours.

Gold Price Performance. Source:

TradingView

Gold Price Performance. Source:

TradingView

Professional trader Peter Brandt drew attention to the sheer scale of gold’s latest selloff, noting that the metal’s market capitalization plunged by an estimated $2.1 trillion in a single day.

“In terms of market cap, this decline in Gold today is equal to 55% of the value of every cryptocurrency in existence. @PeterSchiff ‘s pet rock lost $2.1 trillion in value today. That is 2,102 billion $ worth,” Brandt wrote.

What Does Gold’s Historic Decline Mean For Bitcoin?

Meanwhile, as gold struggled, Bitcoin gained momentum. BeInCrypto Markets data showed that BTC rose 0.51% over the past 24 hours.

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

At press time, it traded at $108,491. According to analyst Ash Crypto, these diverging movements signaled that the rotation of capital from gold to Bitcoin has begun.

Previously, Ash had forecasted that October could bring a brief market downturn before a powerful Q4 rally, starting with ‘parabolic candles likely towards the last 10 days of October.’ According to him, the Q4 rally would push Bitcoin and altcoins to new highs. So, the current shift could likely be the first sign that his forecast is starting to play out.

“Yesterday I told you it was time for the great rotation from gold into bitcoin. Today the rotation started,” Anthony Pompliano added.

BTC vs. Gold is breaking out!Gold down, Bitcoin up.Is the safe haven rotation in play?

— Nic (@nicrypto) October 21, 2025

Additionally, market research firm Swissblock noted that Bitcoin’s surge as gold slumps isn’t new — the same pattern has emerged before.

“In April, gold dumped 5% in 3 days, right before Bitcoin broke out from its macro bottom and expanded, while gold consolidated. The investor’s flight to gold has created patterns that defy the textbooks (indices rising, and gold too). Gold and BTC are moving in opposite directions, this decoupling could be the window Bitcoin needs to finish the year with a statement: Pump hard, Bitcoin style. This could be the last opportunity,” the post read.

Amid this, attention has turned once again to Bitcoin’s long-term potential compared to traditional assets. Earlier, Binance founder CZ predicted that Bitcoin would eventually overtake gold.

“Prediction: Bitcoin will flip gold. I don’t know exactly when. Might take some time, but it will happen,” CZ stated.

While it may be too early to call such a flip, the latest market conditions clearly favor Bitcoin. If this momentum continues, the current rotation could mark the early stages of a structural shift — one that defines the next chapter in the long-standing rivalry between gold and Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Prospects in EdTech and Career Training: Fast-Expanding Academic Pathways Tailored to Meet Industry Demands

- Global higher education is reshaping curricula to align with AI, security, and green energy industry demands, creating high-growth career pathways. - AI programs see 45% annual enrollment growth (2020-2025), with graduates earning 56% higher wages than non-AI peers in fields like cybersecurity and data science. - Security programs address 750,000 U.S. cybersecurity job gaps through AI-driven threat detection, while wind energy training responds to 64% global wind power growth in 2025. - Institutions like

Will Fed Leadership Change Disrupt Ethereum’s 2026 Rally?

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d