Bitcoin’s Profit Supply Shrinks as Price Fails to Breach 2-Week Downtrend

Bitcoin shows capitulation signals as profit-taking collapses and selling accelerates. BTC remains below $108,000, but reclaiming $110,000 could spark recovery toward $112,500.

Bitcoin (BTC) is facing mounting pressure after extending its two-week-long decline. The cryptocurrency has struggled to break above resistance, suggesting growing investor fatigue.

Market conditions remain fragile as trading volumes decline and volatility spikes, leaving Bitcoin vulnerable to further losses if sentiment fails to recover soon.

Bitcoin Holders Are Losing Gains

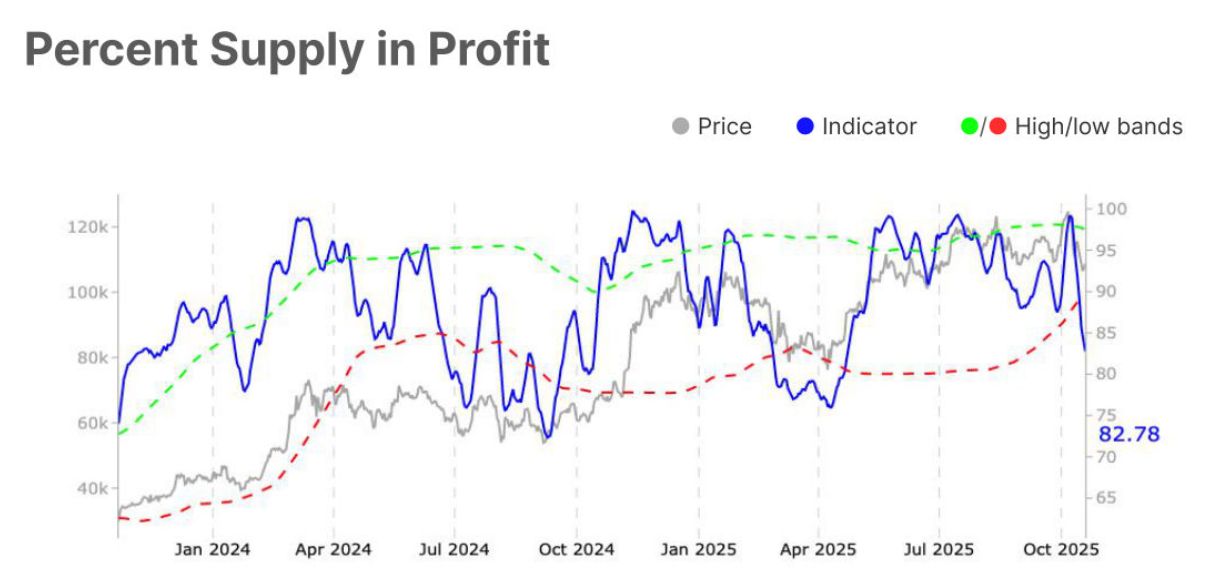

The percentage of BTC supply in profit has dropped significantly, falling from 98% to 78% within two weeks. This steep decline reflects widespread unrealized losses and signals rising investor caution. Such rapid contractions are typically seen during capitulation phases, when fear dominates the market and selling intensifies.

The reduced incentive for profit-taking highlights that most holders are either in loss or barely breaking even. This creates a self-reinforcing cycle of hesitation, where buyers remain cautious while sellers seek to exit at the first sign of strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Supply In Profit. Source:

Santiment

Bitcoin Supply In Profit. Source:

Santiment

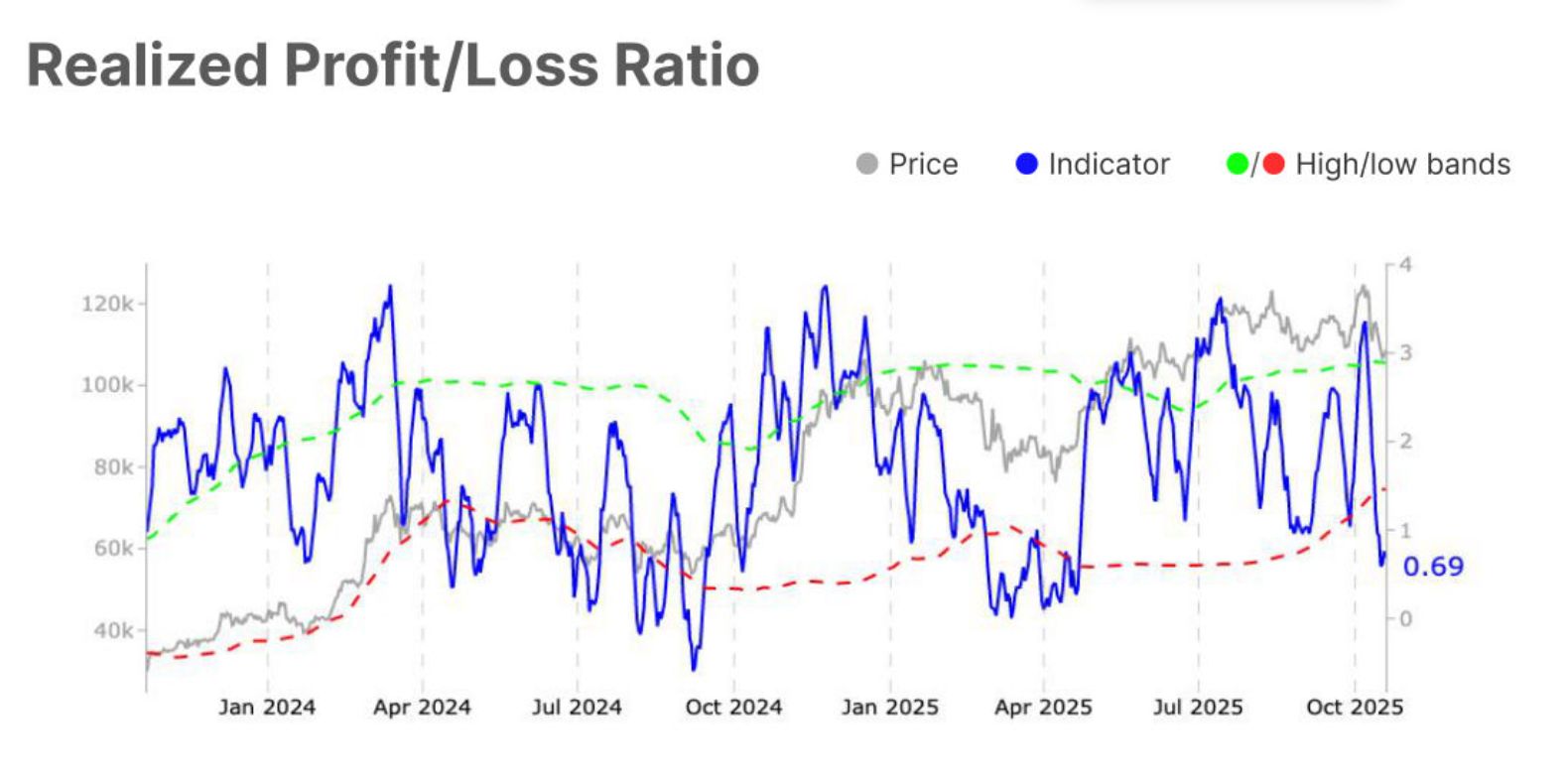

The Realized Profit to Loss (RPL) Ratio reinforces this capitulation narrative. The metric, which tracks Bitcoin’s realized gains versus realized losses, has slipped from 1.2 to 0.7, breaching the lower bound of 1.5. This means more investors are selling at a loss, indicating capitulation-like conditions across the market.

Such a low ratio reflects the growing dominance of loss realization, where participants exit positions in panic rather than strategic profit-taking. The broader macro environment—tight liquidity, risk-off sentiment, and declining inflows—adds further pressure.

Bitcoin RPL Ratio. Source:

Santiment

Bitcoin RPL Ratio. Source:

Santiment

BTC Price Under Pressure

At the time of writing, Bitcoin trades at $107,734, holding below the $108,000 resistance. The crypto giant has repeatedly failed to break the two-week downtrend line, signaling weakening momentum and growing skepticism among investors.

The formation of lower lows this week is concerning. If Bitcoin cannot reclaim the $110,000 psychological level, the price could slip further toward $105,000 or even lower, amplifying selling pressure. Sustained bearishness could accelerate this move, pushing BTC into deeper correction territory.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if Bitcoin manages to regain $110,000 as support, the technical outlook could improve sharply. This would invalidate the downtrend and open the door to a move toward $112,500 and possibly higher. In that case, short-term recovery would be back on the table, but for now, caution remains the dominant theme across the Bitcoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terra Luna Classic Shakes the Crypto Market with Surprising Developments

In Brief LUNC experienced a significant price decline following Do Kwon's sentencing. The court cited over $40 billion losses as a reason for Do Kwon's penalty. Analysts suggest short-term pressure on LUNC may persist, despite long-term community support.

NYDIG: Tokenized Assets Offer Modest Crypto Gains as Growth Depends on Access and Regulation

Cardano Investors Split As Market Fatigue Sets In