Unveiling the Hidden Truth of the Crypto Market: How the "Insider Network" Controlling 90% of Funds Creates Booms and Busts, and Bitcoin's Next Playbook

The price fluctuations in the crypto market are almost never random.

Every surge, crash, or even sudden “systemic panic” is orchestrated by the same group of people—the internal networks (Insiders) who truly control the flow of funds.

According to on-chain tracking data, over 90% of the crypto market’s capital is controlled by a handful of whales and institutions. They control exchange liquidity, gain access to macro news in advance, and can even influence regulatory timing.

The market trends seen by retail investors are the “scripts” designed by these insiders.

The crash on October 10 (UTC+8) is a typical example.

Just 30 minutes before the market crash (UTC+8), certain wallets quietly established short positions worth $500 million; almost simultaneously, another address transferred $700 million to Binance.

Subsequently, a massive bearish candle with over 1,000 BTC traded in a single minute completely broke through the market.

This was not a coincidence, but a meticulously planned “liquidity liquidation operation.”

Even more bizarre, every time before Trump announces major economic or crypto policies, similar pre-positioning actions appear on-chain.

This suggests that the “source of information” likely comes from the core circle of the White House—assistants and advisors who already know the direction before the president posts.

The “CEO rumors,” “exchange leaks,” and “media reports” seen by the public are merely smokescreens released by them to divert attention and create scapegoats.

This manipulation logic has long been repeatedly validated.

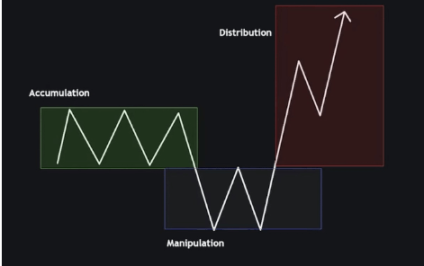

Pre-positioning—locking in direction through derivatives;

Triggering panic—crashing the market to liquidate retail investors;

Accumulating and rotating—institutions collecting chips at low prices;

Narrative reversal—guiding a new rally with ETFs, policies, or geopolitical events.

This is the modern version of the “capital cycle.”

Retail investors are forced to act as liquidity providers, while the real winners are those who can see the script in advance.

The current market may appear turbulent, but in reality, it is highly orderly.

Retail investors’ chips are being washed out, while the proportion of BTC held by institutions and whales has reached a historic high.

This “crash” is not a market crisis, but a redistribution of power.

Conclusion:

This is not the end, but a reboot.

The crash on October 10 (UTC+8) was a key battle for the big players to reshape the chip structure.

With the Federal Reserve about to cut interest rates, liquidity returning, and gold prices hitting new highs, bitcoin is quietly being reshaped as an “in-system asset.”

As retail investors exit in fear, institutions are quietly building positions.

The real game is just beginning.

The next script for bitcoin—has already been written, just waiting to be executed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically

Stunning Bitcoin Whale Awakening: Dormant Addresses Move $178M After 13 Years