IOST Supports Ethscriptions’ Rollup Launch for Fully On-Chain L1 Assets

IOST, a well-known platform for multi-chain infrastructure for RWAs, has partnered with Ethscriptions, the prominent Ethereum rollup platform. The partnership is focused on supporting the impending key Ethscriptions upgrade. As mentioned in IOST’s official X announcement, the collaboration backs the ecosystem with the launch of a Rollup solution to let all assets completely exist on L1. Hence, the development goes in line with the platform’s commitment to promoting technical advancement and interoperability across chains.

🚀 IOST has formed a strategic partnership with @eths_X to support and follow the major upgrade of Ethscriptions

— IOST (@IOST_Official) October 20, 2025

🌐 This milestone marks the first Rollup solution where all assets fully exist on Layer 1, ushering in a new era of L1-standardized EVM data assets. pic.twitter.com/mwNgRZrCvV

IOST Backs Ethscriptions’ Latest Upgrade for L1 Standardization in Strategic Partnership

IOST’s new partnership attempts to back Ethscriptions’ impending major upgrade. The move is anticipated to play a crucial role in the standardization of EVM data assets. At the same time, the development is also devoted to pushing the Web3 market toward a relatively scalable and secure future. In this respect, the technological framework of EthsX, the native crypto token of Ethscriptions, assists in L1 standardization to boost technological framework.

Apart from that, this landmark development is a notable step toward the establishment of a relatively inclusive blockchain ecosystem. Thus, by backing the upcoming Ethscriptions upgrade, the main objective of IOST is to enhance data asset security, efficiency, and transparency when it comes to cross-chain operations. Keeping this in view, the joint effort enables users and developers to leverage the improved performance without any compromise on decentralization.

Pioneering Unique Rollup Solution for Robust Web3 Growth

According to IOST, the partnership integrates completely L1 assets into the ecosystem of Ethscriptions. This presents a wider market trend towards decreasing L2 reliance. This guarantees that transfers as well as asset ownership remain secure and verifiable. Ultimately, it fortifies IOST’s ecosystem and establishes a benchmark for additional collaborations within the blockchain sector, prioritizing transparent, secure, and scalable decentralized technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

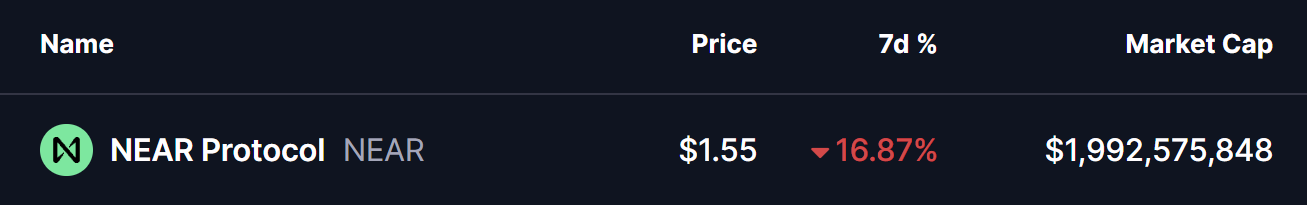

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027

PEPE Holds $0.054322 Support as Price Trades in a Tight Range