U.S. Government Shutdown Affects Crypto Market Stability

- Sec, CFTC operations halted, creating regulatory uncertainty.

- Investor sentiment affected, driving crypto market volatility.

- Market liquidity stressed due to regulatory delays.

Progress on the U.S. government shutdown remains uncertain, impacting financial market stability. The halt in regulatory approvals suspends crypto ETF processes, causing heightened market volatility and stress on crypto liquidity as investors seek stability in uncertain times.

The ongoing U.S. government shutdown began on October 1, 2025, affecting regulatory processes and creating volatility in cryptocurrency markets. Major stakeholders have issued statements highlighting the impact on investor sentiment and liquidity.

The shutdown’s impact is significant as core regulatory processes stall, leading to increased crypto market uncertainty. Investor sentiment is shaken due to liquidity stress and paused digital asset rules.

The ongoing U.S. government shutdown halts core regulatory processes involving the SEC and CFTC. Cryptocurrency markets are experiencing volatility as investor sentiment wanes and liquidity shows signs of stress. Government Shutdown Clock: Monitor progress and status

U.S. Congress has yet to resolve the deadlock over spending bills, with President Trump acknowledging further negotiations. Financial analysts warn of the inevitable economic impact due to prolonged government inactivity.

“A shutdown of the US federal government is not just political games in Washington. It creates uncertainty that spills over into global markets, and cryptocurrencies feel this shock too.” – Kate Lyman, Chief Market Analyst at AvaTrade

The immediate effects include stalled SEC crypto ETF approvals and delayed digital asset rules, contributing to uncertainty in the markets. The crypto sector faces volatility due to missing traditional market signals.

Financial analysts indicate increased market unpredictability, with heightened volatility observed in BTC and ETH prices. Institutional interest in ETFs is delayed, and stablecoin transactions increase as investors seek to mitigate risks.

Analysis suggests potential fluctuations in cryptocurrencies. The market could experience rapid shifts if the shutdown persists, affecting liquidity and investment strategies considerably. Historical trends show similar patterns during past shutdown events.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MIRO and Aether Network Join Forces to Transform Web3 Payments and Blockchain Infrastructure

Ethereum Price Signals Bearish Reversal as 1K–10K ETH Wallets Keep Selling

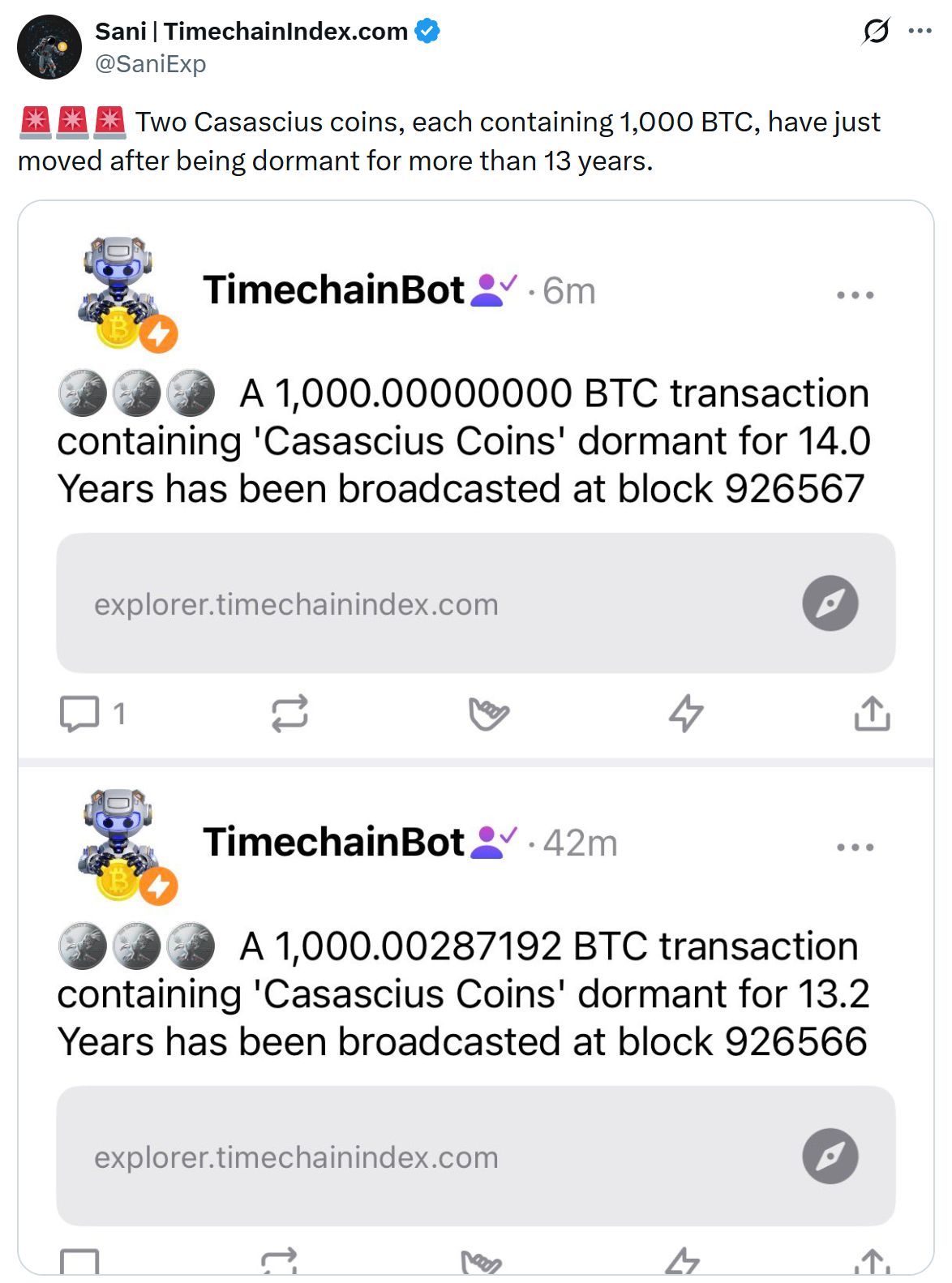

2,000 Bitcoin on the move: Rare Casascius coins awaken after 13 years

Pundit Shares 6 Practical Ways XRP Could Witness a Supply Shock