Elon Musk Triggers Another Meme Coin Rally

Elon Musk’s Grok video starring Floki reignited the FLOKI token’s momentum with a 30% surge, reversing losses from crypto’s recent crash and drawing new investor focus.

Elon Musk caused FLOKI to rally after posting a new video on social media. Demonstrating Grok’s video generation capabilities, Musk employed Floki as an unofficial mascot.

Although FLOKI recently rallied after a European ETP listing, the Black Friday crash erased all these gains. The 30% growth after Elon’s post has done a lot to help the token rebound.

Elon Causes FLOKI Rally

Elon Musk has had an explosive impact on the meme coin sector, with his business decisions and social media posts alike spurring huge token movements.

Today has been no different, as Elon posted a new video starring Floki the mascot, causing the related asset to rise dramatically:

Flōki is back on the job as 𝕏 CEO!

— Elon Musk (@elonmusk)

Specifically, Elon posted this Floki video to demonstrate Grok’s AI-generated video capabilities. He has also caused meme coin rallies by teasing these features in development, but it looks like X won’t be splitting Grok videos into a separate app for the moment.

Chaotic Price Fluctuations

In any event, Elon’s post was a huge boon for FLOKI, the meme coin. The token crashed hard after crypto’s Black Friday earlier this month, and it has been stagnant until today.

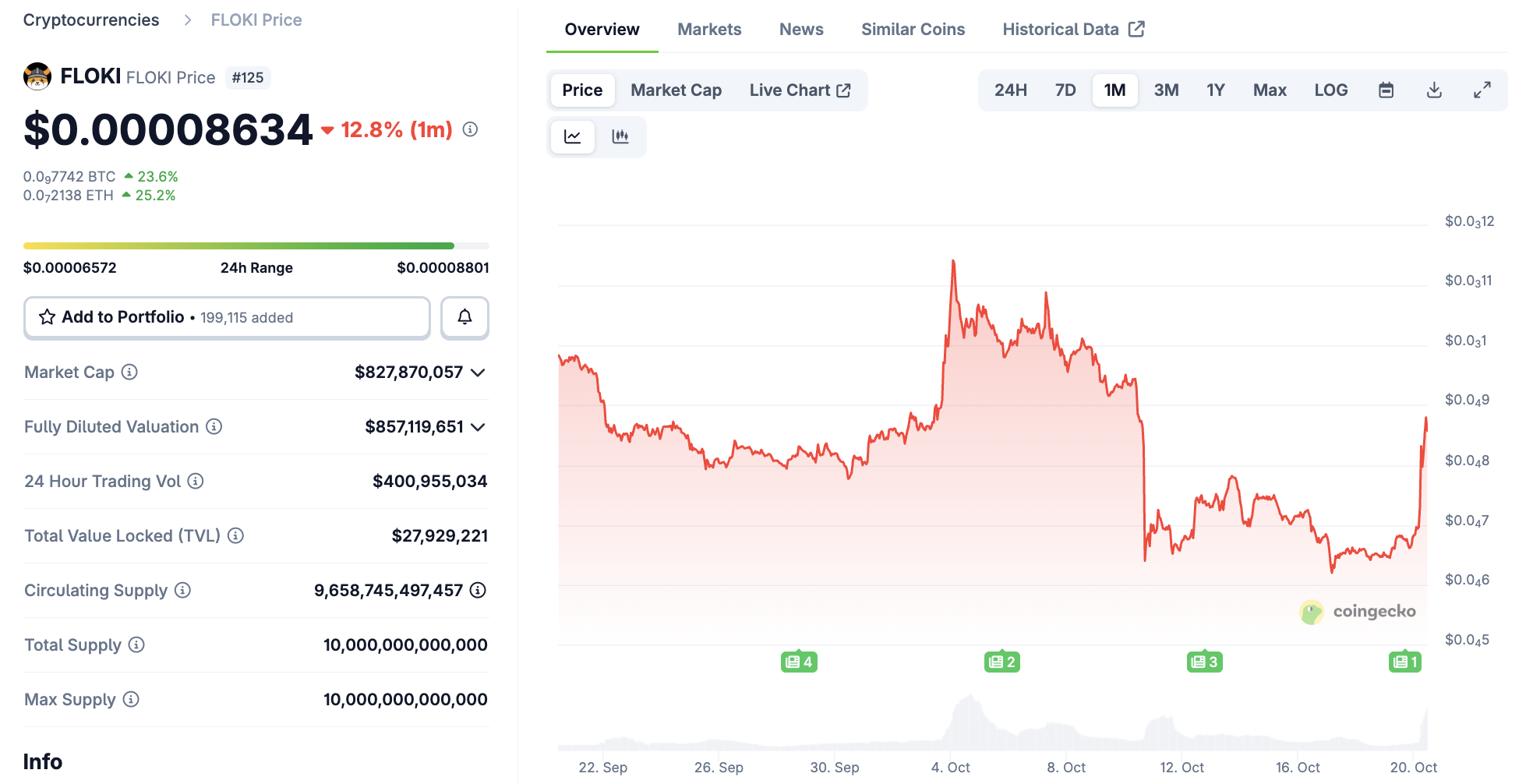

With this new post, however, FLOKI rallied around 30%, recovering much of the lost gains from the crash:

FLOKI Price Performance. Source:

FLOKI Price Performance. Source:

In other words, if Elon Musk keeps demonstrating interest in Floki like this, it could cause a wider recovery. Earlier this month, a FLOKI ETP launched in Europe, providing a big boost to the token. The Black Friday crash erased all these gains, however, and Elon seems like the best prospect to reverse it.

Of course, Elon’s social media posts might not be a reliable boost for FLOKI in the long run. It’s impossible to predict which token he’ll fixate on; although CZ shows persistent support for several projects, Musk’s endorsements are often momentary.

Whatever happens next, this has been a big boost for FLOKI. Hopefully, the project will continue capitalizing on its moment in the spotlight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Abrupt Price Swings and Effects on the Market: Blockchain System Vulnerabilities and Changes in Investor Confidence

- Solana's 2025 volatility stems from infrastructure vulnerabilities, unacknowledged outages, and shifting investor sentiment. - Network design prioritizing consistency over availability caused outages, exposing risks in high-throughput systems. - Developer growth (83% increase) contrasts with security gaps and inadequate documentation in smart contracts. - Price dropped 26% in November 2025 amid extreme fear metrics, despite institutional staking and ETF inflows. - Technical upgrades face skepticism due t

Financial Wellbeing Emerging as a Key Investment Trend in 2025: Prospects in Fintech and Personal Finance Management Solutions

- Financial wellness emerges as a 2025 investment theme, driven by AI, cloud tech, and rising demand for budgeting/debt management tools. - Market growth projects $4.2B to $10.2B (2025-2034) for financial wellness software, with PFM tools expanding at 12.5% CAGR to $11.12B by 2035. - Key innovators like MX, Acorns, and Affirm leverage automation and predictive analytics, while ETFs like Invesco PFM offer diversified fintech exposure. - Strategic risks include data privacy concerns and regulatory scrutiny,

Bitcoin Leverage Liquidation Crisis: Exposing Systemic Threats in Cryptocurrency Derivatives Markets

- 2025 Bitcoin's $100,000+ price collapse triggered $22B in leveraged liquidations, exposing crypto derivatives market fragility. - 78% retail-driven perpetual futures trading with 1,001:1+ leverage ratios created self-reinforcing price declines. - Decentralized exchanges enabled $903M ETF outflows and extreme fear index readings, revealing liquidity illusion risks. - Systemic risks now span traditional markets as crypto acts as volatility mediator, amplifying macroeconomic shocks. - Regulatory reforms and

Runway unveils its inaugural world model and introduces built-in audio support to its newest video model