Bitcoin’s Hashrate Hits the Stratosphere: Miners Flex 1.164 Zettahash of Pure Power

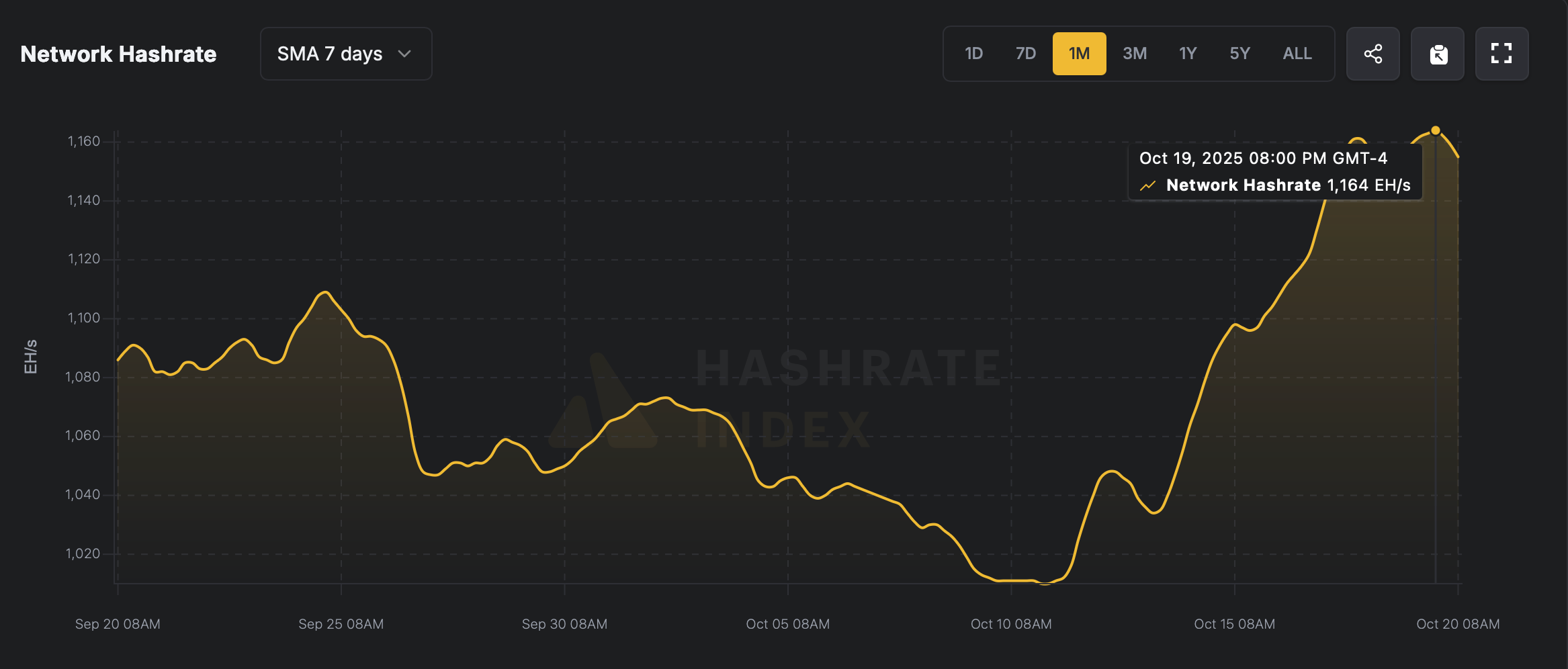

Bitcoin’s hashrate just cranked things up another notch, blasting to 1,164 exahash per second (EH/s) on Sunday at 2:40 p.m. Eastern time.

Bitcoin’s Hashrate Rockets While Revenue Improves

Fresh off its 1,157 EH/s high just two days back, Bitcoin’s hashrate has casually leveled up—adding another 7 EH/s to hit 1,164 EH/s, or for those who love big numbers, a cool 1.164 zettahash per second (ZH/s).

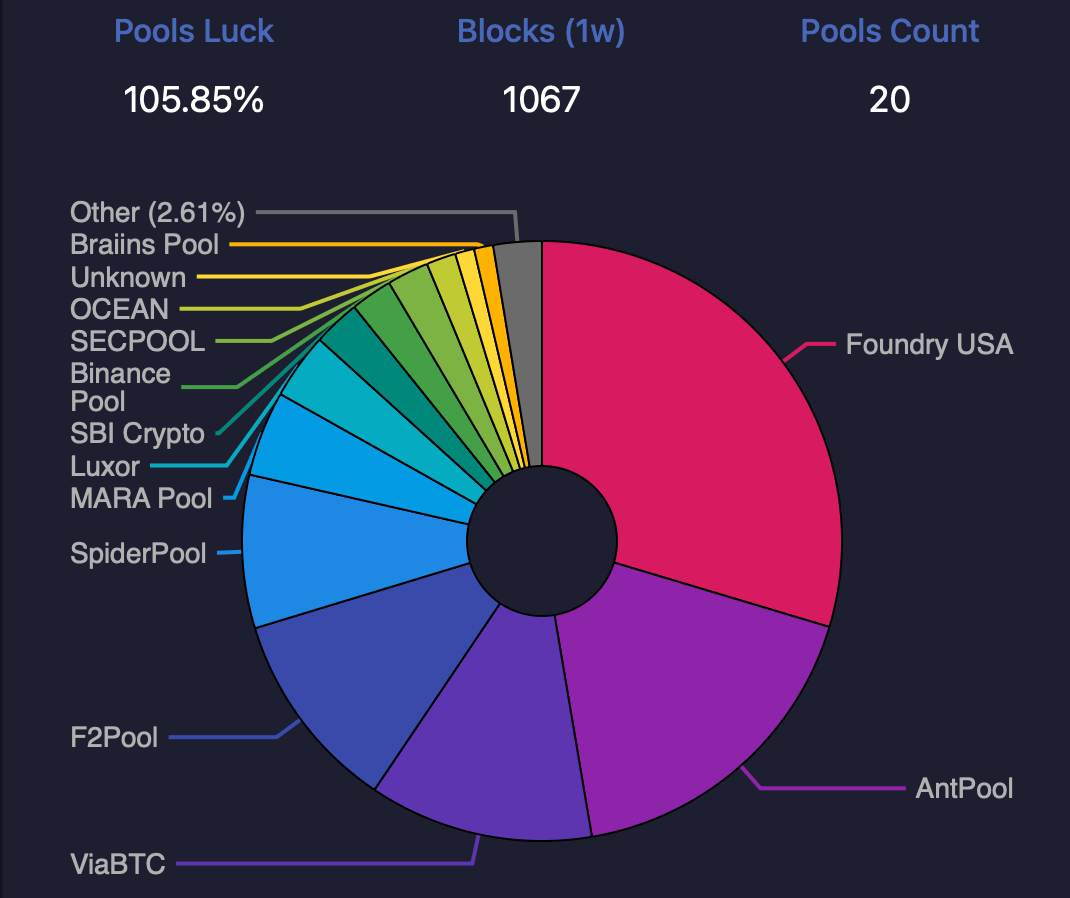

According to current hashrate stats, as of 11:45 a.m. on Oct. 20, Bitcoin’s hashrate is cruising at 1,154.16 EH/s. Leading the charge is Foundry USA, mempool.space metrics show, flexing 334.18 EH/s—roughly 28.96% of the entire network’s muscle.

Antpool’s holding steady with about 199.24 EH/s, making up 17.26% of Bitcoin’s total hashrate. Together with Foundry, this powerhouse duo controls a hefty 46.22% of the network.

Coming in third is ViaBTC with 135.99 EH/s, roughly 11.78% of the total, while F2pool and Spiderpool round out the top five at 122.29 EH/s and 92.77 EH/s, respectively. With BTC’s price on the upswing, hashprice—the estimated value of one petahash per second (PH/s)—has inched higher too.

In just 24 hours, the hashprice climbed 3.14%, rising from $46.51 to $47.97 per PH/s. Even so, the hashprice remains 6.89% below its Sept. 20, 2025 level. Over the past day, miners have been raking in an average of 3.14 BTC per block—though just 0.60% of that comes from onchain fees.

Bitcoin’s mining game is firing on all cylinders, with hashrate milestones stacking up and hashprice ticking higher in step with BTC’s price climb. Foundry and Antpool continue to dominate the charts, while 84 distinct smaller pools keep the competition lively.

Despite hashprice trailing its Sept. 20 level, miners remain locked in and laser-focused, proving once again that Bitcoin’s network isn’t just strong—it’s relentlessly pushing the limits of digital grit and computational endurance.

FAQ 🧭

- What is Bitcoin’s current hashrate?

As of Oct. 20, Bitcoin’s hashrate is cruising near 1,154 EH/s after recently touching 1.164 zettahash per second (ZH/s). - Which mining pools dominate the Bitcoin network?

Foundry and Antpool lead the pack, jointly controlling about 46% of Bitcoin’s total SHA256 hashrate. - How has Bitcoin’s hashprice changed recently?

The hashprice climbed 3.14% in 24 hours, rising from $46.51 to $47.97 per PH/s. - Are miners earning more from block rewards?

Miners earned an average of 3.14 BTC per block over the past day, which means only 0.60% stemmed from onchain fees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating How Vitalik Buterin's Advancements in ZK Technology Are Shaping Blockchain Investment Trends

- Vitalik Buterin's GKR protocol boosts Ethereum's scalability, enabling 43,000 TPS via ZK computation. - Institutional adoption accelerates with ZK-based compliance solutions, attracting BlackRock and Deutsche Bank partnerships. - ZK startups like zkSync and StarkNet secure $55M+ in funding, with market caps surging as infrastructure matures. - Investors target ZK-EVM compatible projects and hybrid models, aligning with Ethereum's 2026 roadmap.

ZK Technology's 2025 Price Increase: Sustained Value Driven by Blockchain Integration and Growing Institutional Engagement

- ZK technology's 2025 price surge stems from on-chain adoption and institutional investments, signaling a structural market shift. - ZK rollups now process 15,000 TPS with $3.3B TVL, driven by infrastructure upgrades and 230% developer engagement growth. - 35+ institutions including Goldman Sachs deploy ZKsync for confidential transactions, while Nike/Sony adopt it for supply-chain transparency. - Market fundamentals project 22.1% CAGR to $7.59B by 2033, validating ZK as blockchain's foundational infrastr

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.