Key Market Information Discrepancy on October 20th, a Must-See! | Alpha Morning Report

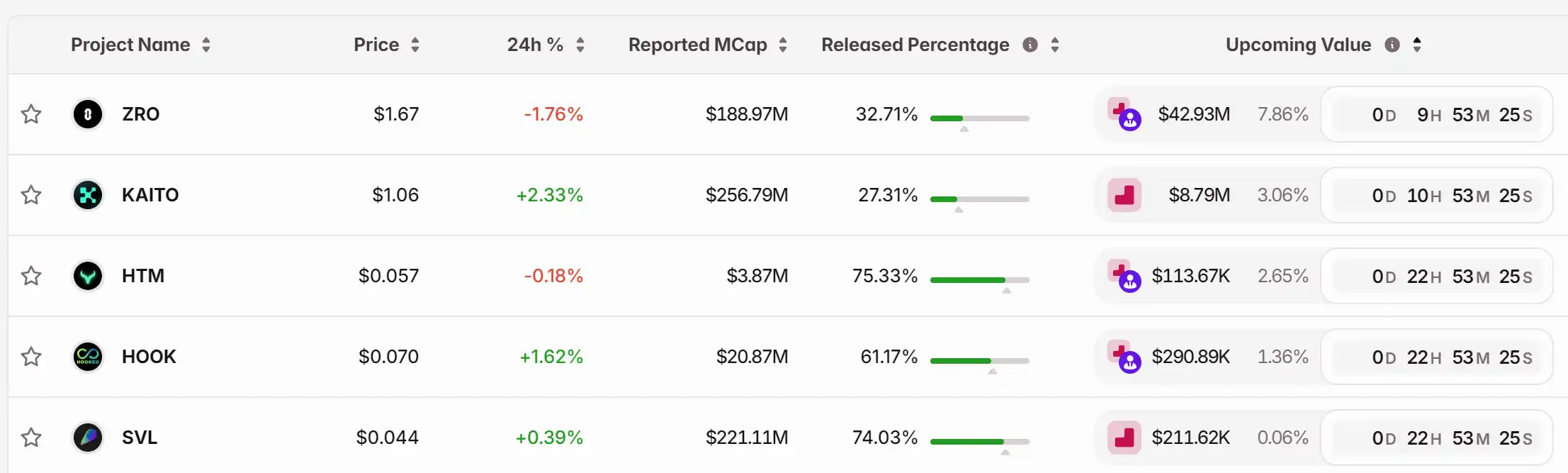

1. Top News: This week's CPI Data is Coming, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization 2. Token Unlock: $ZRO, $KAITO, $HTM, $HOOK, $SVL

Top News

1.This Week's CPI Data Released, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization

2.pump.fun Launches X Account Spotlight Aimed at Accelerating ICM

3."1011 Insider Whale" Once Again Shorts Bitcoin with 10x Leverage, Entry Average Price at $109,133.1

4.MLN Surges Over 73% in 24 Hours, Market Cap Reaches $25.5 Million

5.Binance Alpha to List SigmaDotMoney (SIGMA) on October 21

Articles & Threads

1. "$15 Billion Bitcoin Private Key Accidentally Cracked by U.S."

In October 2025, a massive cryptocurrency seizure case was revealed in the U.S. Federal District Court for the Eastern District of New York, where the U.S. government confiscated 127,271 bitcoins worth approximately $15 billion at market prices.

2. "New York Times: Trump Family's Cryptocurrency Scam Worse Than Watergate"

In American political history, no president has intertwined national power, personal brand, and financial speculation on a global scale like Trump. As cryptocurrency enters the White House and the digital shadow of the dollar entangles with national will, we must rethink a fundamental question: In this era of "on-chain sovereignty," do the boundaries of power still exist?

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain’s $6.8 Billion Bet: Will Advancements Outpace Its Security Risks?

- Terminal Finance's collapse exposed blockchain fintech vulnerabilities from delayed tech adoption and security flaws, triggering sector-wide scrutiny. - Naver-Upbit's $6.8B AI-blockchain merger faces challenges after Upbit's $36M Solana breach, mirroring 2019 North Korean-linked attacks. - Balancer's $116M hack revealed systemic DeFi risks, with debates over audit efficacy despite 11 prior security reviews. - Binance's legal troubles and BNB's price slump highlight market skepticism, while initiatives li

Bitcoin News Update: Krugman Links Bitcoin's Decline to Waning 'Trump Trade' Hype

- Bitcoin's 30% drop from October peak linked to fading "Trump trade" speculation, per Nobel laureate Paul Krugman, who frames it as speculative rather than stable value. - BlackRock's IBIT ETF regained $3.2B profit post-$90K rebound, while SpaceX's $105M BTC transfer sparks custodial strategy debates amid market volatility. - Naver's $10B Dunamu acquisition and corporate Bitcoin treasury moves highlight institutional crypto integration, despite $19B industry selloff and regulatory challenges. - Prediction

Bitcoin News Today: "Conflicting Whale Strategies Cast Uncertainty on Bitcoin's Path to $100K"

- Bitcoin's drop below $100,000 coincided with mixed whale strategies, including accumulation, shorting, and exchange deposits, signaling uncertain market direction. - Ethereum whales used 16.08 million DAI to buy 5,343 ETH at $3,010, while Bitcoin whales deposited 9,000 BTC, potentially signaling selling preparation. - Derivatives markets showed conflicting bets, with a $91M BTC short and $36.4M long flip, while ETF inflows ($84M total) hinted at institutional confidence amid macroeconomic risks. - Analys

Exchanges Call on SEC: Deny Exemptions to Maintain Fairness in the Market

- WFE warns SEC against broad crypto exemptions for tokenized stocks, citing risks to investor protections and market integrity. - Tokenized stocks lack dividend rights, voting access, and custody frameworks, creating "mimicked products" with weaker safeguards. - SEC's sandbox-style exemptions risk regulatory arbitrage, allowing crypto platforms to bypass rules enforced on traditional exchanges. - Global bodies like IOSCO warn tokenization amplifies data integrity and custody risks, urging unified standard