XRP Whale Count Hits An All-Time High Amid Market Turmoil

Ripple’s plan for a $1 billion digital asset treasury and growing ETF speculation have further strengthened market confidence in XRP’s long-term outlook.

XRP is showing renewed strength after weeks of steep declines, emerging as the day’s top performer among major cryptocurrencies.

According to BeInCrypto data, the token climbed more than 4% in the past 24 hours to trade near $2.38, rebounding from a $2.25 low on October 17. Notably, this was its weakest price level since early July.

Why Did XRP Rebound?

Blockchain analytics firm Santiment reported that XRP’s recovery coincided with a sharp rise in mid- to large-sized holders.

According to the firm, the number of wallets holding at least 10,000 XRP has reached an all-time high of roughly 317,500. This increase suggests that investors used the recent pullback to accumulate rather than exit.

📊 XRP's price has rebounded back a modest +5.3% since its bottom 12 hours ago. A good long-term sign is the amount of mid to large stakeholders continues to grow. There are now an all-time high ~317.5K wallets with at least 10K $XRP.🔗 Chart link: pic.twitter.com/qOom9t876s

— Santiment (@santimentfeed) October 17, 2025

Notably, this pattern mirrors previous accumulation phases observed since November 2024, when XRP first broke above $1.

Since then, each XRP price correction has been followed by renewed buying pressure from investors who are increasingly confident in Ripple’s ecosystem and long-term roadmap.

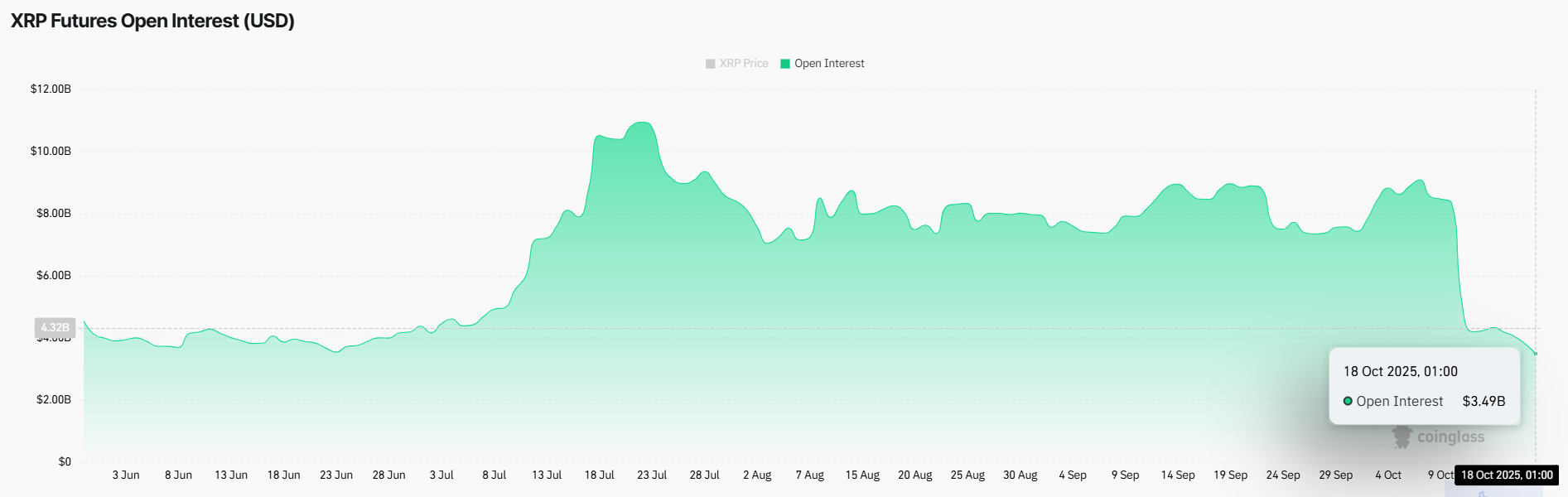

At the same time, open interest in XRP futures has fallen sharply to $3.49 billion, according to CoinGlass data. This is its lowest level since June.

XRP Open Interest. Source:

CoinGlass

XRP Open Interest. Source:

CoinGlass

Market analysts noted that the decline in leveraged positions signals reduced speculative activity and a shift toward more defensive investor behavior.

Historically, such declines in open interest often coincide with market bottoms, where selling exhaustion gives way to recovery phases.

Ripple’s Effort Bolsters XRP

Beyond on-chain signals, Ripple’s corporate strategy may also be fueling market optimism for the digital asset.

This week, reports emerged that the firm is preparing a $1 billion Digital Asset Treasury (DAT) company to manage and accumulate XRP as part of its long-term reserves.

Ripple has spent roughly $3 billion on acquisitions of major firms, including Metaco, Hidden Road, Rail, and GTreasury, over the past two years. These purchases aim to build an integrated corporate finance stack for the token and its Ripple USD (RLUSD) stablecoin.

Adding to this positive outlook, speculation is mounting that the US Securities and Exchange Commission could soon approve an XRP exchange-traded fund (ETF).

Indeed, the anticipation has driven a spike in applications for leveraged XRP ETF products. This surge highlights both renewed institutional interest and a growing appetite among investors for higher-risk exposure.

Together, these developments point to a deep belief in XRP’s resilience and Ripple’s long-term strategic vision of bolstering the token’s global adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

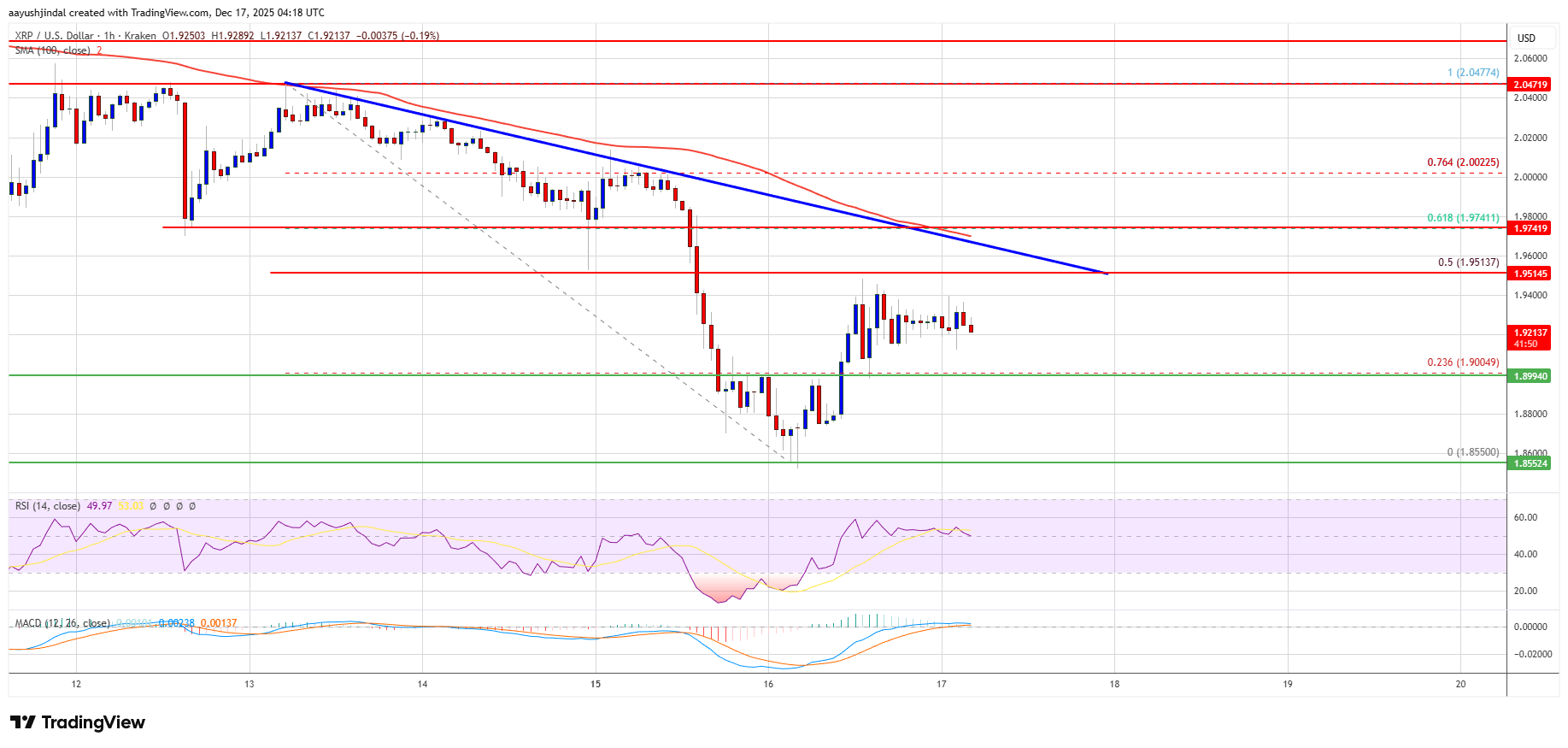

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?