Bitcoin (BTC) Price Analysis for October 19

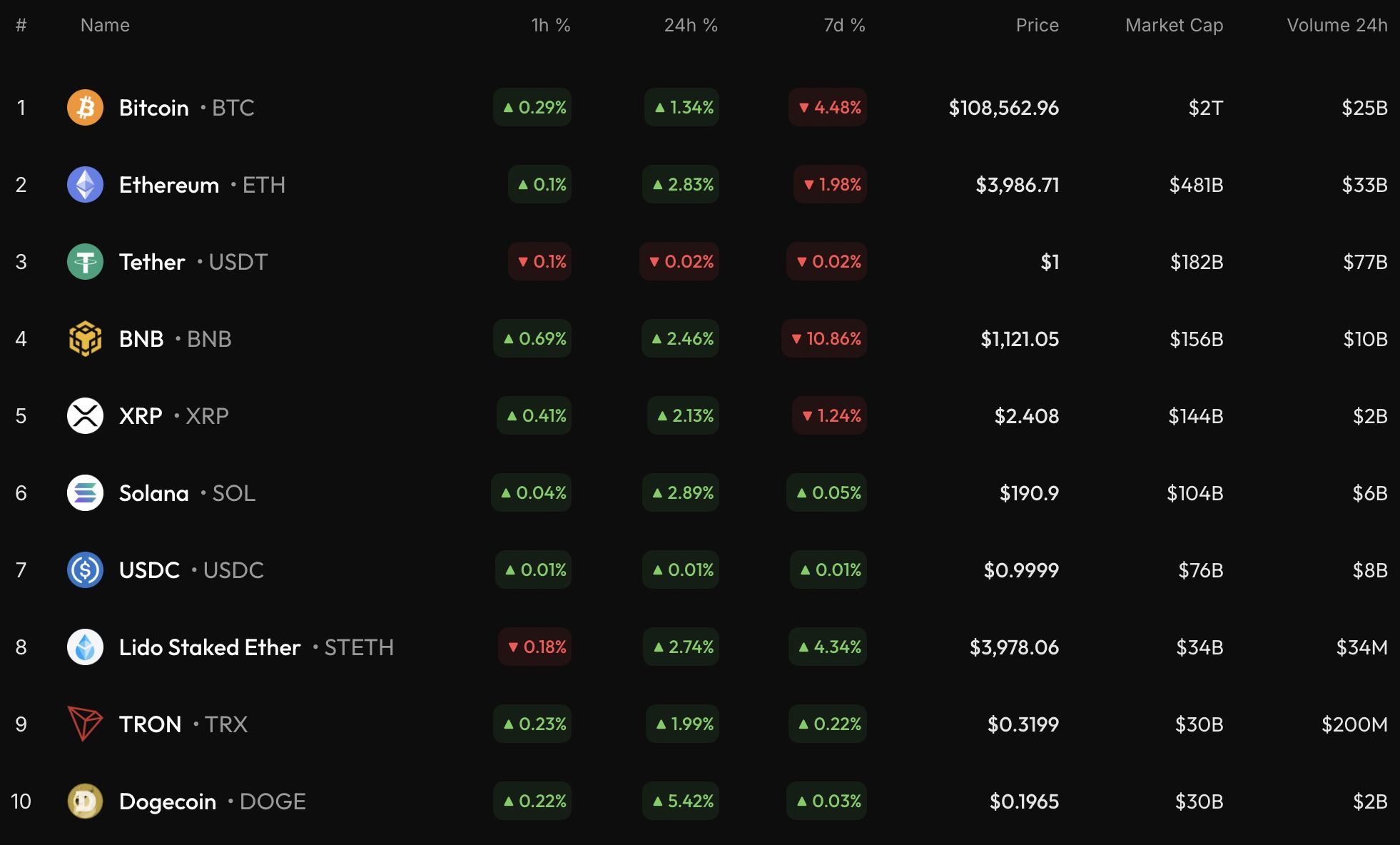

The rates of most coins keep rising on the last day of the week, according to CoinStats.

BTC/USD

The price of Bitcoin (BTC) has gone up by 1.34% over the last 24 hours.

On the hourly chart, the rate of BTC has broken the local resistance of $108,234. If the daily bar closes above that mark, the upward move is likely to continue to the $109,000 range.

On the bigger time frame, the price of the main crypto is going up after yesterday's bullish closure. However, the volume is low, which means bulls might need more time to get strength for a continued move.

In this regard, consolidation in the narrow range of $108,000-$110,000 is the more likely scenario.

From the midterm point of view, the situation is less positive for buyers. If the weekly bar closes near its low, there is a high chance of a test of the support of $100,426 by the end of the month.

Bitcoin is trading at $108,455 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Increasing Need for Expertise in AI and Computational Fields: Discovering Investment Prospects in Educational and Training Platforms

- Farmingdale State College (FSC) expands computing programs and partners with Tesla/Amazon to address AI/data science demand. - Edtech firms like Century Tech use AI for personalized STEM learning, aligning with FSC’s need to scale enrollment while maintaining rigor. - Global AI education market projected to reach $12.8B by 2028 (33.5% CAGR), driven by corporate/university collaborations like SUNY-NY Creates TII. - Investors face risks in regulatory scrutiny and curriculum obsolescence but gain opportunit

Magic Eden to expand $ME buybacks in 2026 using revenue from Swaps, Lucky Buy, and Packs

The Emergence of Hyperliquid (HYPE): Analyzing the Latest Market Rally

- Hyperliquid (HYPE) dominates 73% of decentralized derivatives market in 2025 via liquidity innovations and hybrid trading structures. - HIP-3 protocol and two-tier architecture drive $3.5B TVL, enabling EVM compatibility and 90% fee cuts to attract DeFi projects. - Platform's 71% perpetual trading share reflects strategic buybacks ($645M in 2025) and 78% user growth amid shifting capital toward on-chain infrastructure. - Hybrid model challenges CEX dominance while facing aggregator risks, but institution

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal