Japan's Financial Services Agency plans to allow banks to acquire and hold cryptocurrencies for investment purposes

Jinse Finance reported that the Financial Services Agency (FSA) of Japan is preparing to review relevant regulations and may allow banks to acquire and hold cryptocurrencies such as bitcoin for investment purposes. This would mark a significant policy shift, as the current regulatory guidelines, revised in 2020, effectively prohibit banks from holding cryptocurrencies due to volatility risks. The FSA plans to discuss this reform at a Financial Services Committee meeting, aiming to align crypto asset management with traditional financial products such as stocks and government bonds. At the same time, it will explore frameworks for managing crypto-related risks. If approved, capital and risk management requirements may be proposed before banks are permitted to hold digital assets. In addition, the FSA is also considering allowing banking groups to register as licensed "cryptocurrency exchange operators" to provide trading and custody services. Japan's crypto market is growing rapidly, and in early September, the FSA sought to shift crypto regulation from the Payment Services Act to the Financial Instruments and Exchange Act to strengthen investor protection. Meanwhile, Japan's three major banks have jointly issued a yen-pegged stablecoin, and the Securities and Exchange Surveillance Commission plans to introduce new regulations to prohibit and penalize crypto insider trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

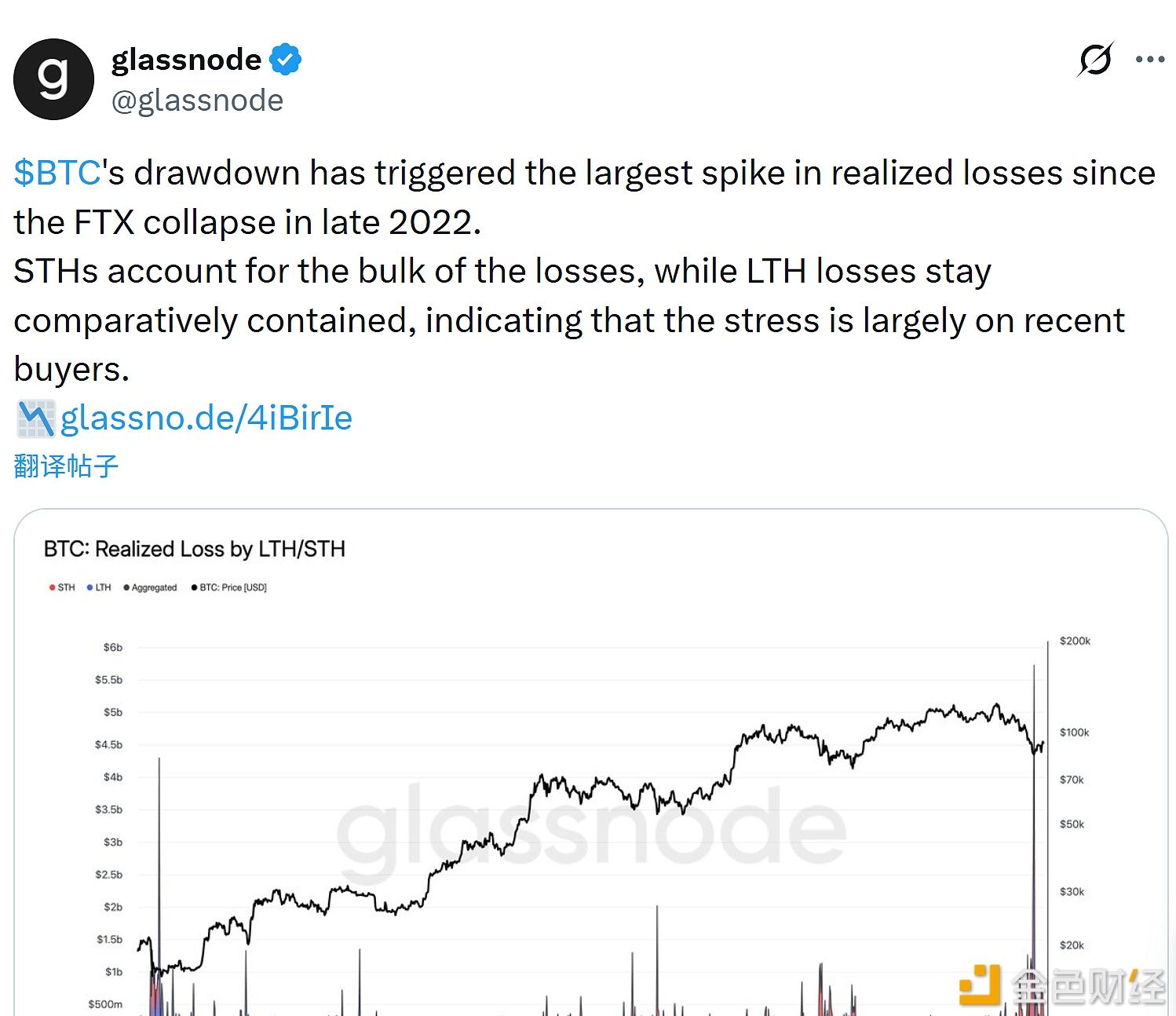

Glassnode: Short-term holders bore most of the losses during this BTC correction

Matrixport: Bitcoin's current rebound is more reflected in position structure rather than price itself

Ethereum Prysm client bug causes validator participation to drop by 25%, nearly resulting in loss of finality