Ansem: It will be difficult to change the current bearish outlook unless BTC climbs back above $112,000.

According to ChainCatcher, crypto KOL Ansem stated that clear SFP (Swing Failure Pattern) formations can be observed on the weekly charts of XRP, SOL, and ETH, indicating that the market trend resembles a momentum exhaustion rather than the start of a new bull market. He pointed out that this situation is similar to LTC's trend in 2021, and that the price of BTC has now fallen below its 2024 high.

Ansem believes that the broad distribution phase, which has lasted for 10 months, may be coming to an end, with the market lacking new narrative drivers. MSTR has fallen below the 200-day moving average for the first time since peaking in November last year, turning it into a resistance level and showing a weak market structure. He added that unless BTC climbs back above $112,000, it will be difficult to change the current bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bubblemaps: Snipers identified in the WET presale, with over 70% of addresses being their sybil addresses

Metaplanet raises $50 million by collateralizing bitcoin to purchase more bitcoin

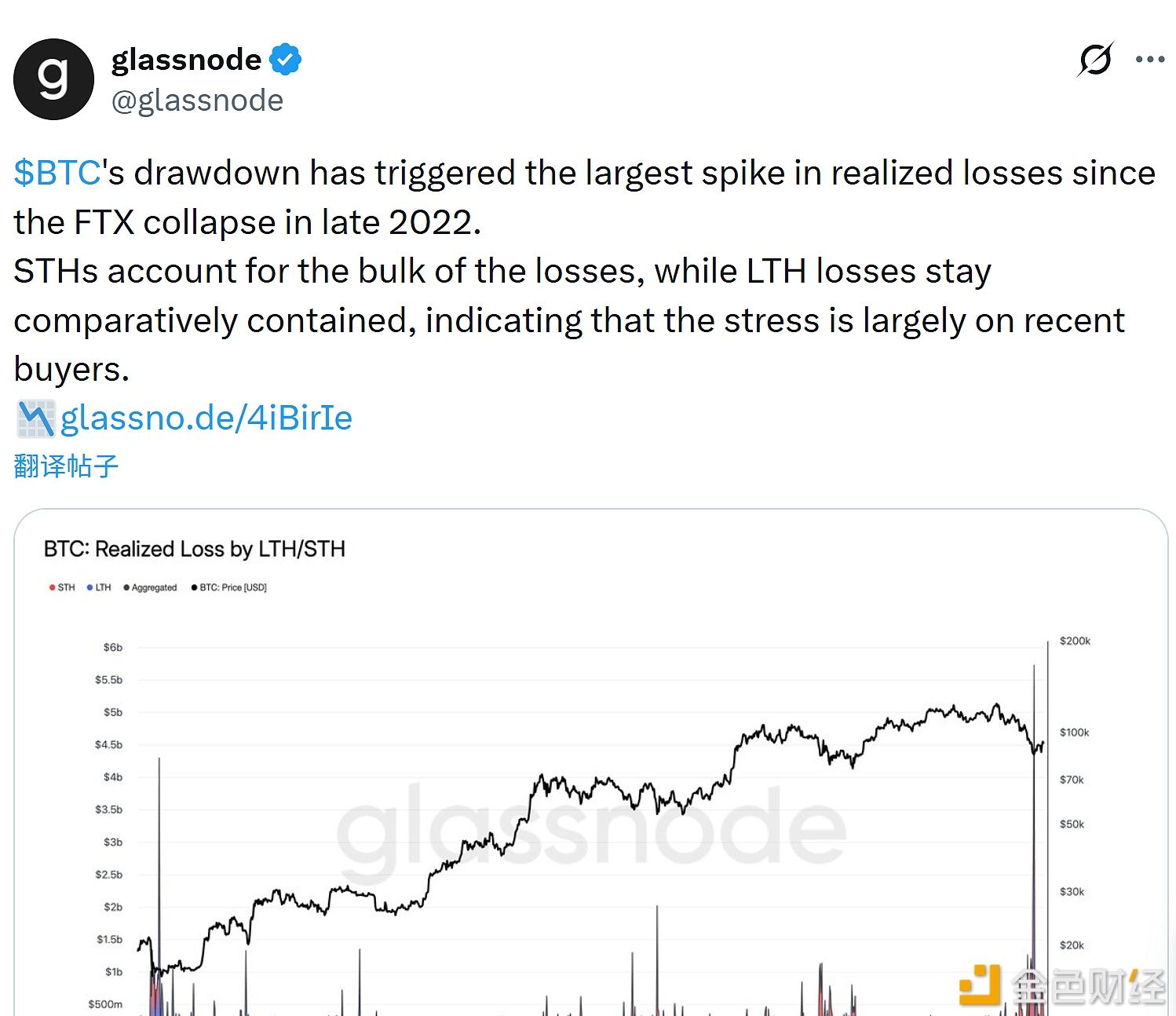

Glassnode: Short-term holders bore most of the losses during this BTC correction

Matrixport: Bitcoin's current rebound is more reflected in position structure rather than price itself