Bitcoin and Ethereum ETFs See Heavy Outflows as Market Holds Firm

Crypto Market Remains Resilient Despite ETF Outflows

The crypto market is showing resilience even as Bitcoin and Ethereum ETFs recorded $598 million in outflows.

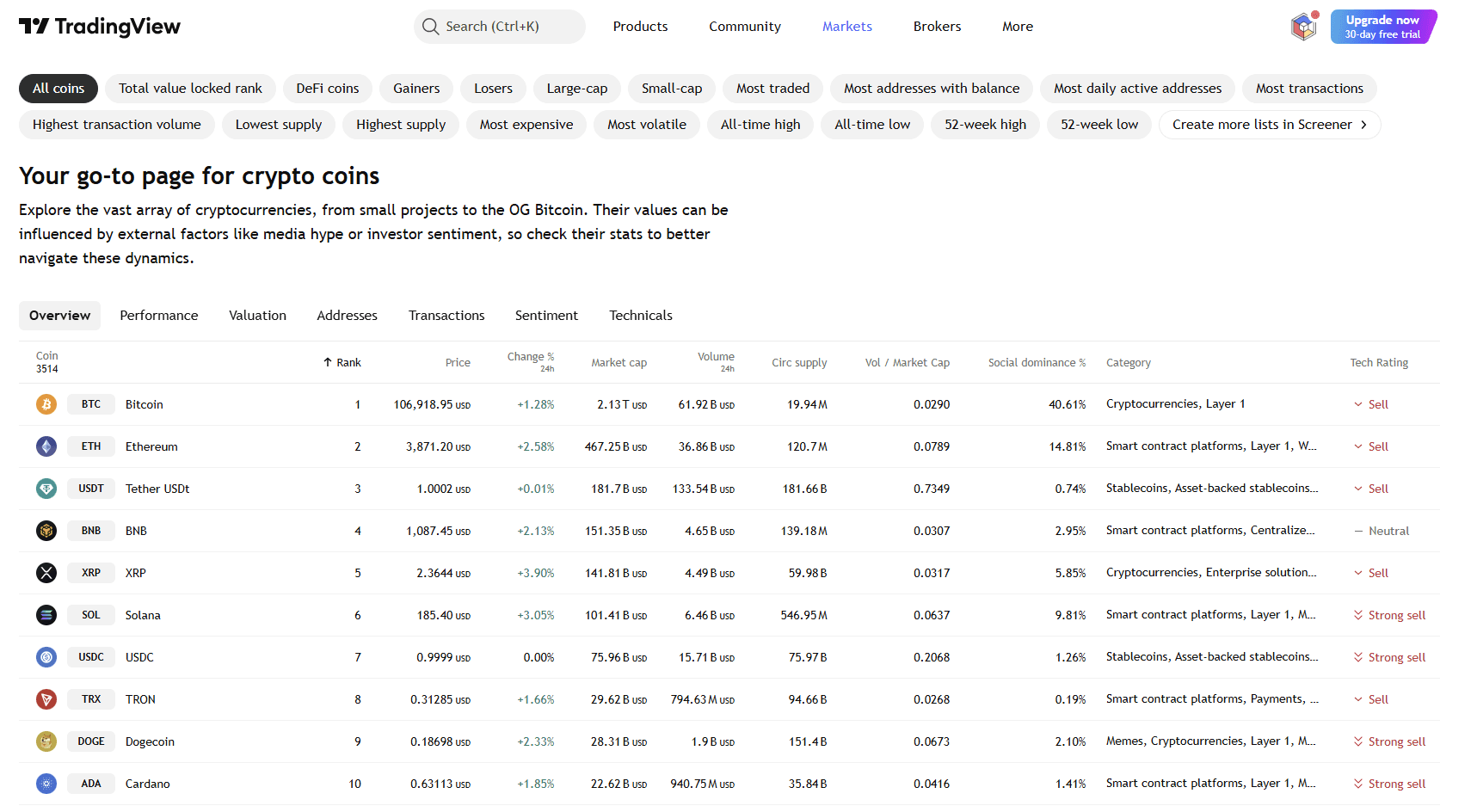

While such numbers often signal bearish pressure, prices tell a different story. Bitcoin is trading around $107,000 (+1.45%) and Ethereum has risen 2.35% to $3,876. This indicates investors are reallocating positions rather than exiting the market.

By TradingView - 2025-10-18

By TradingView - 2025-10-18

Analysts explain that ETF outflows may reflect short-term profit-taking or portfolio rotation instead of fear. Institutional sentiment remains cautious, but on-chain data shows strong retail buying activity supporting market stability.

Robert Kiyosaki Calls Government Money “Fake”

Author of Rich Dad Poor Dad , Robert Kiyosaki , reiterated his belief that government-issued money is “fake.”

He argues that continuous money printing by central banks devalues purchasing power, while assets like Bitcoin, gold, and silver preserve real wealth.

Kiyosaki’s comments reinforce Bitcoin’s image as a hedge against inflation and a store of value amid global economic uncertainty.

Peter Schiff Warns of a Correction but the Market Stays Calm

Economist Peter Schiff predicts that Bitcoin, Ethereum, and altcoins could soon face losses due to high leverage and speculation. He claims the market remains detached from fundamentals and could correct if liquidity tightens.

However, Schiff’s warning contrasts with current market data . Bitcoin dominance stands above 41%, trading volume exceeds $61 billion, and altcoins like XRP (+4.2%), BNB (+2.4%), and Solana (+2.3%) are also gaining.

The overall sentiment remains confident, showing that investors view current ETF outflows as temporary.

Security Flaw Exposes 120,000 Bitcoin Wallets

While prices remain steady, a new security concern surfaced this week. Researchers discovered a flaw in the Libbitcoin Explorer 3.x library, leaving over 120,000 Bitcoin wallets vulnerable to attacks.

The problem stems from a weak random number generator that could allow hackers to predict private keys. Experts advise users to move funds to wallets using cryptographically secure RNG (CSPRNG) and compliant BIP-39 seed phrases .

Although this issue affects a limited group of wallets, it highlights the importance of security as crypto adoption continues to grow.

Conclusion: Outflows Do Not Equal Fear

Despite concerns about ETF withdrawals and bearish predictions, the crypto market remains strong. Bitcoin’s network activity , Ethereum’s growth, and retail participation all support a stable trend .

The combination of cautious institutional positioning and resilient investor sentiment signals a balanced, maturing market. Strategic accumulation and improved wallet security remain the most important factors for long-term success.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Perhaps as soon as next week, the term "RMP" will sweep across the entire market and be regarded as the "new generation QE".

The Federal Reserve has stopped its balance sheet reduction, marking the end of the "quantitative tightening" era. The much-watched RMP (Reserve Management Purchases) could initiate a new round of balance sheet expansion, potentially injecting a net increase of $20 billion in liquidity each month.

Enemies reconciled? CZ and former employees join forces to launch prediction platform predict.fun

Dingaling, who was previously criticized by CZ due to the failure of boop.fun and the "front-running" controversy, has now reconciled with CZ and jointly launched a new prediction platform, predict.fun.

Why is it said that prediction markets are really not gambling platforms?

The fundamental difference between prediction markets and gambling lies not in gameplay, but in mechanisms, participants, purposes, and regulatory logic—the capital is betting on the next generation of "event derivatives markets," not simply rebranded gambling.

2025 Crypto Prediction Mega Review: What Nailed It and What Noped It?

Has a year passed already? Have those predictions from back then all come true?