Public Mining Companies Raise Billions in Debt to Fund AI Pivot

Bitcoin miners are taking on record debt to fund AI infrastructure and growth. This shift from hardware collateral to convertible bonds could redefine the industry’s financial future — if profitability keeps pace.

Major public mining companies are aggressively raising billions of dollars through convertible bonds, the largest capital push since 2021.

This could mark a turning point toward AI expansion, but also carries the risk of equity dilution and mounting debt pressure if profits fail to accelerate.

A New Wave of Large-Scale Debt Issuance

The year 2025 marks a clear shift in how Bitcoin miners raise capital. Bitfarms recently announced a $500 million offering of convertible senior notes due 2031. TeraWulf proposed a $3.2 billion senior secured note issuance to expand its data center operations.

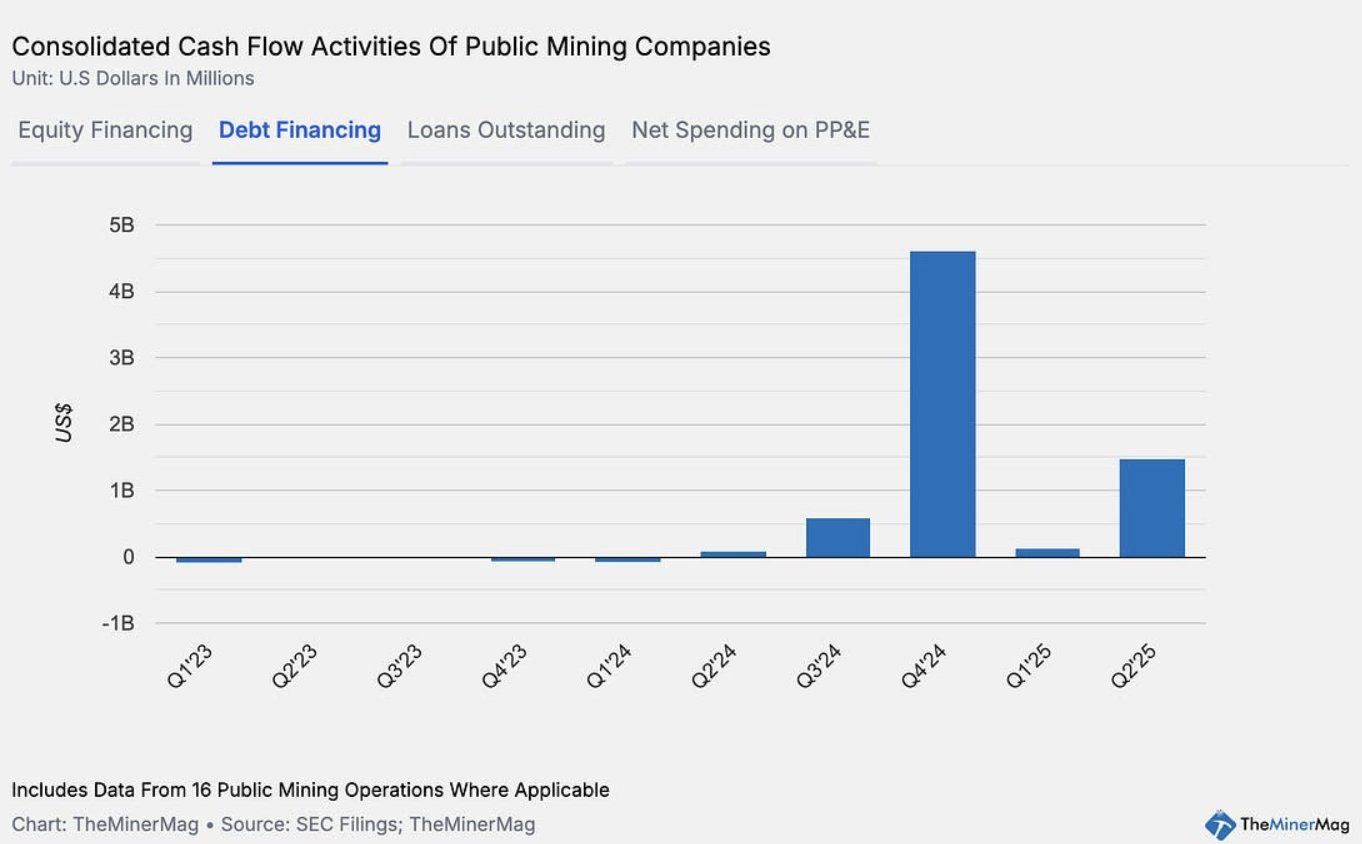

According to TheMinerMag, the total value of convertible and debt note issuances from 15 public mining companies reached a record $4.6 billion in Q4 2024. That figure fell below $200 million in early 2025 before surging again to $1.5 billion in Q2.

Consolidated cash flow activities of public mining companies. Source:

TheMinerMag

Consolidated cash flow activities of public mining companies. Source:

TheMinerMag

This capital strategy mirrors what MicroStrategy has done successfully in recent years. However, today’s debt model fundamentally differs from the 2021 cycle in the mining industry. Back then, ASIC mining rigs were often used as collateral for loans.

Public mining companies increasingly turn to convertible notes as a more flexible approach to financing. This strategy shifts financial risk from equipment repossession to potential equity dilution.

While this gives companies more breathing room to operate and expand, it also demands stronger performance and revenue growth to avoid weakening shareholder value.

Opportunities and Risks

If miners pivot toward new business models, such as building HPC/AI infrastructure, offering cloud computing services, or leasing hash power, these capital inflows could become a powerful growth lever.

Diversifying into data services promises longer-term stability than pure Bitcoin mining.

For instance, Bitfarms has secured a $300 million loan from Macquarie to fund HPC infrastructure at its Panther Creek project. Should AI/HPC revenues prove sustainable, this financing model could be far more resilient than the ASIC-lien structure used in 2021.

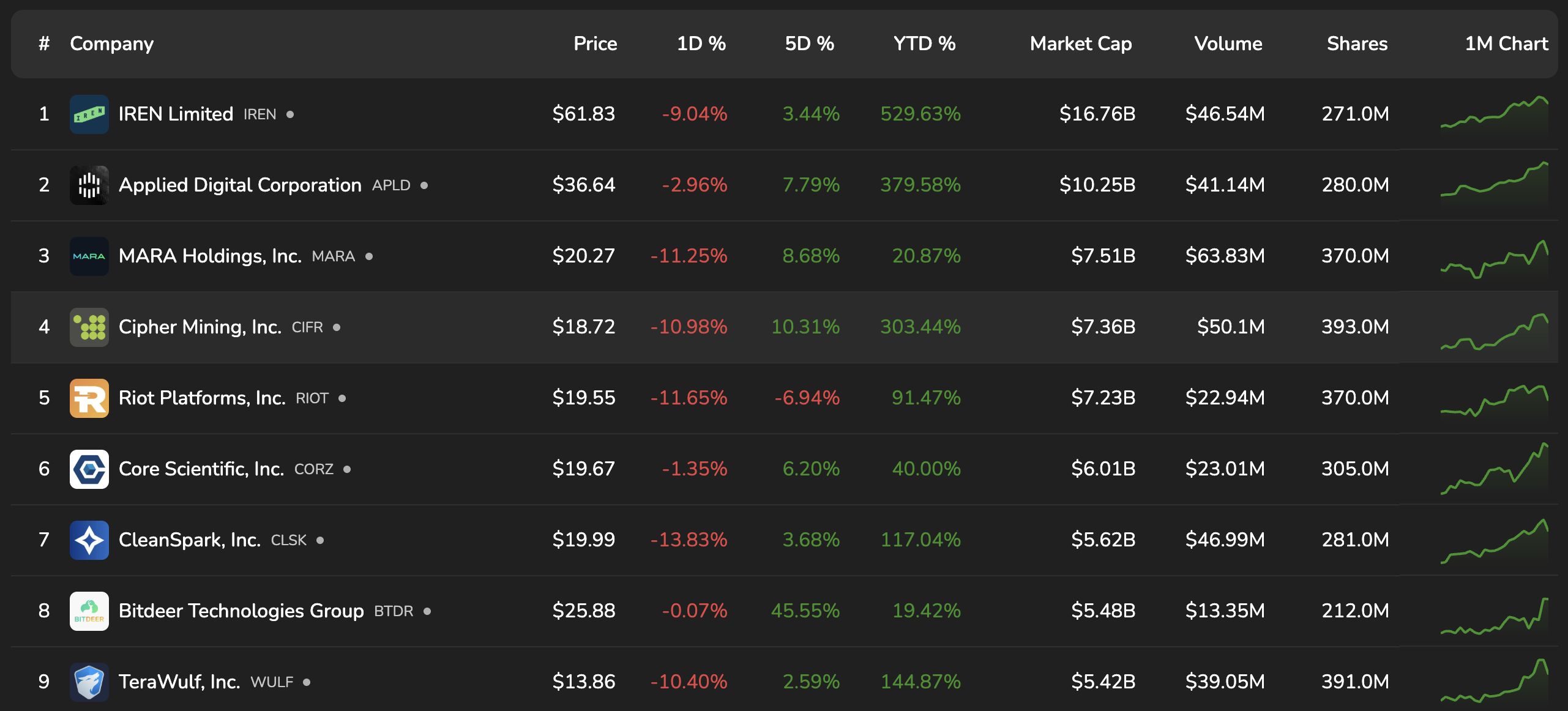

The market has seen a positive reaction from mining stocks when companies announce debt issuances, with stock prices rallying as the expansion and growth narrative is emphasized. However, there are risks if expectations are not met.

Shares of mining companies. Source:

bitcoinminingstock

Shares of mining companies. Source:

bitcoinminingstock

Suppose the sector fails to generate additional income to offset financing and expansion costs. In that case, equity investors will bear the brunt through heavy dilution — instead of equipment repossession as in previous cycles.

This comes when Bitcoin’s mining difficulty has reached an all-time high, cutting into miners’ margins, while mining performance across major companies has been trending downward in recent months.

In short, the mining industry is once again testing the limits of financial engineering — balancing between innovation and risk — as it seeks to transform from energy-intensive mining to data-driven computing power.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.