Crypto Markets React as Trump Says High China Tariffs ‘Not Sustainable’

US President Donald Trump clarified on Friday that proposed 100% tariffs on Chinese goods “won’t stand”, suggesting a softer stance than initially feared. The statement comes amid rising global trade tensions and has already stirred speculation in traditional and crypto markets alike. Bitcoin Reacts as Trump Softens on China Tariffs While the initial threat of

US President Donald Trump clarified on Friday that proposed 100% tariffs on Chinese goods “won’t stand”, suggesting a softer stance than initially feared.

The statement comes amid rising global trade tensions and has already stirred speculation in traditional and crypto markets alike.

Bitcoin Reacts as Trump Softens on China Tariffs

While the initial threat of aggressive tariffs raised concerns over global risk sentiment and capital flight, Trump’s latest comments signal a potential easing in trade policy.

In an interview with Fox News, President Trump discussed trade tensions with China and his upcoming meeting with Xi Jinping in South Korea in two weeks.

“They’re always looking for an edge. They ripped off our country for years,” Trump said.

He further added that China really hurt the US economy in the past, but now that has changed.

When asked whether a 100% tariff on top of existing China tariffs could be upheld, Trump said no, adding that such a move wouldn’t be sustainable.

“I think we are gonna do great with China,” Trump noted.

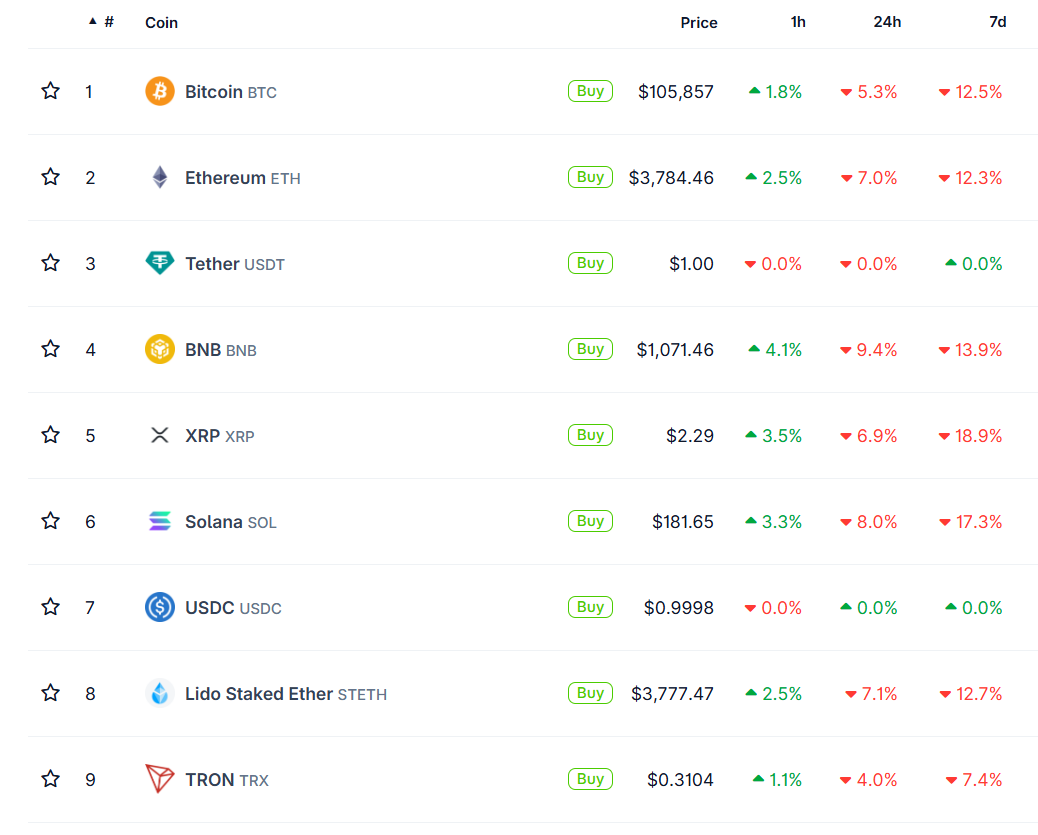

This shift has been interpreted as a relief signal for risk-on assets. In response, Bitcoin price showed a slight uptick, up nearly 2% on the 1-hour chart. Top cryptocurrencies followed suit, showing positive momentum after Trump softened his stance.

Price Performance of Top Cryptocurrencies. Source:

Coingecko

Price Performance of Top Cryptocurrencies. Source:

Coingecko

The change in stance comes as global markets plunged late last week after Donald Trump announced sweeping new tariffs and export controls on China, escalating trade tensions to their highest level since 2019. The aggressive move sent shockwaves through global markets, with risk assets like Bitcoin and Ethereum tumbling in response.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interop roadmap "accelerates": After the Fusaka upgrade, Ethereum interoperability may reach a key milestone

a16z "Big Ideas for 2026: Part Two"

Software has eaten the world. Now, it will drive the world forward.

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.