Hyperliquid-based Ventuals Attracts $38 Million Within 30 Minute

Ventuals, a protocol designed for trading tokenized private and pre-IPO companies, launched its HYPE liquid staking vault today, which will be used to fund the protocol’s HIP-3 permissionless derivatives market on Hyperliquid.

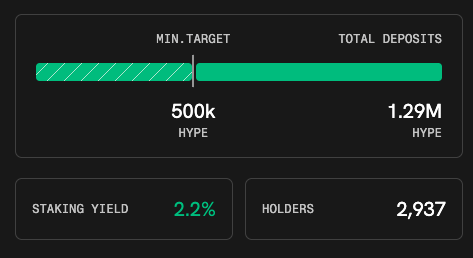

The launch included a minimum stake threshold of 500,000 HYPE, worth roughly $19 million, which was filled in just five minutes, with the top depositor contributing 250,000 HYPE. Users who deposited before the threshold was hit will receive a 10x multiplier on their points distribution and an official Ventuals NFT.

Inflows continued to pour in, with a little over 1 million HYPE, worth $38 million, raised in the first half hour. The total sits at 1.29 million HYPE at the time of writing.

The protocol is set to compete with other HIP-3-related protocols, including Hyperliquid’s largest liquid staking platform, Kinetiq, and TradeXYZ, a derivatives trading market launched by Unit, the ecosystem’s leading tokenization platform.

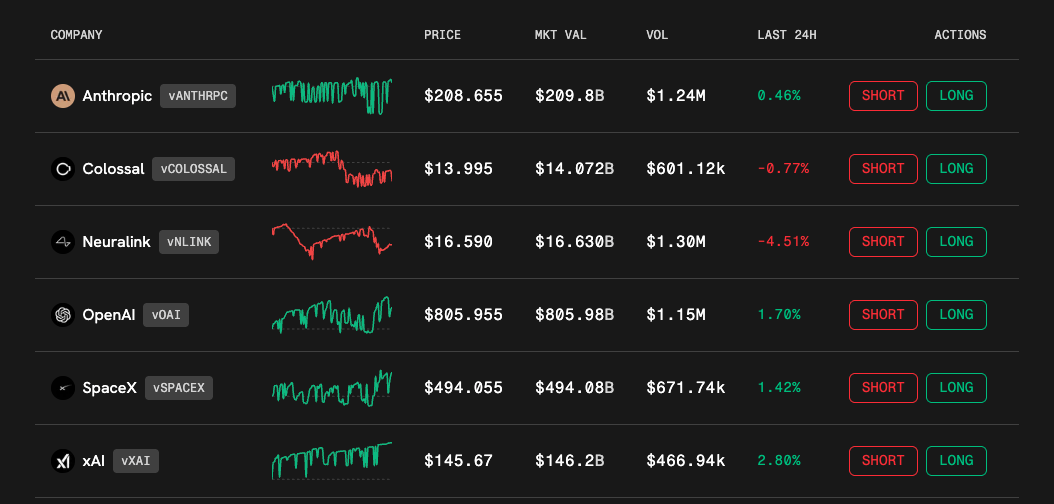

Ventuals sets itself apart by focusing specifically on private equity and pre-IPO companies, including OpenAI, SpaceX, and Kraken. Some of the most popular markets by testnet volume include Kraken, Neuralink, and Polymarket.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Italy orders non-compliant VASPs to exit as MiCAR rules kick in

Local Leadership and the Drive for Technological Advancement: How Minneapolis is Building Economic Strength

- Minneapolis integrates AI and centralized IT systems to boost municipal efficiency and tech-driven governance. - The city's medical tech sector leads with 16% U.S. talent share and 16 expansion projects in 2024. - Workforce shortages (59% hiring challenges) and rising costs hinder scalability despite innovation gains. - Investors face opportunities in medtech and AI tools but lack transparent metrics for evaluating tech ROI. - Minneapolis highlights the need for balancing tech innovation with accountabil

The Impact of a 30% Increase in ICP Token Value on Investments in Blockchain Infrastructure

- ICP's 30% price surge to $4.71 in November 2025 stems from ICP 2.0 upgrades (Caffeine, Internet Identity 2.0) and institutional partnerships with Microsoft Azure and Google Cloud. - This growth challenges AWS/Azure dominance, with ICP's Fission upgrade enabling scalable decentralized storage and attracting enterprises seeking alternatives to centralized cloud providers. - However, regulatory uncertainty and market volatility (e.g., 91% drop in token transfers during dips) raise questions about long-term

The Economic Impact of Incorporating AI in Sectors Driven by Data

- Global AI infrastructure investments by tech giants like Alphabet and Microsoft are projected to reach $315B in 2025, generating $15T in economic value by 2030 through automation and analytics. - The U.S. leads with $470B in AI infrastructure funding (2013-2024), driven by cloud expansion expected to hit $3.4T by 2040, creating fragmented markets for consolidation. - Data-centric ecosystems (e.g., JHU, ICP Caffeine AI) enable pharmaceuticals and finance firms to build competitive barriers via proprietary