BlackRock CEO Takes Back Anti-Bitcoin Comments, Says Markets Force Investors to ‘Relook at Your Assumptions’

The CEO of the asset management titan BlackRock says he was flat-out wrong to be a skeptic of Bitcoin.

In a new interview with 60 Minutes, Larry Fink shares a more optimistic stance on crypto as he explains why he takes back his earlier criticism of Bitcoin (BTC).

“We were talking about Bitcoin then. It was a domain of money launderers and thieves, but you know, the markets teach you: you have to always relook at your assumptions.”

While Fink thinks that some cryptocurrencies such as memecoins can be abused, he says he’s now a believer in digital assets investing.

“There is a role for crypto in the same way there’s a role for gold. It’s an alternative for those looking to diversify. This is not a bad asset but I don’t believe that it should be a large component of your portfolio.”

Fink also suggests opening retirement 401ks up to private investments.

He says startup companies, artificial intelligence (AI) and data centers offer great opportunities for investing.

“What the markets will teach you over the last 100 years, even at the worst moments, if you have the ability to persevere and you have a long-term horizon, you’re going to do fine and a diversified portfolio is essential.”

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: BitMine's Ethereum Acquisition Echoes MicroStrategy's Bitcoin Strategy, Targets $3,600 Surge

- Ethereum fluctuates between $2,600–$3,000 as analysts monitor $2,800 support level for recovery signals. - BitMine Immersion Technologies accumulates 3% of Ethereum supply (3.63M ETH, $11.2B value), mirroring MicroStrategy's Bitcoin strategy. - Spot ETF inflows ($230.9M) and institutional demand, coupled with Apparent Demand metric hitting 26-month highs, suggest potential $3,600 rally if $2,800 support holds. - BitMine's $7.4B market cap and 51.5 current ratio highlight its unique financial position, wi

Bitcoin Updates: The Cryptocurrency’s Eco-Friendly Transformation—How Artificial Intelligence, Cloud Technology, and Renewable Energy Drive Responsible Expansion

- Crypto market shifts toward sustainability via AI, cloud, and blockchain, with Alibaba and Bybit leading green tech integration. - Bitcoin miners like CleanSpark leverage renewable energy and low-cost remote locations, while BI DeFi's $180M XRP inflows highlight institutional eco-friendly interest. - CoinShares pivots to diversified crypto ETFs amid regulatory scrutiny, mirroring industry trends toward high-margin sustainable products. - Crypto donations exceed $3M for Hong Kong fire relief, showcasing a

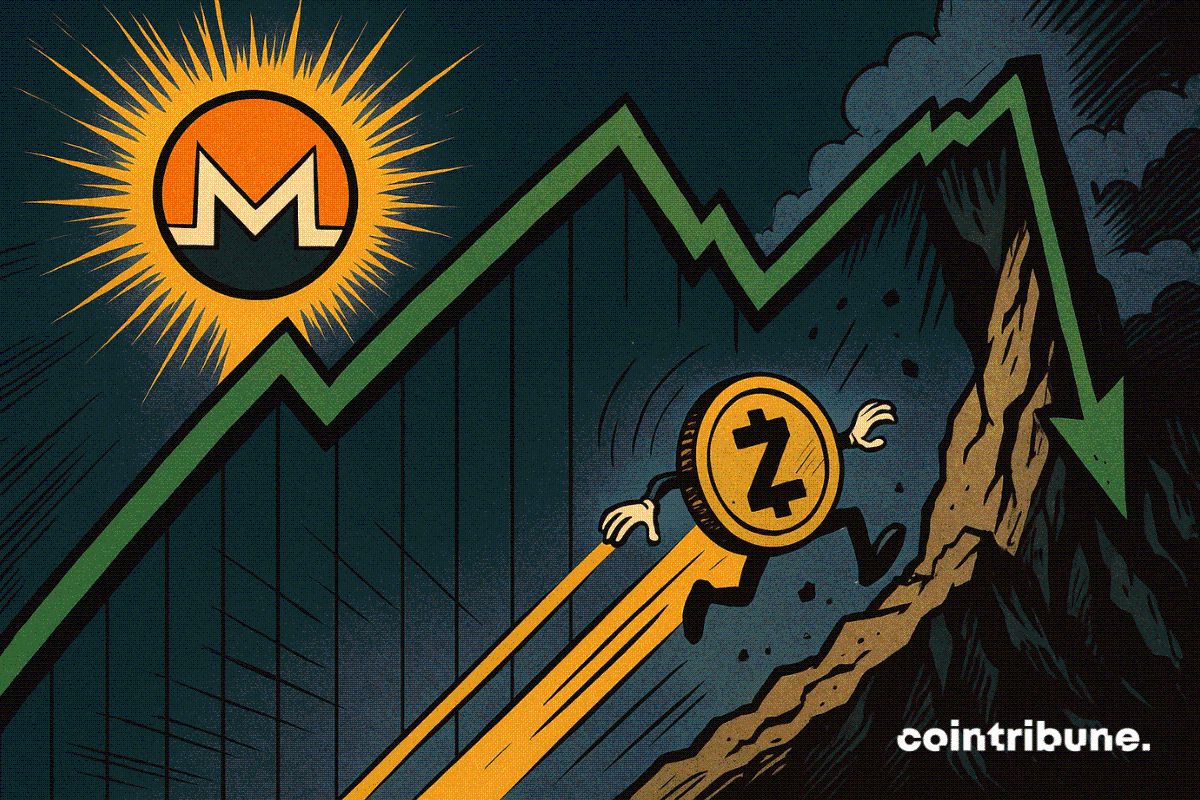

Monero Gains, Zcash Struggles In Privacy Coin Shake-up

Is Pump.fun (PUMP) Poised for a Bullish Move? This Fractal Setup Suggest So!